2022 was a year in which investors could find little comfort, as both stocks and bonds fell. In 2023, investors are worried about a recession. Mike Coop, Chief Investment Officer, Europe, Middle-East & Africa for Morningstar Investment Management feels that “as investors, the reality is that a recession appears the most likely scenario for many countries.”

2022 was a year in which investors could find little comfort, as both stocks and bonds fell. In 2023, investors are worried about a recession. Mike Coop, Chief Investment Officer, Europe, Middle-East & Africa for Morningstar Investment Management feels that “as investors, the reality is that a recession appears the most likely scenario for many countries.”

However, it is impossible to know both the severity and duration of any potential recession. According to Preston Caldwell, Morningstar’s head of U.S. economic research, it’s a virtual coin toss—at least in the U.S., which accounts for around a quarter of the global GDP3 and over 60% of the global stock market. He stresses the need to look beyond 2023: "Either way, we expect growth to accelerate again in 2024 as the Federal Reserve lifts off the brakes" Caldwell said, and forecasts that inflation has a reasonable probability of receding to normal levels in 2023 and could even undershoot the Fed’s 2% inflation target by 2024.

And while 2022 may have been gloomy, 2023 could have some brighter times ahead.

Expect a Much-Improved Long-Term Investing Environment

Philip Straehl, the Global Head of Investment Management Research at Morningstar Investment Management says that he doubts that returns are in store for the foreseeable future. “Taking a longer-term perspective, the 2022 downturn has set the stage for a much-improved long-term investing environment,” he said.

One reason for optimism comes from fixed income. The 10-year U.S. real yields are at their highest level since 2009 , offering meaningfully positive return prospects after inflation—following an extended period of not keeping up with consumer prices. “Major investment-grade bond markets priced to deliver a return after inflation between 1.5% to 2% over the next decade,” he adds.

In fact, equity market valuations are significantly better now than late-2021, too.

“For example, 12 months ago, there were no developed country equity markets that were undervalued using our valuation models. In contrast, at the end of October 2022, almost 30% of countries were cheap compared to their long-term fair-value expectations (i.e., undervalued). Notably, this proportion was even higher at the end of September 2022, with 37.5% of countries in coverage presenting as being undervalued,” Straehl said.

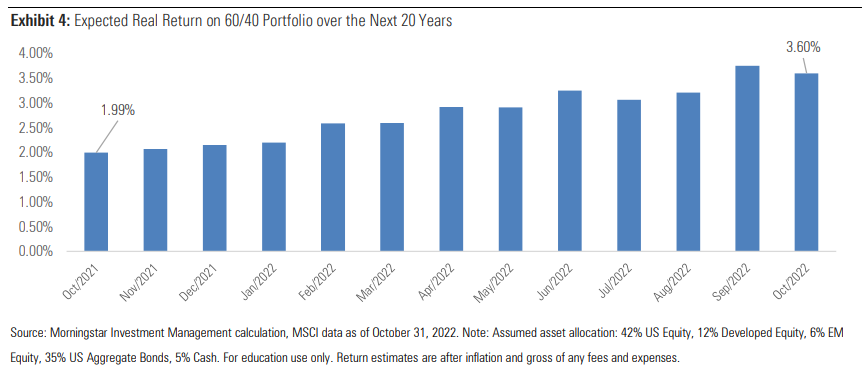

60-40 Portfolio to Deliver Returns After Inflation of 3.6%

Considering the improvements in equity and fixed income valuations over the course of 2022, Straehl’s valuation models suggest that the 60/40 portfolio stands to deliver a return after inflation of 3.6% over the next two decades, a 1.6% improvement from a year ago.

Where are the Opportunities Right Now?

“Rotation within equity markets was another key theme over the course of 2022. In other words, those assets displaying the best prospects a year ago are not displaying the best prospects today. This rotation has seen some assets fall away in their appeal and others rise over the past 12 months,” Straehl says.

He points to energy companies as an example, that stood out through 2020 and much of 2021 as one of the most attractive assets, but has now declined in rankings, while the prospective ranking for communication services companies has gone the other way.

“Twelve months ago, the communication services sector was ranked sixth out of the 10 world sectors. Today, it sits at the top. Communication services is a truly diverse sector, encompassing internet media companies (such as Alphabet (GOOG) and Meta (META)), entertainment companies and telecom services providers. In part a function of weak recent share price returns—experienced by a number of its most significant constituents—global communication services now possess one of the highest valuation-implied return estimates among the sectors we cover. While we do see heightened fundamental risk present in the sector as opposed to other asset classes, valuations (both absolute and relative) as well as contrarian elements tip the scales on our conviction in favour of a “Medium to High” overall score,” he explains.

Straehl also sees significant opportunity within emerging-markets equity, which as a sector has experienced broadly negative share returns in 2022—especially in U.S. dollar terms.

“Given our assessment of valuation, the fundamental risk picture and contrarian elements, we conclude that absolute and relative valuations have improved to the degree that emerging markets merit an upgrade in our overall conviction to “Medium to High”,” he adds.

Better Valuations Create Opportunity, But the Principles of Good Investing Still Apply

While this analysis may seem encouraging, especially after a challenging year, Straehl acknowledges that periods of market volatility can be unnerving for investors.

“Our approach is to follow a disciplined valuation-driven investment process guided by a set of investment principles that keep us focused on the long term and what matters fundamentally. Periods of uncertainty often lead to the biggest opportunities in the market, as market participants overreact to news. Yet, the principles of good investing must still apply,” he says.

Straehl puts forward five key lessons that will hold us in good stead through 2023 and beyond:

1) to be long-term minded,

2) to use a consistent framework for assessing value,

3) to deeply assess fundamentals,

4) to think contrarian, and

5) to understand where you are in the capital cycle.

“As we navigate markets today, we remind ourselves of these lessons and remain optimistic that the best days for investors lie ahead,” he says.

.jpg)