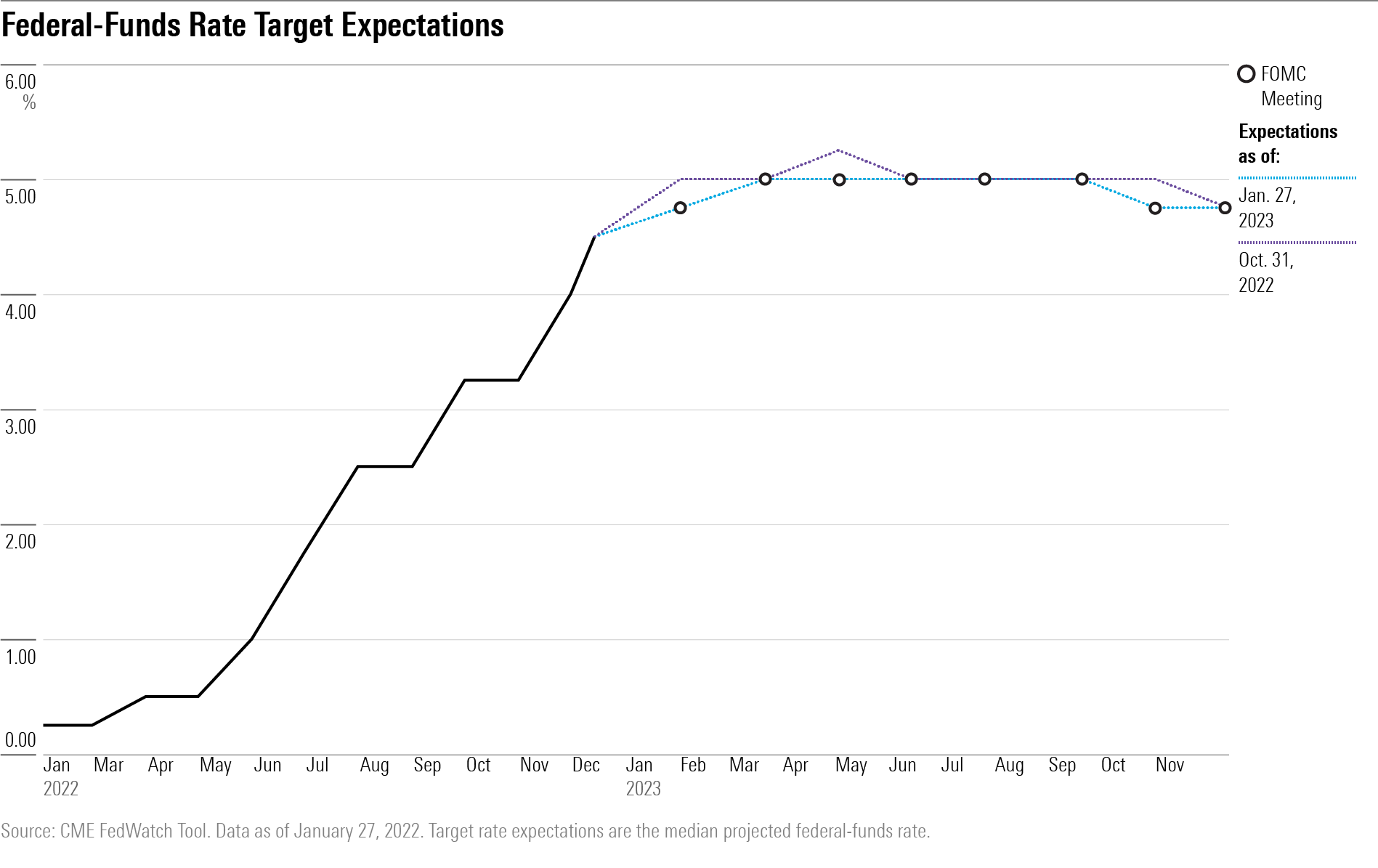

The U.S. Federal Reserve is widely expected to push up interest rates yet another notch this week, but more important for investors could be how Fed officials handle an expectations gap with the markets around where rates will go later this year.

The Fed is seen raising the federal-funds rate by another quarter-point Wednesday, following the Bank of Canada last week, which would take its target rate to 4.5%-4.75%. A year ago, the target rate was effectively zero.

Even as the Fed is seen raising rates again, investors have been heartened by signs that inflation is on a downswing and, coupled with expectations for a recession sometime this year, widely see the Fed shifting from rate hikes to rate cuts by the end of this year. (A Fed easing in 2023 has been the call for some time by Morningstar’s chief U.S. economist, Preston Caldwell.)

What Will the Fed Signal on Lowering Rates?

But Fed officials have been singing a different tune. Worried that easing up on the brakes too soon could lead to a revival of inflation pressures, the Fed is signaling that it will continue to raise rates—at least one more time this year—and that no rate cuts will be in store during 2023. Should that happen, the Fed might have to reverse course yet again. That kind of yo-yo monetary policy is something the Fed most likely wants to avoid.

When it comes to this week’s Fed meeting, analysts expect the Fed to double down on its message of staying focused on keeping rates high and fighting inflation.

One reason the Fed may keep up the tough talk is that monetary policy is transmitted to the economy through the financial markets. If investors hear the Fed talking about lowering interest rates now, the market will start taking interest rates lower ahead of any official action, lifting stock prices and making it easier for companies and consumers to borrow. That runs counter to the Fed’s efforts to keep money tight at the present time.

That’s a key part of why investors should expect hawkish talk from Fed Chair Jerome Powell when he gives a press conference after the policy announcement Wednesday afternoon.

“We fully expect him to sound somewhat stern,” says Rebecca Felton, senior market strategist at RiverFront Investment Group. In recent public comments, Fed officials have “certainly come down on the side of further tightening and keeping the restrictive policies in place for some time,” she says.

At RiverFront, expectations are that inflation will stay higher than the Fed would like. “It is difficult to envision inflation getting even remotely close to their targets by year-end in 2023,” Felton says. “So even though they might take the pace at which they’re hiking down to that 25 basis points, it is still a hike, not a pivot.”

That’s the case even though economic data is showing weakness in some places and strength in others. That, Felton says, could include another strong reading on job growth in Friday’s January employment report. “The mixed bag of data doesn’t necessarily lead toward any change in policy.”

From the stock market’s perspective, “if you think about the whole notion of whether the Fed is our friend or not, we still don’t believe that the Fed is our friend” when it comes to the direction of monetary policy, she says. RiverFront expects that 2023 will be a year of low-single-digit positive total returns for stocks.

Anders Persson, Nuveen’s global fixed-income chief investment officer, offers a similar take.

“We do expect that Powell will pretty much have the same message as he has had the last couple of meetings and press conferences, which is he is going to reinforce that the Fed is very focused on inflation and is still very concerned that it’s going to stay sticky,” Persson says.

“But the markets are much more focused on economic data, what that is going to mean for the path that the Fed will actually take as opposed to what they are signaling,” Persson says.

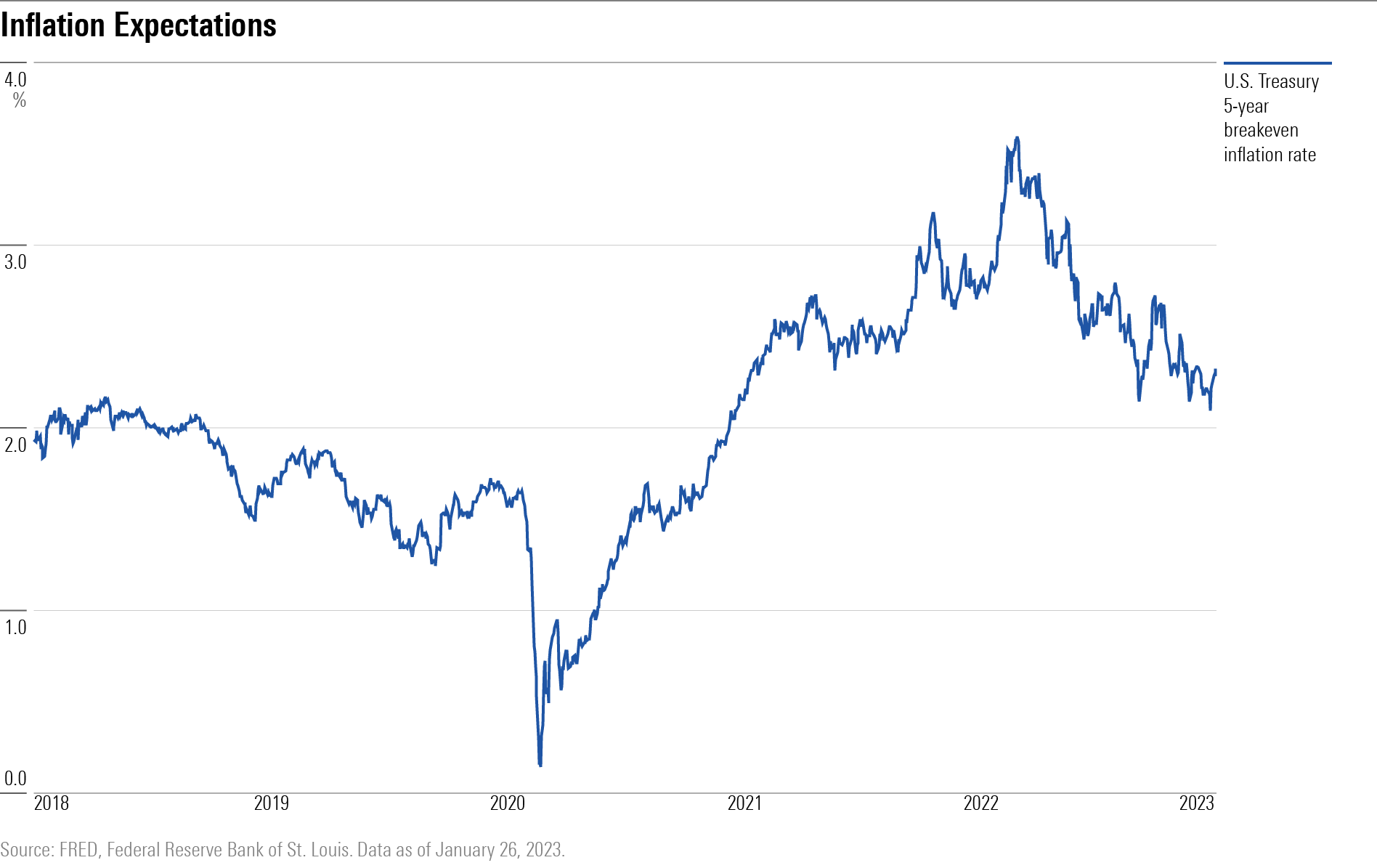

In the bond market, for example, inflation expectations have come down significantly from their peak.

Still, Persson says the view at Nuveen is the markets are overly optimistic about the potential for interest-rate cuts. While Persson says there’s a chance the Fed won’t raise interest rates more than one more time, “our bigger conviction view is that they are not going to be cutting this rate this year.”

“We just don’t see them turning around that quickly,” Persson says. “We don’t think the data is going to be that clear to the Fed that they’re willing to back off” from the inflation fight.

While Persson says the bond market could be proved wrong in expectations for looser monetary policy by the end of the year, he doesn’t see bond yields heading back up to the highs seen last year. “There could be a drift up,” in yields as investors realize the Fed won’t lower rates this year, but “we feel like yields have peaked for this cycle,” Persson says.

Events scheduled for the coming week include:

- Wednesday: Meta Platforms META reports earnings.

- Thursday: Apple AAPL, Alphabet GOOGL, Amazon.com AMZN, Ford Motor F, Eli Lilly LLY, and Sirius XM SIRI report earnings.