Most people are familiar with greenhouse gas emissions, which cause climate change. Yet non-greenhouse-gas emissions, typically known as pollution, pose big risks to human health and infrastructure. And as with greenhouse gas emissions, air pollution stems largely from the use of oil, natural gas, and coal.

Air pollution is recognized by the World Health Organization as the biggest environmental threat to human health. The main source of air pollution is non-greenhouse-gas air emissions: substances such as nitrogen oxides, sulfur oxides, and particulate matter—particles that can be inhaled with diameters smaller than 10 micrometers.

Air pollution now causes more than 4 million deaths annually, while also claiming hundreds of millions of years of healthy life. Some 99% of the global population breathes air that exceeds the WHO guideline limits for unsafe levels of non-greenhouse-gas air pollutants. Air pollution raises the risk of death and the risk of cancers and various other chronic health conditions. It also has adverse impacts on the natural environment, agriculture, buildings, and infrastructure, expanding risks for investors. These risks stem from the tightening regulations, which may fall more heavily on the shipping, steel, and construction materials industries, among others.

Air Pollution Affects Everybody, but Not Everybody Equally

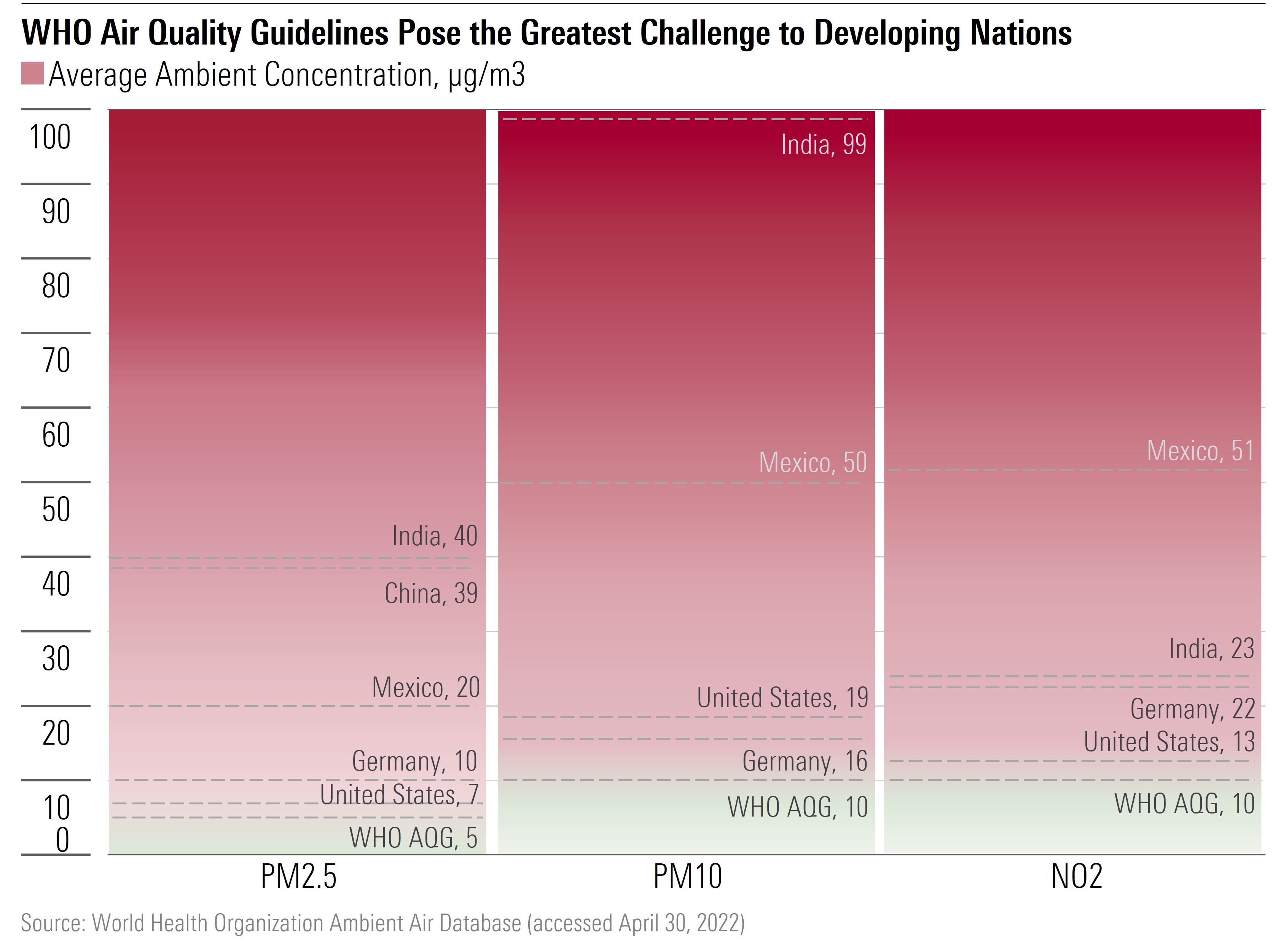

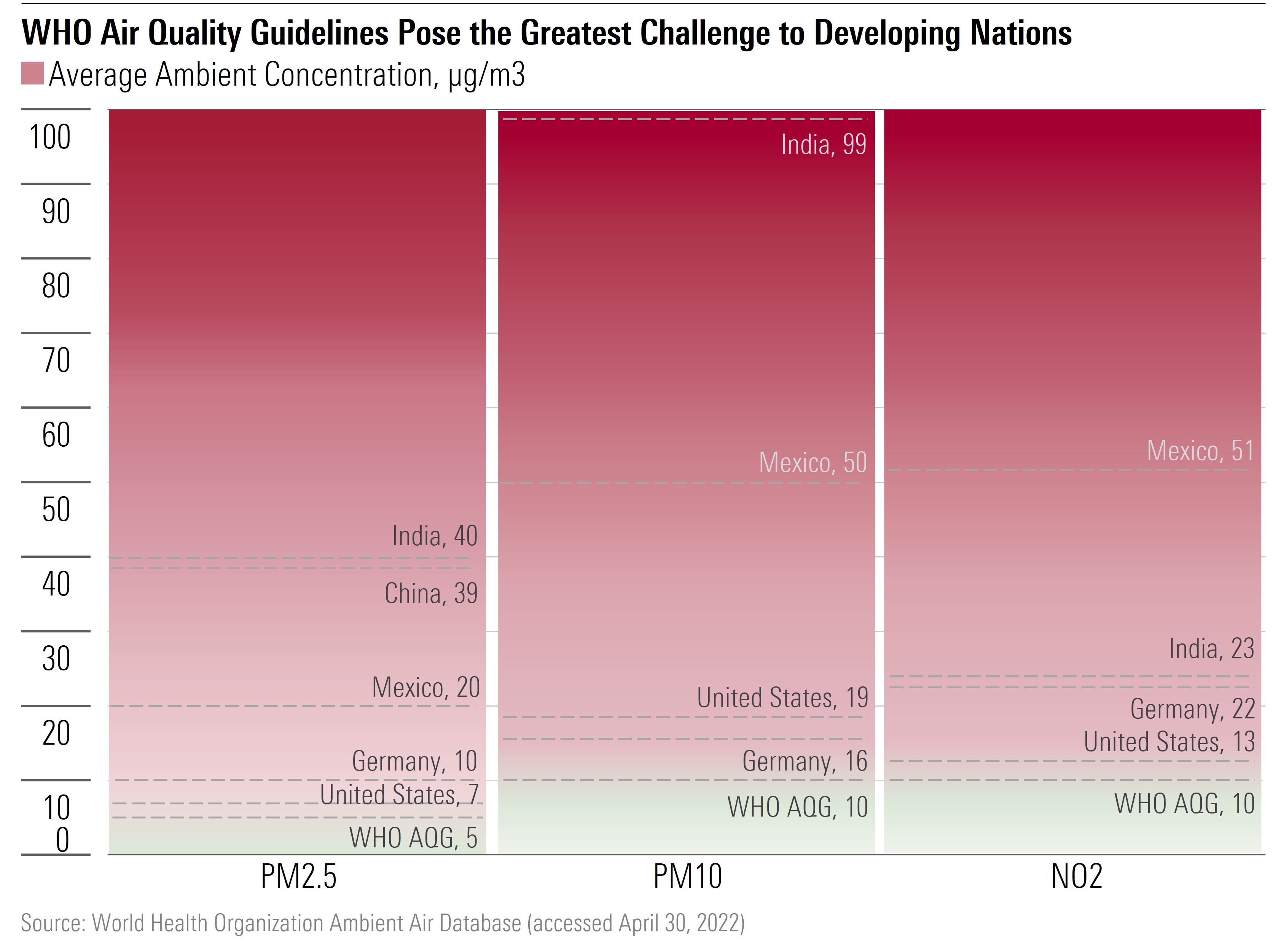

High-income countries have seen marked improvements in the average concentration levels of key air pollutants over the last three decades. But in low- and middle-income countries, rapid urbanization and accelerated economic development have led to unsafe levels of pollution. The vast majority of the 4 million annual fatalities occur in these regions.

The WHO issues air quality guidelines for key air pollutants, meant to minimize the negative health outcomes caused by air pollution.

Some countries, especially in the Western world, are close to bringing their air emissions within these guidelines. Many low- and middle-income countries still face challenges.

National Air Quality Standards Are Bound to Tighten

The risk that standards will be tightened in the future is considerable. They are likely to be dictated by the WHO, the foremost authority on international public health. The WHO air quality guidelines are a policy tool, supporting governments in implementing standards that are based on the latest scientific research, and enjoy the endorsement of the global health community.

In 2021, the WHO updated its guidelines for key pollutants such as particulate matter and nitrogen dioxide based on findings that these air pollutants are more dangerous than previously understood. This should further increase pressure on policymakers.

Air Pollutants Are Not Made Equal

Estimates of damage costs for air pollutants vary widely, with the highest cost associated with pollutants that directly impact human health. For instance, damage costs per kilo of emissions for a number of cancer-causing heavy metals are incredibly high. Also significant are the damage costs associated with emissions of particles that are 2.5 micrometers or smaller, which increase the risk of respiratory or cardiovascular diseases.

Meanwhile, other substances such as nonmethane volatile organic compound emissions, or NMVOCs, have lower damage costs as they do not impact human health directly but rather contribute to the formation of other pollutants such as ozone.

Plenty of Room for Improvement in Corporate Disclosures

Corporate disclosures of non-greenhouse-gas air emissions have improved in recent years, supported by developments in sustainable reporting standards and emerging regulations, such as the EU Sustainable Finance Disclosure Regulation. But there is still significant room for improvement.

For instance, reporting non-greenhouse-gas air emissions remains optional under existing sustainability regulations. Furthermore, companies often bundle disclosures together, reducing the informational value of the data.

Investors would also benefit from disclosures related to the location of air emissions. The damage done by a kilogram of emissions can vary quite significantly from one location to another.

What Does This All Mean for Investors?

Tightening air quality standards has the potential to create risks for companies and their investors. It could ultimately force emitters to face up to the damage that their operations impose upon society. If so, companies would be required to pay the costs associated with their polluting activities.

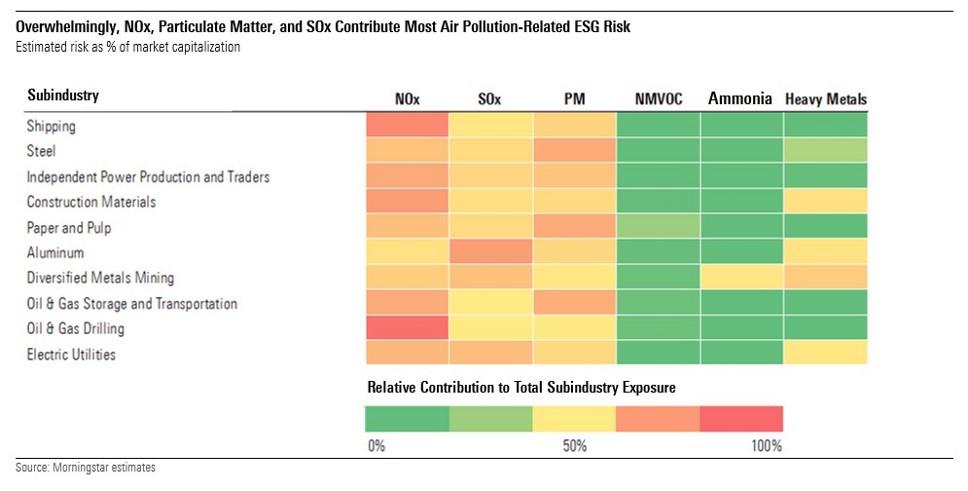

To determine which firms and industries are likely to face the greatest challenges, we’ve estimated the additional cost burden that is likely to arise from tightening air quality standards, which is a function of a company’s emissions and estimates of the damage costs of the different air pollutants, relative to market capitalization.

Some of the largest exposures are in industries such as shipping, steel, and construction materials.

The main drivers of these heightened exposures are emissions of nitrogen oxide, sulfur oxides, and particulate matter. They arise in part because of the ubiquity of fossil fuel combustion across many industries exposed to air pollution ESG risk. As with greenhouse gas emissions, non-greenhouse-gas emissions stem largely from the use of oil, natural gas, and coal.

Investment Opportunities Exist Despite the Challenges Posed by Air Pollution

We’ve identified a few ways for investors to gain exposure to the non-greenhouse gas air emission theme. One is to identify companies for which tightening regulation poses no risk given their low emissions of non-greenhouse gases. Another is to identify companies with high non-greenhouse-gas emissions risk but with economic moats that help them minimize that risk. Economic moats that offer pricing power (on account of intangible assets, switching costs, or efficient scale) best position firms to lift prices as costs escalate.

A sweet spot, combining both these approaches, is represented by competitively advantaged companies that are also making strides to transition to cleaner product portfolios and technologies. Meanwhile, the pricing power conferred by their economic moats helps insulate the portion of their portfolio that remains more exposed to tightening regulation.

One such company is narrow-moat Entergy ETR, one of the largest power producers in the United States, currently trading in 4-star territory. Entergy’s five Southeast utilities benefit from rising U.S. energy demand and substantial clean energy growth opportunities. Regulators allow Entergy to capture more than 90% of its investments in customer rates with little regulatory lag, enhancing cash flow for new investments and supporting Entergy’s efficient-scale competitive advantage. We expect Entergy to invest $4 billion annually through 2025 to upgrade its expansive grid and replace coal generation with mostly solar. Customer demand for emission-free energy will create growth opportunities for Entergy while minimizing rate impacts for most customers.

Another example is Corteva CTVA. Despite currently trading in the 3-star territory, this wide-moat name could offer a good way to play the non-greenhouse-gas emissions theme, and we recommend investors keep it on the watchlist for future buying opportunities. Farmers are willing to pay up for Corteva’s products as the company’s seeds help farmers maximize yields and the crop protection products help farmers deal with weeds, insects, and fungi. The company is also transitioning its crop protection portfolio to increase the proportion of biologicals, which are natural products that allow the company to reduce its air emissions versus manufacturing traditional crop chemicals. When combining price increases to offset increased costs and the portfolio transition, we expect Corteva to be well-positioned in the face of increased emissions regulations.