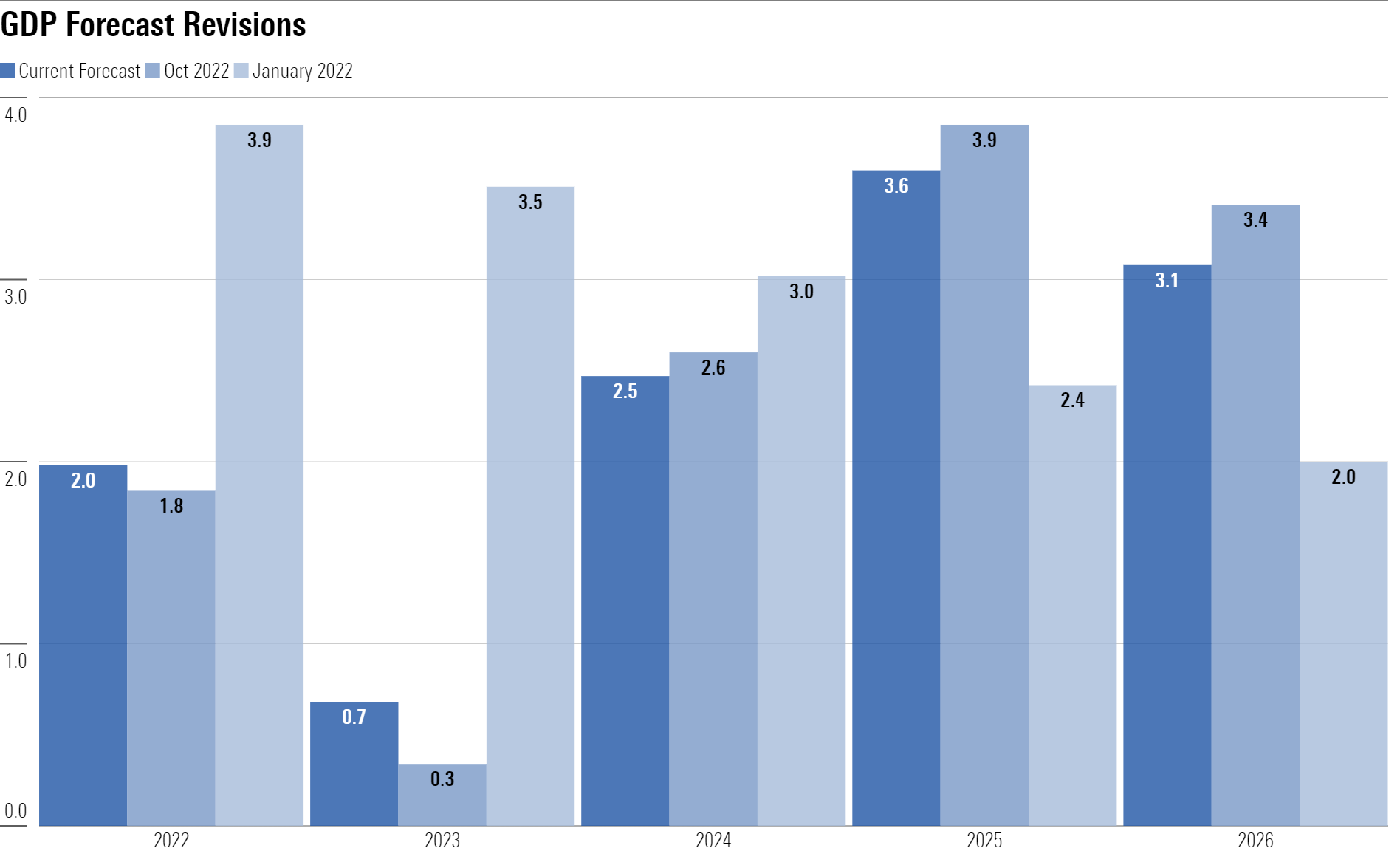

We Expect Growth to Trough in 2023 and Then Accelerate in 2024

Since our last update, we’ve hiked our 2022 and 2023 U.S. gross domestic product forecasts as real consumption and net exports are trending better than expected. We expect a GDP growth rate of 2.0% for 2022 and 0.7% for 2023.

These promising trends were apparent in the robust 2.6% annualized increase in third-quarter real GDP. The Atlanta Fed is now projecting a 2.8% increase in the fourth quarter. Also, financial conditions have loosened thanks to the positive October inflation report, with the 10-year Treasury falling over 50 basis points.

A formal recession in 2023 remains a 30%-50% possibility, given our expectations that GDP growth in the first half of the year is close to zero. But we think there’s been too much of a focus on the question of whether a recession will or won’t occur—the more important question is the severity of any potential recession.

We expect any recession to be mild, as GDP growth is on track to rebound strongly in 2024 and after, as the Federal Reserve pivots to monetary easing.

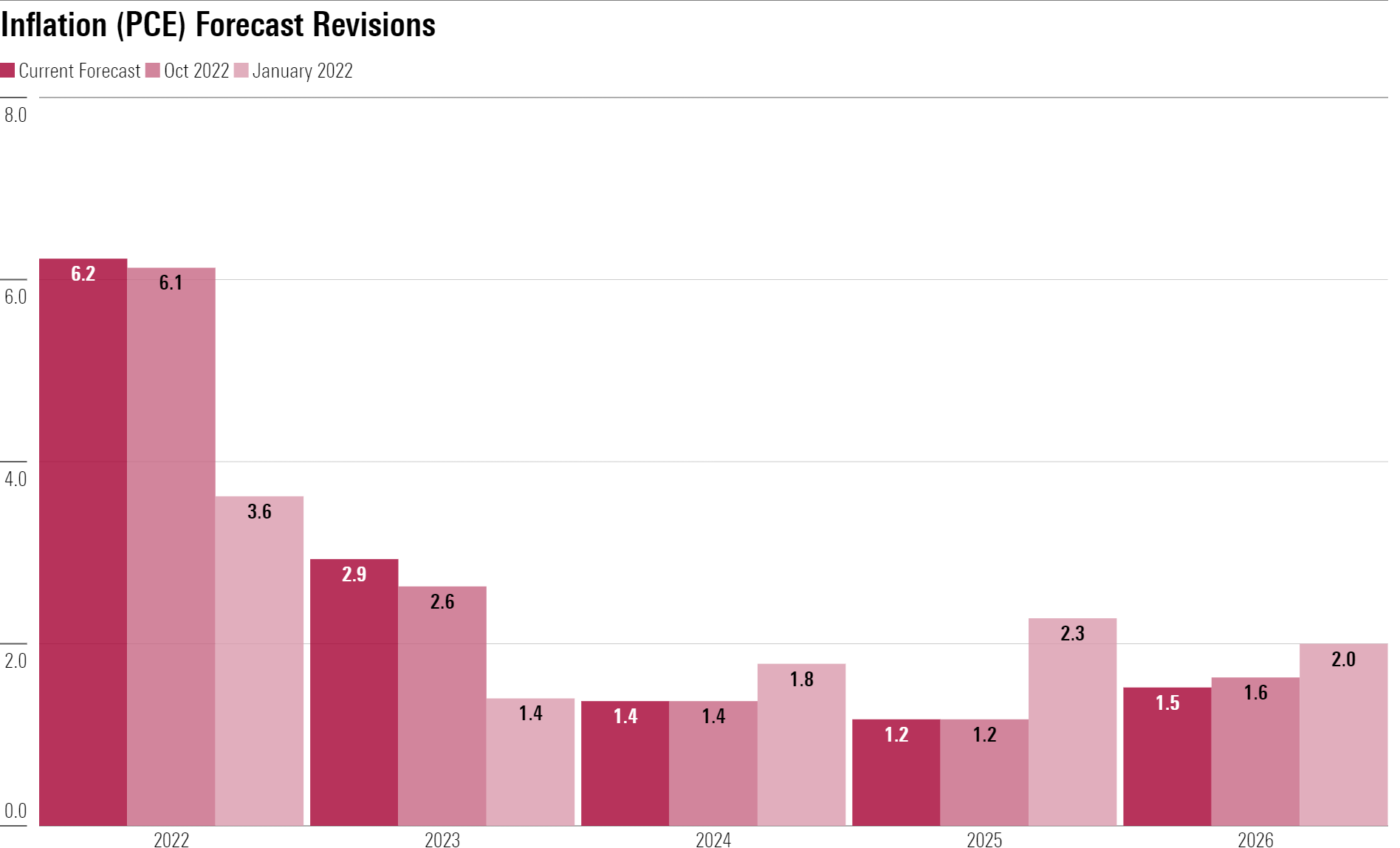

Inflation Should Return to Normal in 2023

Despite the positive news for October inflation, we’ve hiked our near-term inflation projections slightly, owing to the likely path for housing inflation. We now expect the housing component of the Consumer Price Index to increase 7% in 2023, compared with 5.75% previously.

Still, we expect a clearer victory in the war on inflation within the next year. We think most of the sources of today’s high inflation will abate (and even unwind in impact) over the next few years, including energy, autos, and other durables. Plus, aggressive capacity expansion across many areas could turn widespread shortages into surpluses within a few years.

Combining these factors with monetary policy tightening, we expect inflation to average just 1.8% over 2023-26.

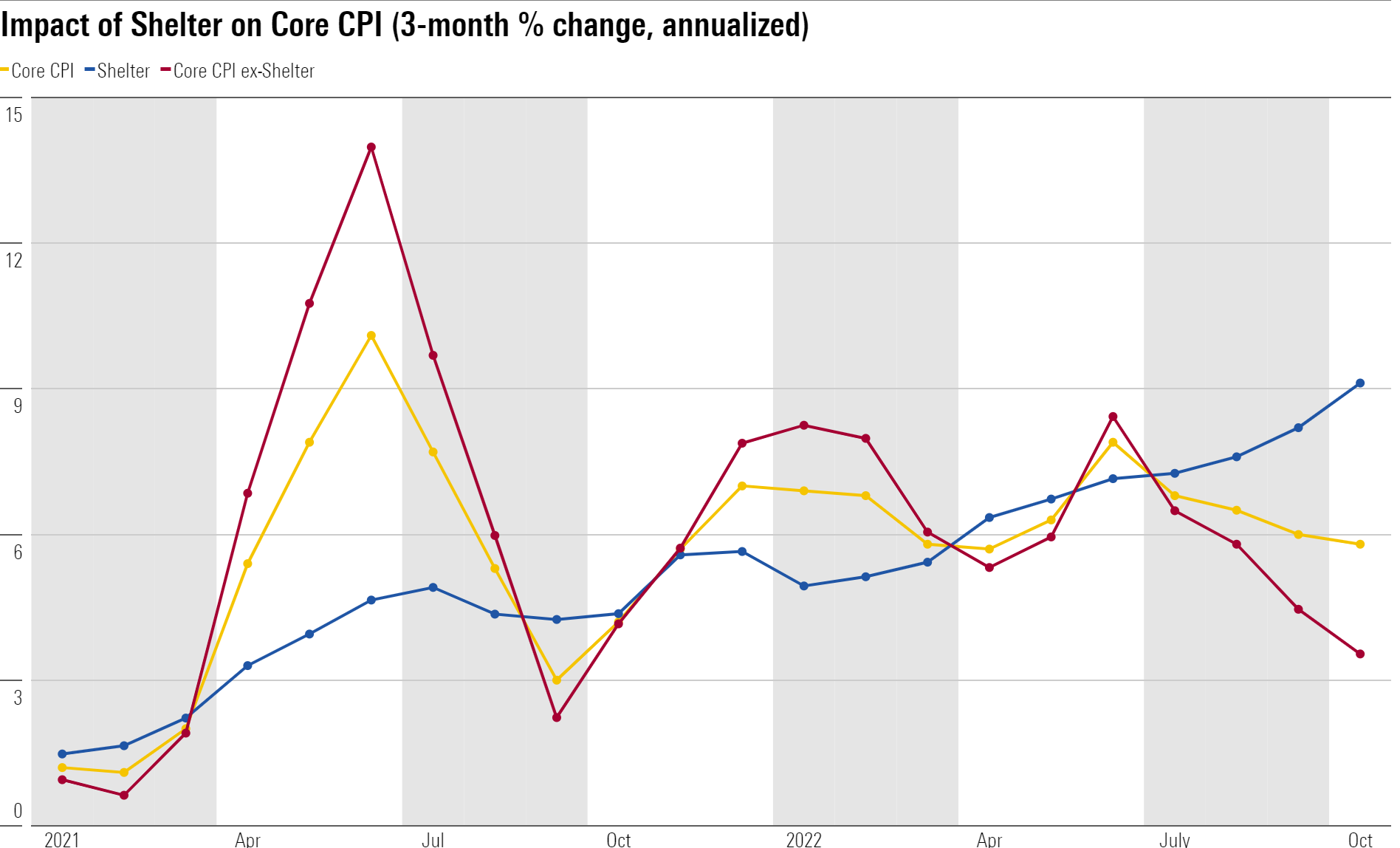

Recent Data Brings Better News on Inflation

The data is starting to bring signs that our thesis on falling inflation is playing out.

Core inflation in terms of the CPI surprised on the downside in October at 0.2% month over month. We caution that the monthly data is volatile, and a three-month moving average shows less of a clear downtrend.

But more importantly, core inflation excluding “shelter” (housing) is indicating a clear and dramatic downtrend. This reduction has been broad-based but especially focused in goods prices, where supply disruptions appear to be alleviating.

The argument for excluding shelter prices is that they respond with a long lag to market conditions. A deceleration in market rent growth is already in progress and should continue amid slowing housing demand and expanding housing supply. This should reduce the shelter component of inflation indexes greatly later in 2023 and thereafter.

.jpg)