On the topic of Silicon Valley Bank's recent collapse, Morningstar strategist Eric Compton says, "Aside from crypto-related meltdowns, this is one of the first banks we’ve seen that has really suffered a liquidity crunch that has forced it to restructure the balance sheet and realize losses on its securities portfolios."

Sounds scary, but could this affect Canadian investors?

SVB Wasn't as Strong as the Big Six

Canadian investors could be impacted by the collapse through a hit to the balance sheets of Canadian banks, but so far major banks look stronger, says Compton: "Compared to other banks, SVB scores materially worse than any bank we cover [including Canada’s Big Six banks] on a number of liquidity and unrealized loss metrics,” he says, “This makes us think that SVB could be facing a unique liquidity crunch that does not have to feed through the entire system. However, it does highlight that these risks are now more elevated, even if they do not ultimately occur for others. It also highlights that it can be very difficult to predict how funding pressure can change in any given quarter and when these risks can materialize.”

Regulators Reacting Fast

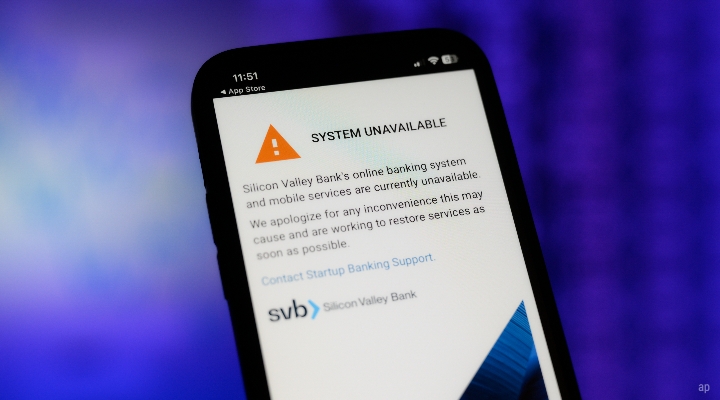

Pouncing on emerging risks at a systematic level, Canada's banking regulator, the Office of the Superintendent of Financial Institutions (OSFI) on Sunday said it was taking temporary control of Silicon Valley Bank's (SIVB) Canadian subsidiary, with an eye on permanent control. It also said it would ask the Attorney General of Canada to petition for a winding-up of operations. Meanwhile, Compton remains relatively confident on the health of other banks: “We don't currently see a bank under our coverage that we think will have to take similar measures as SVB. As funding pressures increase, the primary effect we see is an increase in the pricing of funding, putting pressure on net interest income."

Mortgages Are More of a Tipping Point for Canadian Banks

Negative interest income may be a smaller problem than the state of slowing loan growth in Canada, which Compton sees slowing, along with signs of credit strain beginning to emerge. At CIBC (CM), we’ve seen an uptick in mortgage delinquencies, says Compton, "and some shifts in originations and overall balances into higher loan/value distributions." This could push the bank further down a precarious path in the event of a downturn. Since it has the highest concentration of uninsured Canadian mortgages.

Compton says he is already predicting issues from net interest income to an extent, adding that he does not expect any changes to bank stock fair value estimates from the recent developments. "But liquidity issues are an evolving risk worth watching," he says.

Which Canadian Funds Hold SVB?

In the immediate term, Canadian investors should consider checking how much SVB they're holding in their portfolios. Here are the funds with the highest holdings:

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KZTYZGO2RRDDXPKYWJVXWIM6YI.jpg)