On the 24th of May, Amazon (AMZN) held its annual general meeting, where a record number of proposals – 33 – came up for vote. This meeting was important to those tracking sustainability and governance themes both at U.S. companies, and worldwide.

The Amazon 2023 proxy card reflects all of the key proxy voting trends we’ve seen in the past couple of years.

- There are a record number of proposals. Amazon shareholders cast votes on 33 topics this year, including 11 director elections, four other management resolutions and 18 shareholder resolutions.

- Executive pay, governance and board oversight continue to generate areas of contention between management and shareholders. These issues have continued to escalate at Amazon over the past couple of years.

- Shareholder proposals cover an increasingly wide range of environmental, social and governance topics. Amazon’s proxy card covers all three themes, with a particular focus on social topics and stakeholder impacts.

Executive Compensation Was a Key Area of Dissent

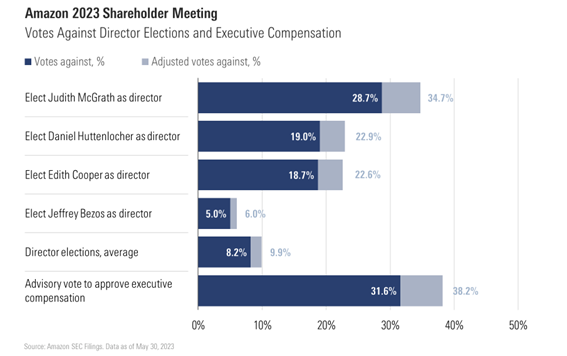

Among the management proposals, executive compensation was a key area of dissent for Amazon shareholders—as it often is at many companies. Almost 32% of the company’s shareholders voted not to approve the company’s executive compensation in the “Say on Pay” proposal this year. That equates to over 38% opposition from independent shareholders, if we adjust the calculation to exclude the 12.3% shareholding of executive chair Jeff Bezos and other Amazon board members.

Shareholder dissatisfaction with executive pay was visible in votes against director elections too; in particular, the directors on Amazon’s leadership development and compensation committee (proxy advisor ISS advised a vote ‘Against’ all three). Committee chair Judith McGrath’s re-election was opposed by over one third of Amazon’s independent shareholders. The other two directors on the committee saw over one fifth of the company’s independent shareholders vote against their re-appointments.

This appears to be a long-running, and deteriorating, situation. At Amazon’s 2022 shareholder meeting, 27% of Amazon’s independent shareholders voted against McGrath’s election. However, the other two directors on the committee were both supported by over 90% of shareholders.

Asset Managers are Unhappy with Executive Compensation

It’s clear that asset managers are increasingly seeking to ensure that executive compensation reflects value created for shareholders. For example, the Big Three index fund providers, BlackRock, State Street, and Vanguard have all recently reiterated their focus on ensuring alignment between management pay and financial value creation in their priorities for engaging with companies. Morningstar Direct data shows the three asset managers are also Amazon’s largest independent shareholders representing around 16% of the company’s shares.

When shareholder patience with a company’s executive pay practices runs out, it is common for them to vote against the election of the chair and members of its compensation committee—which happened at Amazon.

We analyzed the voting decisions and rationales of six asset managers and eight asset owners (such as state-run investment funds) in the U.S., Canada and Europe to get to the heart of the matter. The six asset managers are Abrdn, AllianceBernstein, Allianz Global Investors, Columbia Threadneedle, LGIM, and Schroders. The eight asset owners are CalPERS, CalSTRS, NY State Common Retirement Fund, Texas Teachers Retirement System, and Florida State Board of Administration in the U.S.; Ontario Teachers Pension Plan and British Columbia Investment Management Corp in Canada; and, Norges Bank Investment Management, a top 10 Amazon shareholder based in Norway.

Common reasons given for these shareholders’ dissatisfaction with executive pay at Amazon include:

- Insufficient demonstrable links between pay and company performance over the past year;

- Restricted share awards that vest after elapsed time only and lack performance-related conditions;

- The size of payouts awarded to some executives; and

- Shareholders believe that termination payments after a change of control should be similar to those paid under normal circumstances.

Many of these shareholders reported having engaged with Amazon over the past year. Further, the company’s size and large index weighting means it is often a stock that even highly active managers are reticent to sell out of. So, absent any change of course by management, several shareholders are likely to escalate their dissent on this issue further in the coming years.

Shareholders Care About Amazon Workers and Customers

The shareholder proposals on Amazon’s 2023 proxy card covered a broad range of environmental, social, and governance themes. There were 18 such proposals this year, up from 15 in 2022. Four of these resolutions have a clear environmental angle—addressing issues like climate or plastic pollution. Two proposals address governance themes, while the remaining 12 address social issues. This split well reflects the prevalence of social-themed resolutions in the U.S. which, as we have observed, contrasts with a greater focus on climate matters elsewhere in the world.

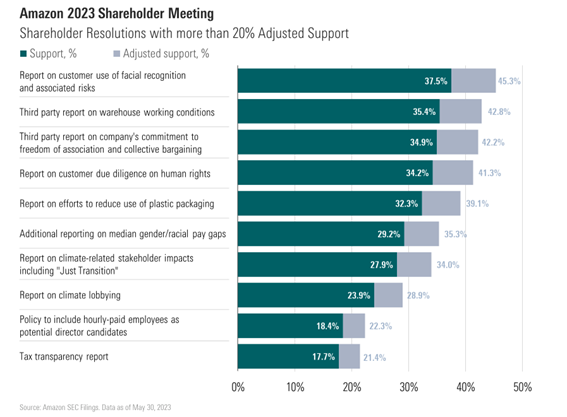

For the second year running, 10 shareholder proposals at Amazon were supported by more than 20% of the company’s independent shareholders. These are shown on the chart below.

Four of these resolutions qualify as key resolutions according to our methodology. This means they were supported by more than 40% of the company’s independent shareholders. The four key resolutions request additional reporting on:

- Freedom of association and collective bargaining;

- Warehouse working conditions’

- Customer use of facial recognition technology; and

- Customer due diligence on human rights.

These four resolutions focus on societal implications of the company’s interaction with key stakeholders, namely its workers and customers.

In particular, investor attention on freedom of association and collective bargaining is rising, as the vote at Amazon and another well-supported proposal at Starbucks this year both indicate. The Amazon proposal was the only one to be supported by all of the 14 managers and asset owners in our review who disclosed their votes—including a mixture of state investment funds from both pro- and anti-ESG states.

Notably, all four of these proposals are similar to four resolutions filed at Amazon’s 2022 shareholder meeting, where they also gained the support of more than 40% of the company’s independent shareholders. Average adjusted support for the four proposals has fallen slightly from 49% to 43% year-on-year, but it appears that many shareholders believe greater transparency on these matters is of benefit. Our selection of 14 asset managers and asset owners often mention that such measures benefit shareholders by enabling them to “assess the company’s management of related risks and opportunities for improvement.”

Proposals requesting reporting on gender and racial pay gaps, tax transparency, lobbying, and packaging materials, and new policies on employee-director nominations, also returned to Amazon’s proxy card for a second year running. All these proposals gained more than 20% independent shareholder support, as did a new request for reporting on climate-related stakeholder impacts.

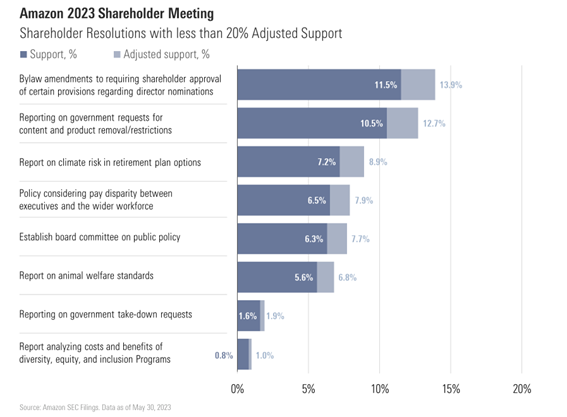

Low Support for Highly Specific Asks

Last year saw an increase in the absolute number of shareholder resolutions, as well as the number of those asset managers dismissed as “overly prescriptive.” The trend towards highly specific asks in shareholder resolutions appears to be continuing, and is noticeable among the eight resolutions on Amazon’s 2023 proxy card that failed to obtain the backing of 20% of the company’s independent shareholders.

Several of the asset managers and asset owners we reviewed commented that the proposals were either “onerous” or “prescriptive”, not in shareholders interests, or that Amazon’s existing reporting, oversight and controls were sufficient in these matters.

What Does This Mean for Amazon Shareholders, and Stakeholders?

All in all, we can gather three key takeaways from Amazon’s shareholder meeting that read across to the 2023 proxy season as a whole.

- Shareholders’ focus on value creation, aligned incentives, and appropriate oversight remains as strong as ever. There is increasing willingness to hold individual directors accountable for perceived shortcomings.

- Shareholder proposals requesting additional insight into how companies are managing material ESG risks continue to be well supported, as they allow investors to make prudent, long-term decisions about where to invest their capital.

- Proposals that seek information not material to shareholders’ interests or already provided by companies, and those that demand that management take highly specific actions continue to be poorly supported.

As the proxy season wraps up in June, we will soon have a better idea of exactly how these trends will shape the corporate agenda, and shareholders topics of engagement with companies, in the coming year.