According to Alan Turing, father of modern computing science, the ultimate test for AI was to be a program before which a subject would be unable to say whether he is dealing with a computer or a human being. That day might be here, as the world is awed by ChatGPT.

“It is a ‘Ah-ha!’ moment for investors and consumers, observes Mark Noble, Executive Vice-President, ETF Strategy, at Horizons ETF. “GPT-like abilities have been around for a while, but this is the first time people can interface with something that feels almost human.”

What is ChatGPT?

Editor's Note: The answer to this question is taken from a conversation with ChatGPT.

ChatGPT is a large language model trained by OpenAI, designed to generate human-like responses to natural language prompts. It is based on the GPT (Generative Pre-trained Transformer) architecture, which uses unsupervised learning to train a neural network on massive amounts of text data, allowing it to learn patterns and relationships in language.

ChatGPT is capable of generating text in a wide variety of styles and genres, including news articles, fictional stories, poetry, and more. It can also answer questions, complete sentences, and even carry on a conversation with a user.

The goal of ChatGPT is to simulate human-like conversation and provide a useful tool for a variety of applications, such as chatbots, virtual assistants, and language translation.

However the chatbot is not without its flaws. “While we have safeguards in place, the system may occasionally generate incorrect or misleading information and produce offensive or biased content. It is not intended to give advice,” the website popup reads, as one tries to log into ChatGPT.

Challenges of ChatGPT

In social networks, there is widespread apprehension that chatbots could mislead, misinform, even manipulate participants.

First of all, factual errors abound, but that could change when the data set expands. Presently, the bot sits on a base of 175 billion parameters. Some claim that in a year, that base will expand to 100 000 billion parameters, and ostensibly, the errors should reduce.

Meanwhile, the Bing chatbot had some unsettling episodes, with the bot claiming to be in love with a journalist and asking that he divorce his wife.

Serge Robert, Director of the Institute of Cognitive Sciences is categorical: AI is strictly “syntactic”, not “semantic”. It can cleverly associate symbols, but it does not, and cannot, “link them to needs and actions, like humans, or even animals, do”. In other words, it is totally devoid of awareness and any capacity to assign meaning.

That’s not to say that AI is benign. “Meta-cognition will always set humans apart, Robert claims, but we’re moving toward robots that will behave increasingly in human-like ways.”

Another challenge of AI is job obsolescence, and it threatens mostly better-paid, better-educated workers, observed a 2019 Brookings study. Production, engineering, science and management are some of the work categories most at risk, while social service, health support, food service and education were among the least.

McKinsey Global Institute argues that artificial intelligence shifts the focus from “jobs” to “tasks”. Jobs are comprised of many tasks, and while tasks can be automated, jobs will mostly hold steady. “While less than 5% of all occupations can be automated entirely using demonstrated technologies, writes McKinsey, about 60% of all occupations have at least 30% of constituent activities that could be automated. More occupations will change than will be automated away.”

However, those numbers seem to concern an ever-receding future. For this article, we couldn’t find any study that tried to account for jobs lost to AI to this day.

What Exactly is Artificial Intelligence?

Editor’s Note: The answer to this question is taken from a conversation with ChatGPT.

Artificial Intelligence (AI) refers to the development of computer systems that can perform tasks that typically require human intelligence, such as visual perception, speech recognition, decision-making, and natural language processing. The key feature of AI is the ability to learn from data, recognize patterns, and make predictions or decisions based on that learning.

AI encompasses various technologies, including machine learning, deep learning, natural language processing, and computer vision. AI has numerous applications in a wide range of industries, from healthcare and finance to manufacturing and transportation. It is used to develop products and services that can improve efficiency, accuracy, and productivity, as well as to create new opportunities for innovation and growth.

Artificial Intelligence is Turning into an Oligopoly

One final challenge of AI rests with investors: the paucity of available stocks to invest in. The readily available ones are always the usual suspects: nVidia (NVDA), Microsoft (MSFT), Google (GOOG), Meta (META), Amazon (AMZN) and Apple (APPL).

As a report on Microsoft by Morningstar Senior Equity Analyst Dan Romanoff says, AI capacity is so deeply buried in the company that it’s not obvious how it contributes to revenue growth and profitability. “The company plans to integrate AI throughout its entire portfolio. We view immediate monetization opportunities as limited, but believe they will become more material over time as customers become more comfortable with AI usage and interaction, and use cases proliferate.” All in all, Romanoff does “not believe there is a durable moat in Microsoft’s Bing search engine”.

What investors are confronting is a more insidious problem: the concentration of AI in a handful of players. “It’s a monopolistic grab, Noble states. Giants dominate the number of AI engineers available. They’re buying all the upstarts. Most AI will be developed by AI giants.”

Robert concurs. “Tech giants are gulping down everything. Thanks to their enormous resources, they are the exclusive players.”

Investors Should Find the Shovel Makers

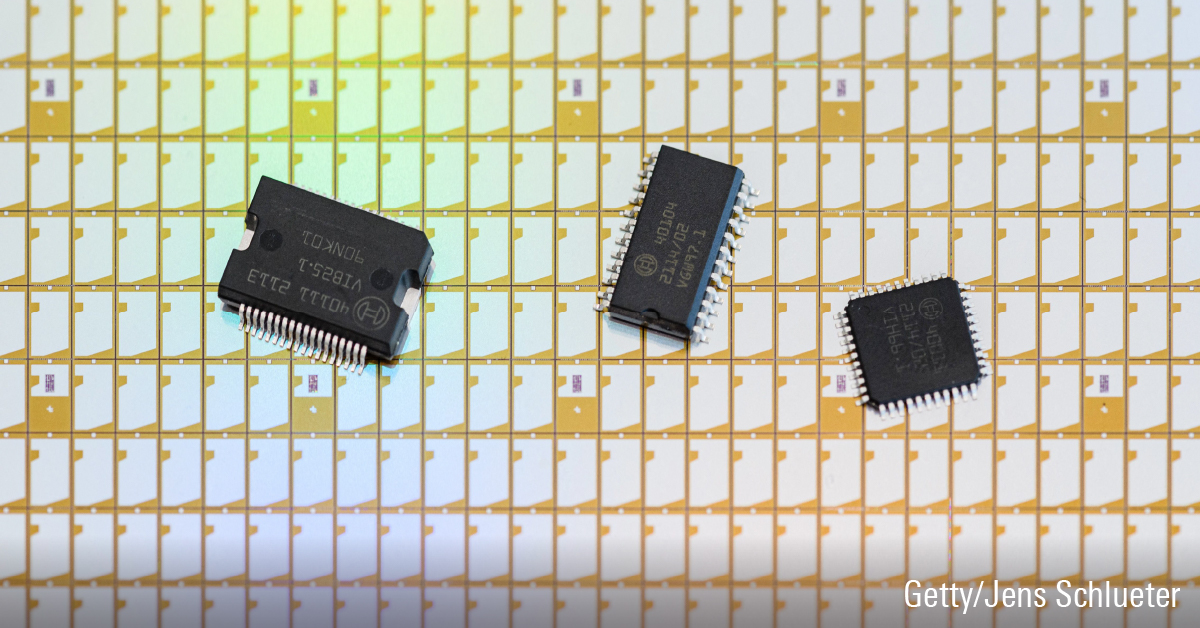

Where opportunity rests, Noble believes, is among the suppliers of “picks and shovels” to the gold extractors, namely companies like chipmaker nVidia, Taiwan Semiconductor Manufacturing (TSM) and electronic lithography maker ASML (ASML). Such players will profit wherever AI capacity is developed.

Because one key feature of AI is that it is more an enabler than an onstage star. “There will be upfront applications, but few, Noble says. AI is mostly a background enabler. The investment industry is the best example where you have AI in the background scraping for dividends and returns. You have every advantage in keeping it to yourself for your competitive advantage. AI algorithms contribute “brain power” to your industry; you won’t sell your brain itself, only the result of what comes out of it.”

One should also keep an eye on upstart companies that have not yet made it to the stock market. From 2019 to 2022, Morningstar Pitchbook identifies 401 companies that have received US$ 7.5 billion in venture capital financing in the two key areas of generative AI and neural search. One such company, Databricks, founded in 2013, boasts 4860 employees in 25 offices globally. “Databricks has achieved the necessary scale and growth to realize high performance in public markets, writes Brendan Burke, Senior Analyst, Emerging Technologies. The company reached US$ 800 million in 2021, and in Q3 2022, the CEO disclosed US$ 1 billion in annual recurring revenue.”