Credit Suisse (CS) on Tuesday published its delayed annual report, announcing material weaknesses in its financial controls and an end to board bonuses following a difficult 2022.

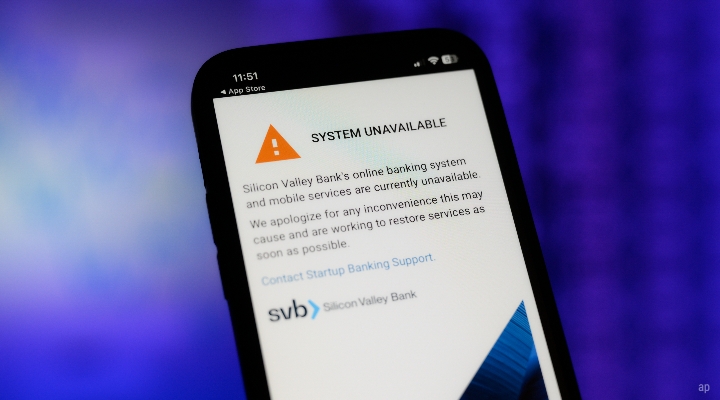

Credit Suisse shares fell 4% this morning, moving to levels just above the record low it reached at the worst point of trade on Monday, when the financial sector reacted to the failures of Silicon Valley Bank (SIVB) and Signature Bank (SBNY).

The annual report had been delayed over a dispute with the Securities and Exchange Commission over revisions to its cash flow statements from 2019 and 2020, as well as related controls. The bank's annual report published Tuesday describes "material weaknesses in our internal control over financial reporting" both for 2021 and 2022.

The bank says it failed to design and maintain an effective risk assessment process to identify and analyse the risk of material misstatements. It also failed to design and maintain effective monitoring activities.

"While we are taking steps to address these material weaknesses, which could require us to expend significant resources to correct the material weaknesses or deficiencies, any gaps or deficiencies in our internal control over financing reporting may result in us being unable to provide required financial information in a timely and reliable manner and/or incorrectly reporting financial information, which could reduce confidence in our published information, impact access to capital markets, impact the trading price of our securities or subject us to potential regulatory investigations and sanctions," the bank said.

The bank did confirm its financial statements for 2021 and 2022, as well as cash flow details from 2020, 2021 and 2022.

"It may have been a 'technical' issue according to the Swiss bank but in the current environment and given the company's recent sketchy track record, investors were hardly in a forgiving mood," said Russ Mould, investment director at AJ Bell.

Credit Suisse has lost money for five straight quarters and says it's expecting to post a loss before tax this year. It's undergoing a big transformation after losing billions lending to the Archegos family office and having to freeze $10 billion worth of funds tied to Greensil Capital. Clients pulled out about $100 billion from Credit Suisse in the fourth quarter.

Credit Suisse says it won't pay a bonus to any of its executive board members for the 2022 year, and said its chairman, Axel Lehmann, will voluntarily give up a chair fee of 1.5 million francs ($1.6 million). Lehmann is reportedly being probed over comments he made saying outflows had stopped at the Swiss bank when they had continued.

The Morningstar View

Morningstar banking analyst Johann Scholtz says:

"Regarding the financial reporting controls issue, it could not have come at a worst time for Credit Suisse. As we have once again seen with the SVB debacle, trust and confidence are everything in banking. Credit Suisse was already under pressure as depositors, and other funding providers lost confidence, leading to substantial client withdrawals in 4q22, and its cost of funding increased with ballooning CDS spreads.

"The announcement will do little to help restore confidence. However, most analysts pay little intention to banks’ cash flow statements. Cash is the raw material for a bank, meaning cash flow statements do not always reflect the actual operating cashflows for a bank. The misstatements are also confined to prior periods. It once again confirms that Credit Suisse's risk management and internal controls were deficient in the past."