It’s not always good when your mutual fund is in the news, but when it is, it’s important to look beyond the headlines to determine the true impact of the story. Take CI Global Income and Growth, as an example.

Almost a year ago, the fund lost a significant portion of its global equity team to another firm. While that exodus and other departures and retirements set off alarms in the financial news media, nearly 12 months later, the situation is not as dire as it seemed. The fund still gets a Morningstar Medalist Rating of Neutral. Here’s why.

What Does a Fund House Do When Its Team Leaves?

In July 2022, 12 investment professional sfrom the global equity team that picked stocks for CI Global Income and Growth and other strategies left CI Global Asset Management for Bank of Montreal, according to news reports. This came on the heels of the departures of the fund’s former derivatives and quantitative expert, Allan Howard-Maclean in March 2022, and Eric Bushell, one of the fund’s founding managers, in late 2021.

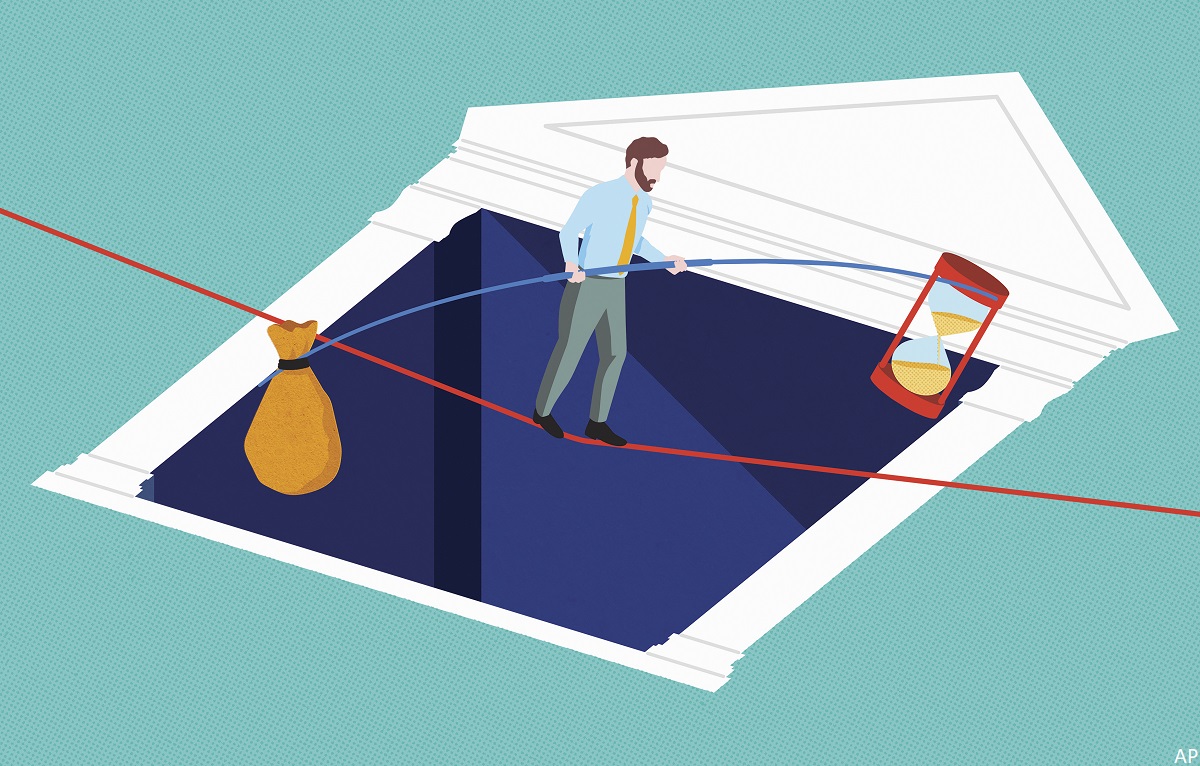

While some members of the fund’s management team did indeed depart, the strategy’s key portfolio managers remain. For the last few years, CI Global Asset Management underwent an effort to centralize internal capabilities supporting the fund, with separate groups dedicated to risk, derivatives, and currency, among others. This means that though the recent exits left the team fragile, the steps taken by the asset manager to centralize investment capabilities among its different investment teams lessen that impact. CI Global Income and Growth did not lose as much as once feared.

For example, losing Maclean-Howard’s intimate knowledge of derivatives diminished the team, but now it has access to a separate, specialized group within the firm to handle the fund’s currency hedging.

Strong Managers Still Remain at CI Global Income and Growth

Four other key individuals who led CI Global Income and Growth to impressive results for more than a decade remain even after Bushell’s departure. Drummond Brodeur, Matthew Strauss, John Shaw, and Geof Marshall’s steady leadership can help the strategy weather the recent storm.

Result have been encouraging in the short period since the changes. CI Global Income and Growth F’s 4.4% gain from the Aug. 1, 2022, through May 26, 2023, exceeds the Morningstar Canadian Neutral Global Target Allocation Index and ranks in the top half of the Global Neutral Balanced Morningstar category. The fund ranks in the top quartile for its category year-to-date through May 26.

The global equity team that left selected stocks outside of North America. The firm quickly replaced them, but non-North American stocks have played a smaller role in this fund in recent years. The fund’s non-North American stock stake dropped from 54% of its equity sleeve on May 31, 2013, to 33% in April 2023. That equated to less than a fifth of the overall fund at the time.

Note: the investment professions who left CI also looked at Canadian and U.S. equities.

In Conclusion, the Centralization Strategy Worked!

CI Global Income and Growth suffered bumps in the last twelve months, but it hasn’t been quite the disaster as once feared. Centralization efforts at CI Global Asset Management give the team capabilities potentially lost. The changes in personnel need time to settle. Fragile, but not broken, we will continue to monitor this fund closely.