Up until recently, the idea of investing sustainably has been a nebulous area that proved rather difficult for all but those who really did the research. A recent survey from Mackenzie Investments found that six-in-ten Canadians surveyed have concerns about whether their sustainable investments are truly "sustainable." This landscape, however, is changing quickly.

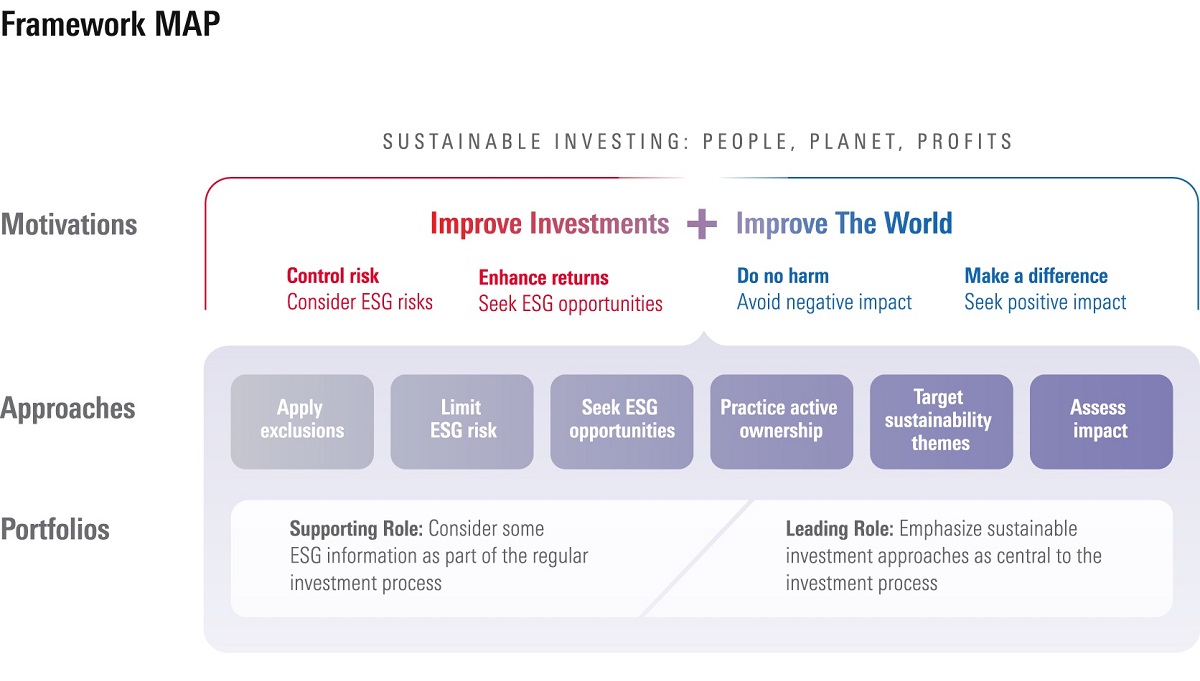

Recently, Canadian regulators put out requirements for Canadian mutual fund and ETF manufacturers to disclose their sustainable investment approaches within the annual filings (no such requirement existed prior to 2021). Subsequently, an industry committee led by Morningstar put forth a framework to identify funds that have done so and have compiled a list of funds that follow one or more of six well-defined approaches to sustainable investing. The framework is well-aligned with Morningstar's own Sustainable Investing Framework, which was designed to help investors line up their motivations to six approaches to sustainable investing. Here it is:

As investors, our motivations for investing can vary from one person to the next. As the framework notes, some investors may only care about controlling risk or enhancing returns to the portfolio, while others might also be interested in making an impact on the planet and its people. For an investor who cares largely about risk and returns, funds that use exclusions, ESG integration or a best-in-class approach, might fit the bill. Meanwhile, those concerned with improving outcomes for people and planet might choose to invest in funds that have a focus on active ownership, those that have an ESG theme, or those that have stated impact goals (and make efforts to measure against those goals). As we can see, the concept of investing sustainably is far from a yes/no decision, and with some effort, it might be reasonable for most investors to at least think about how sustainability plays into their investments, even if strictly from a risk management perspective.

The good news is that a set of funds have been identified by the Canadian Investment Funds Standards Committee and is now publicly available. Any investor can look for funds that state a sustainable investment approach within their latest regulatory filings. This is a great first step for investors who wish to explore the world of sustainable funds. However, the work does not stop here. The framework goes so far as identifying which sustainable investment approaches are used (as stated in filings), however, it does not tell an investor whether the funds are achieving said objectives. For this, motivated investors might look to ratings and measures published by companies like Morningstar, with the large caveat that not all measures are fit for purpose. For example, Morningstar's Sustainability Rating (which is a measure of ESG Risk) might be appropriate for measuring the ESG risk inherent in ESG best-in-class funds, but it might not be the appropriate benchmark to measure engagement (instead an investor might opt to look at proxy voting records from the fund company, something that Morningstar also collects).

Even though IIROC-licensed financial advisors are encouraged to ask questions about your ESG preferences during the regular KYC process, it is very likely that they are still getting up to speed on the new requirement and this framework. For now, investors can freely peruse the definitions and funds published on www.cifsc.org

Is ESG Investing Worth it?

A quantitative study from Morningstar in 2020 showed that when we isolate ESG Risk as a standalone investment factor, by itself it does not help, nor hurt investment returns over time. However, it can be argued that those who are invested in line with their personal values and beliefs might be less likely to pre-maturely sell their investments during times of market volatility, an observation that we saw ring true during the 2020 COVID pandemic sell-off. Some critics also allude to ESG investments being more expensive than traditional funds. In Canada, this is simply not true. Our data shows that investing in a sustainable fund costs an investor essentially the same in fees as compared to a traditional (non-sustainable) fund when we look at median asset-weighted MERs in Canada.

What are the Top Sustainable Funds in Canada?

Based purely on asset size, here are the largest funds in Canada that have stated a sustainable investment approach in their prospectus:

Based on performance as measured by the Morningstar Rating for funds (a strictly objective look-back at after fee risk-adjusted financial returns), here are the best performing funds that have stated a sustainable investment approach in their prospectus:

This article does not constitute financial advice. Investors are urged to conduct their own independent research before buying or selling any of the investments listed here.