.jpg)

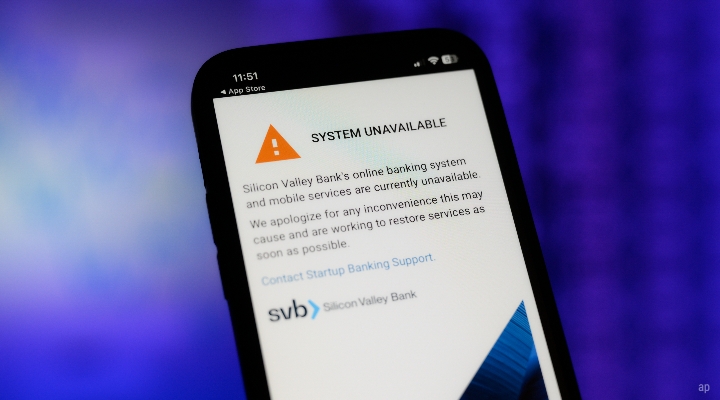

Collapse after collapse of U.S. regional banks led to rapid responses from regulators in both Canada and the United States. But is it enough to prevent indirect damage to our economies?

"In our view, these actions should reduce the likelihood of contagion (see SVB's Failure Sparks Sharp Selloff in the Sector as Banks Face Increased Scrutiny of Unrealized Balance Sheet Losses), thereby minimizing any impact on the near-term U.S. economic outlook," write DBRS Morningstar's Michael Heydt, senior vice president of global sovereign ratings, and Thomas R. Torgerson, managing director and co-head of sovereign ratings, "Nevertheless, stress in pockets of the banking system and corporate sector in the aftermath of this episode may, on the margin, bring forward the weaker economic conditions that we already expected during 2023."

SVB Will Weigh on Bank Profitability

Some of the weaker economic conditions ahead include pressure on the profitability of banks: "The SVB collapse is a tragedy that will weigh on the U.S. and global banking system for some time as it encourages politicians and regulators to push for more capital and higher liquidity levels," says John Hadwen, portfolio manager of global equities for the financials sector at BMO Global Asset Management, "Higher capital and liquidity levels help to reduce risks but also reduce profitability and profitability is a key requirement for system resilience."

Hadwen says SVB needed to restructure its low-risk, low-yield securities portfolio and that required some additional capital. "Unfortunately, deposit customers panicked so rapidly that the bank did not have time to succeed in an equity raise or merger… It seems that SVB's failure resulted from a rather concentrated client deposit base and these clients participated in perhaps the most rapid deposit run in history," Hadwen says, noting that pressure on the rest of the banking sector may not be warranted. "Most banks or deposit institutions have much more diversified deposit bases with a much greater percentage of balances under the deposit insurance caps and so are less likely to experience deposit runs."

Hadwen adds, "Canadian bank valuations will likely be impacted in the longer term from a higher regulatory capital burden and in the short and medium term from higher funding costs across the banking system, but we expect investors should remain relaxed in regard to deposit stability at Canadian banks."

Knock-On Effects Beyond the Banking Sector

Beyond the impact on the banking sector, there may be indirect consequences in other sectors—especially tech. Cash-constrained companies could cut back on services from companies that held cash at SVB, says Malcolm White, portfolio manager of global equities for technology and communication services at BMO Global Asset Management, but it might be a bit early to estimate. "This impact cannot be quantified now and will be dependent on the timing and recovery rates for uninsured entities," White says, adding the issue could affect the cost of capital for venture firms.

While monitoring SVB's ripple effects and whether they reach the tech sector, there may be concerns about the biotech subset, specifically. "I have seen an estimate that around 12% of SVB's deposits were from healthcare and life sciences companies," says Jeff Elliott, lead portfolio manager of global equities for healthcare at BMO Global Asset Management. The impact on individual biotech companies may be limited, however.

"There have been a fair number of disclosures regarding exposure at publicly traded healthcare companies. All that I have seen suggested it was minimal for any individual company," says Elliott, adding that it's likely concentrated in private companies. "Could it lead to financing issues for smaller-cap companies? Yes, on the margin, but larger-cap biopharma is the key driver for clinical development and is well-capitalized enough to purchase and develop assets that smaller biotechs might not get financed. So, I think the risk of material changes to businesses are low."

There's Still Potential for a (Short and Shallow) Recession

The immediate impact of the recent banking turmoil on the U.S. economy appears minor but worth monitoring because it will be adding pressure to an already weak economic outlook.

"Our expectation is that the U.S. economy will run close to stall speed for the next two to three quarters as the full impact of monetary policy tightening is transmitted to the real economy," write DBRS's Heydt and Torgerson. "While labour market conditions are still tight and household balance sheets are generally strong, consumer delinquencies are beginning to rise from historically low levels, and we expect consumers to be more discerning in their spending decisions going forward. Residential investment, which has contracted for seven consecutive quarters, will continue to be weighed down by the ongoing adjustment in the housing market. In addition, exports will face weak global demand. With this outlook, a recession in the U.S. is a clear possibility. However, if the economy enters a recession, we still expect it to be short and shallow, with moderate growth returning by early 2024."

Danger in the Domino Effect

Heydt and Torgerson write that the recent bank failures are unlikely to fundamentally change their U.S. outlook, but there remain many unknowns as potential changes in sentiment affecting both lending and labour manifest in the fallout.

"The fallout could, on the margin, bring forward the expected deterioration in economic conditions," according to Heydt and Torgerson. "Under greater market pressure, banks could increasingly differentiate between high- and low-risk borrowers, thereby intensifying stresses in pockets of the corporate sector and weakening the investment outlook. Likewise, labour market conditions may finally start to loosen as firms recalibrate their demand for workers, potentially accelerating the slowdown in consumer spending. … Over the coming days and weeks, we will be looking at how credit conditions evolve. If credit conditions tighten materially, durably, and in a broad-based manner, we could see the need to revisit our expectations for the U.S. economy."