For roughly the past decade, our primary objective with Ultimate Stock-Pickers has been to uncover investment ideas that our equity analysts and top investment managers find attractive, in a manner timely enough for investors to gain some value. As part of this process, we analyze the quarterly and monthly holdings of 26 separate investment managers: 22 managers oversee mutual funds covered by Morningstar’s manager research group and four Stock-Pickers run the investment portfolios of large insurance companies. As the data from their holdings becomes available, we identify trends and outliers among their holdings as well as meaningful purchases and sales that took place during the period under examination.

Now that all Ultimate Stock-Pickers have reported their holdings for the 2022 period, we think it is appropriate to examine our managers’ high-conviction purchases and sales in aggregate. As stock prices have changed since our Ultimate Stock-Pickers made their buying and selling decisions, we urge investors to analyze securities at current valuation levels before making any investment decisions—we will provide our fair value estimates, moat ratings, stewardship ratings, and uncertainty ratings to help them along the way.

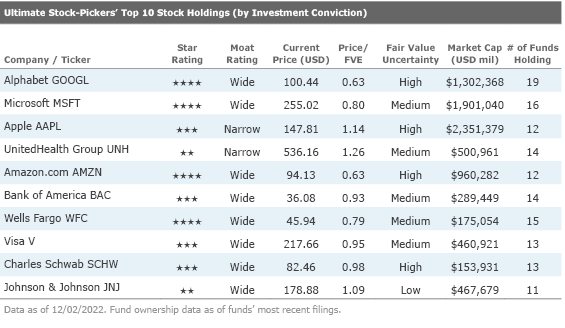

Morningstar’s analysis shows eight of the top 10 conviction holdings have a wide economic moat, with the other two having a narrow moat. In contrast, last quarter’s list had seven wide-moat companies, and three companies were issued a narrow moat. On the conviction sales list this quarter, seven companies have a wide moat, and the remaining three have a narrow moat.

Considering that many of the Ultimate Stock-Pickers are long-term investors, we were not surprised to see that over half of the names composing our top 10 conviction holdings list were the same as the prior quarter; however, we identified higher turnover than in our last report. Alphabet GOOGL (Google’s holding company) and Microsoft MSFT retained the top spots on our list with 19 and 16 funds holding, respectively. Similar to last quarter, our Ultimate Stock-Pickers’ conviction holdings favored the financial services sector this quarter with four companies making the top 10 list. Our Ultimate Stock-Pickers continue to hold names from the technology, healthcare, and communication services sectors, each representing three, two, and one name, respectively. Our current fair value estimates imply that at the time of writing, both Apple AAPL and Johnson & Johnson JNJ are trading at a premium and therefore overvalued.

All the names on our top 10 conviction holdings list were held by at least 11 of the funds we examined. In this edition of Ultimate Stock-Pickers, we’ll take a closer look at Microsoft, which continues to generate sustained interest and currently sits in 4-star territory.

Wide-moat Microsoft was held by 16 funds at the time of this article’s writing. This high uncertainty stock currently trades at a discount to Morningstar analyst Dan Romanoff’s fair value estimate of US$320. Microsoft develops and licenses consumer and enterprise software. It is known for its Windows operating systems and Office productivity suite. The company is organized into three equally sized, broad segments: productivity and business processes (legacy Microsoft Office, cloud-based Office 365, Exchange, SharePoint, Skype, LinkedIn, and Dynamics), intelligence cloud (infrastructure- and platform-as-a-service offerings Azure, Windows Server OS, and SQL Server), and more personal computing (Windows Client, Xbox, Bing search, display advertising, and Surface laptops, tablets, and desktops).

Since taking over as CEO in 2014, Satya Nadella has reinvented Microsoft into a cloud leader such that it has become one of two public cloud providers that can deliver a wide variety of PaaS/IaaS solutions at scale. Additionally, Microsoft embraced the open-source movement and has largely transitioned from a traditional perpetual license model to a subscription model. The company has also enjoyed great success in upselling users on higher priced Office 365 versions, notably to include advanced telephony features. These factors have combined to drive a more focused company that offers impressive revenue growth with high and expanding margins.

In Romanoff’s view, Azure is the centerpiece of the new Microsoft. Even though Romanoff estimates it is already an approximately US$45 billion business, it grew at a staggering 45% rate in fiscal 2022. Azure has several distinct advantages, including that it offers customers a painless way to experiment and move select workloads to the cloud, creating seamless hybrid cloud environments. Since existing customers remain in the same Microsoft environment, applications and data are easily moved from on-premises to the cloud. Microsoft can also leverage its massive installed base of all Microsoft solutions as a touch point for an Azure move. Azure is also an excellent launching point for secular trends in AI, business intelligence, and Internet of Things, as it continues to launch new services centered around these broad themes.

Microsoft is also shifting its traditional on-premises products to become cloud-based SaaS solutions. Critical applications include LinkedIn, Office 365, Dynamics 365, and the Power platform, with these moves now beyond the halfway point and no longer a financial drag. Office 365 retains its virtual monopoly in office productivity software, which we do not expect to change in the foreseeable future. Lastly, the company is also pushing its gaming business increasingly toward recurring revenue and residing in the cloud. Romanoff believes that customers will continue to drive the transition from on-premises to cloud solutions and revenue growth will remain robust with margins continuing to improve for the next several years.

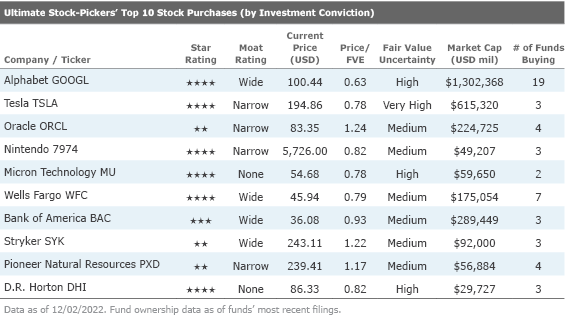

The Ultimate Stock-Pickers’ Top 10 Stock Purchases list contained many names with moats that were distributed across a range of sectors, including communication services, consumer cyclical, energy, financial services, healthcare, and technology. In particular, we are interested in a deeper dive into Nintendo 7974, which was purchased by three funds during the quarter.

Narrow-moat Nintendo trades at a discount to Kazunori Ito’s fair value estimate of JPY 7,000 (listed on the Tokyo Stock Exchange). Nintendo started its video game console business in 1983 with the launch of the NES and started its portable console business in 1989 when it launched Game Boy. Since then, the firm has focused on expanding the gaming population by delivering unique entertainment experiences on its original console systems—the Wii and Nintendo DS are its most popular hardware. However, Nintendo not only makes game consoles, it also owns world-renowned properties such as Super Mario, Pokémon, and Zelda, which have been a source of cash flow for more than a quarter-century.

Ito believes that Nintendo’s policy change in 2014 offered the firm a new growth opportunity by not limiting its popular characters to game consoles, but expanding them to other platforms—such as launching smartphone games, allowing Universal Studios to use its characters, launching animation movies, and selling figurines.

Mario is the most popular video game character in the world, appearing in more than 200 titles since 1981 and selling more than 600 million games throughout its history. At the closing ceremony of Rio Olympics in 2014, the Japanese prime minister dressed up as Super Mario to promote the Tokyo Olympics, which suggests that Mario is not only a popular video game character but also an icon of Japan’s entertainment landscape. Super Mario Run, the first Mario game to be launched on smartphones, recorded more than 300 million downloads, followed by more than 100 million downloads of Mario Kart Tour. Pokémon is another popular franchise from Nintendo, which has a history of over 20 years and has sold more than 340 million games and 28 billion trading cards. Pokémon Go has provided a new user experience through augmented reality, or AR, and recorded more than 1 billion downloads. Pokémon Go has also attained five Guinness World Records for revenue and download numbers.

Ito believes Nintendo’s fans will increase as people are able to enjoy its characters on various occasions, and that the success of the Switch platform proves Nintendo can induce new fans to its ecosystem by leveraging its characters and preparing an attractive game pipeline. Future challenges for the company will be: 1) Whether the company can monetize its characters efficiently on non-console business, 2) Whether re-entry to the greater China market will succeed, and 3) How the company can adapt to the diffusion of the cloud gaming platform. Nevertheless, we believe the company’s ability to deliver fun games through its characters is intact.

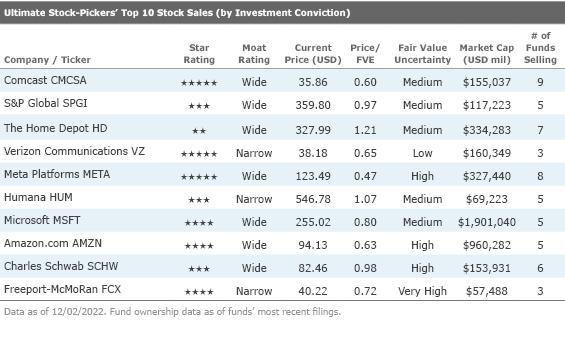

Similar to the previous quarter, the selling activity on the top 10 conviction sales list was a mix this quarter in regard to sector. Three of the names appear on both the holdings and sales lists in the quarter. Approximately half the names on the conviction sales list trade at a discount to our fair value estimates, while only one, The Home Depot HD, was materially overvalued. Of note this period was Meta Platforms META, which currently trades at a discount to analyst Ali Mogharabi’s fair value estimate of $260.

Meta is the world’s largest online social network, with 2.5 billion monthly active users. Users engage with each other in different ways, exchanging messages and sharing news events, photos, and videos. On the video side, the firm is in the process of building a library of premium content and monetizing it via ads or subscription revenue. Meta refers to this as Facebook Watch. The firm’s ecosystem consists mainly of the Facebook app, Instagram, Messenger, WhatsApp, and many features surrounding these products. Users can access Facebook on mobile devices and desktops. Advertising revenue represents more than 90% of the firm’s total revenue, with 50% coming from the U.S. and Canada and 25% from Europe. With gross margins above 80%, Meta operates at a 30%-plus margin.

Mogharabi believes Meta will continue to benefit from an increased allocation of marketing and advertising dollars toward online advertising, more specifically social network and video ads where Meta is especially well positioned. The firm’s Facebook app, Instagram, Messenger, and WhatsApp are among the world’s most widely used apps on both Android and iPhone smartphones. Meta is taking steps to further monetize its various apps, such as providing interactive video ads and tapping into e-commerce. It is also applying artificial intelligence and virtual and augmented reality technologies to various products, which may increase Meta’s user engagement, helping to further generate attractive revenue growth from advertisers in the future.