After months of a brutal bear market, stock prices broadly have bounced from their worst levels. But under the hood, a few names have continued to slide in recent weeks and, in the process, hit levels that Morningstar’s stock analysts say are attractive.

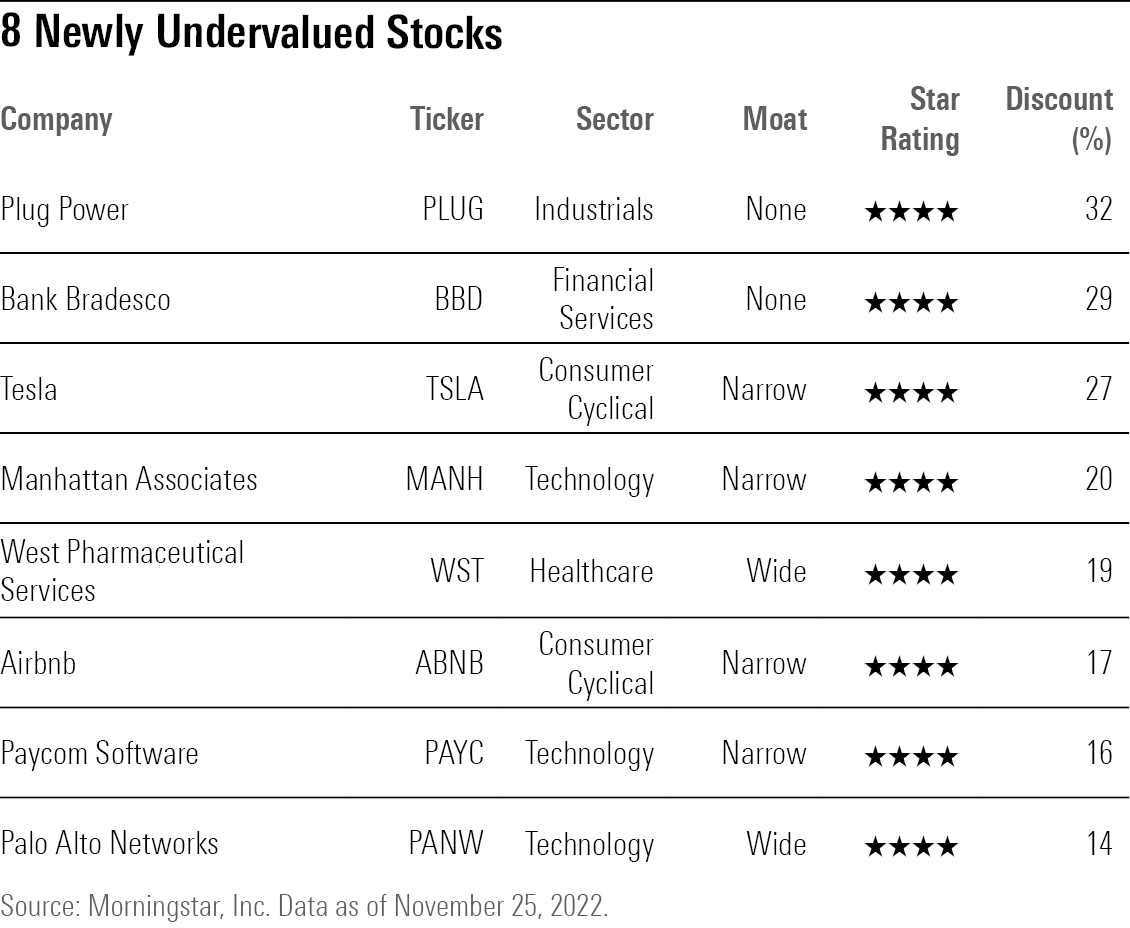

Among the newly cheap stocks:

- Manhattan Associates (MANH)

- West Pharmaceutical Services (WST)

- Airbnb (ABNB)

- Palo Alto Networks (PANW)

The Morningstar US Market Index may be down 18.1% so far this year, but it’s up 10.5% from its most recent lows set in the middle of October. With that bounce, the market is undervalued by 11%, compared with 23% at last month’s lows. By way of contrast, stocks were overvalued by 2% a year ago.

Out of the 841 U.S.-listed stocks covered by Morningstar analysts, 428 stocks were considered undervalued as of Nov. 25, with a Morningstar Rating of either 4 or 5 stars. That’s down from the 570 stocks that were undervalued at the end of September. Still, that’s a massive jump from the end of the third quarter in 2021, when only 181 stocks were undervalued.

But the real change is in the total count of 5-star stocks in the past few weeks. These stocks are considered deeply discounted by Morningstar analysts.

As of Nov. 25, only 134 stocks were at a deep enough discount to their Morningstar fair value estimate to have a rating of 5 stars, slightly more than half of the 211 stocks that were rated at 5 stars at the end of the third quarter. Likewise, that affected the overall U.S. market valuation, which is now only 11% undervalued compared with 23% on Sept. 30.

While the drop in the number of undervalued stocks can in part be attributed to the market’s bounce, recent significant cuts to fair value estimates likely played a big hand as analysts pared back their expectations for growth, especially in the technology and communication services sectors.

Although the number of undervalued stocks declined in the last few weeks there are, of course, stocks that fell into undervalued territory.

To highlight these new undervalued opportunities for long-term investors, we ran the 841 U.S.-listed stocks covered by Morningstar analysts through a screen that looked for stocks that were overvalued or fairly valued as of Sept. 30, but were undervalued as of Nov. 25.

The results showed that while there were not any stocks that reached 5 stars, there were 12 stocks that were rated at 4 stars on Nov. 25, all of which were previously 3-star stocks on Sept. 30. We then filtered that list for stocks that had a discount to their fair value estimate of 10% or more. This left us with eight stocks that recently became undervalued.

To put the focus on opportunities with the greatest margin of safety within our list of eight, we scanned for stocks that had either a narrow or wide Morningstar Economic Moat Rating, indicating that they have a durable competitive advantage over their peers, and that also traded with the highest discount to their fair value estimate. Below are four of those picks, along with what Morningstar analysts had to say about them. A full list of our screen results can be found at the end of this article.

Manhattan Associates

- Star Rating: 4 Stars

- Economic Moat: Narrow

- Discount: 20%

"Narrow-moat Manhattan Associates reported third-quarter results above both guidance and our expectations. Management again raised guidance for 2022 for revenue and earnings per share, driven by strength in deployment for both active transportation management and active warehouse management solutions. We believe the combination of Manhattan’s cloud-based portfolio, new cloud products, and persistent global supply chain challenges is uniquely beneficial for the company over the next several years. Given the macro uncertainty, we appreciate the guidance for 2023, which was slightly below our model. We maintain our fair value estimate of US$155 per share and view shares as modestly undervalued.”

“Management also provided preliminary estimates for fiscal 2023, which were slightly below our initial forecast. Revenue is expected to be in the range of US$800 million to US$820 million, and RPO is expected to grow by 30% at the midpoint to reach US$1.35 billion. Operating margin is expected to remain flattish around 25.5%, due to increased investment activity, hiring talent, and continued license and maintenance attrition pressuring margins. We believe Manhattan has the ability to exceed these targets from their current position, however, we anticipate a more detailed 2023 outlook in the next quarter.”

— Dan Romanoff, senior equity analyst

West Pharmaceutical Services

- Star Rating: 4 Stars

- Economic Moat: Wide

- Discount: 19%

“Wide-moat West Pharmaceutical reported disappointing third-quarter results driven by sales and gross profit below our expectations. The company was not immune to foreign exchange headwinds and inflationary pressures, and we are adjusting our near-term assumptions given management’s new 2022 revenue guidance. We maintain our US$280 fair value estimate given our confidence in the company’s long-term outlook, and shares appear undervalued following the market’s negative reaction to third-quarter earnings.”

“Management provided updated 2022 full-year revenue guidance to US$2.8 billion to US$2.84 billion, coming in lower than our projected US$3.1 billion. Although we accounted for the continued decline in COVID-19-related sales, we did not expect the company to push accelerating customer orders into the following year. With that, we are maintaining more robust revenue growth for 2023 driven by biologics in the Proprietary Products business. This is where West already holds dominant market share fueled by reputational expertise. Our confidence is reinforced by West’s components being used in almost all biologics and biosimilars approved in 2022.”

— Karen Andersen, strategist

Airbnb

- Star Rating: 4 Stars

- Economic Moat: Narrow

- Discount: 17%

"Third-quarter booking growth of 31% exceeded our 28% estimate. But commentary implies fourth-quarter bookings growth decelerates to around 25% (based on our calculation), which we think is a source of [recent] share weakness … third-quarter bookings were at a stout 161% of 2019′s level, with the fourth quarter guided to be at a healthy 166% level, both around the 173% mark in the second quarter. And we had been forecasting a larger fourth-quarter booking deceleration to midteens growth, which now looks far too conservative. Also, 2022 marketing and operation efficiency looks stronger than our forecast, with year-to-date EBITDA margins up more than 800 basis points versus the comparable year-ago period, ahead of the 400-basis-point improvement we were baking in, which we now plan to increase by a few hundred basis points.

"Looking beyond 2022, we acknowledge the uncertain economic outlook but think Airbnb’s demand can navigate higher in 2023 even if a mild recession occurs, stoked by desire to travel, remote work flexibility, and service consumption wallet share. We are encouraged that travel demand broadened out from nonurban leisure trips to cross border nights, which grew 58%, as we think this can continue to support demand growth amid economic uncertainty. Thus, we don’t expect to materially change the midteens average sales growth modeled for Airbnb during 2023-27 or EBITDA margins reaching 30% by the end of this decade versus a negative 10% level in 2019.”

"We expect our Airbnb US$113 valuation to travel higher by a low-single-digit percentage to account for stronger near-term demand and profitability relative to our forecast, leaving shares trading at a slight discount.”

— Dan Wasiolek, senior equity analyst

Palo Alto Networks

- Star Rating: 4 Stars

- Economic Moat: Wide

- Discount: 14%

“We are maintaining our US$200 fair value estimate for wide-moat Palo Alto Networks after the firm kicked off fiscal 2023 with strong financial results … Palo Alto’s solutions are sticky and have numerous touchpoints across an enterprise’s IT infrastructure. In our view, Palo Alto’s leading platform approach for network security, cloud security, and security automation is spurring organizations to consolidate spending toward its products, which increases switching costs. We anticipate the company will reap the positive effects of having customers locked into its ecosystem as it aims to achieve GAAP profitability consistently.”

“Over the long term, we believe Palo Alto’s platform approach will allow the firm to deepen its switching costs across its customers. As customers either adopt more modules within a platform or adopt additional platforms, we see increased entrenchment of Palo Alto’s security solutions in a customer’s IT infrastructure.”

— Malik Ahmed Khan, equity analyst