Investing can be complex, scary, and still fun. Back in 2021, meme stocks were all the rage, fueled by FOMO, or the ‘fear of missing out.’ The problem was though, that stock picking is a complex process, and many investors don’t always have the adequate time, resources, or knowledge to build and maintain a portfolio of individual stocks. At the time, we’d talked about one way to protect your portfolio from yourself, by picking a diversified, low-cost exchange-traded fund.

Still, the lure of stocks heading to the moon can be hard to resist. Recently, Redditor u/vk211 asked r/PersonalFinanceCanada "What are some good reasons for when an investor should buy individual stocks as opposed to investing in a passive global index ETF?” Here’s what some Canadian Reddit investors had to say:

1. When You Participate in Employer Stock Purchase Plans!

“You get them at a discount from your employer.”

“The decision to participate in an ESPP and the decision to hold on to the stock after the purchase date are separate decisions (unless there's a lockup period, non-public stock, etc.).

If you can sell immediately after the purchase, it's always worth it.”

“The time I met a retired branch manager from a major bank cashing out 70k a year in dividend all coming from his ESPP he acquired during his 25 years of work for pennies on the dollar. That is the true financial power!”

2. If You Use Your ‘Play Money’ to Pick Stocks, You Should Be OK

“I use my individual investments like people buying scratch tickets, play money. All the responsible stuff is in index funds, high interest, dividends and ETF’s.”

“10% of my savings in my TFSA is fun money. I.e. to be played around with in stocks. It may seem irresponsible, but it satisfies my need to try and beat the market. I view it as protecting the 90% which is rightfully in very boring ETFs.”

“Exactly this. I only buy individual stocks when a company that is in my circle of expertise is at a larger discount than the overall market, and that discount needs to be larger enough to justify the risk. I have a small bucket of companies I am intimately familiar with and don’t stray outside of the sectors that I am already naturally following and knowledgeable on for non-stock reasons. And when I see one of the companies that I am interested in at a better discount than my usual funds then I’ll dip in a bit.”

u/Kugel

“Use your savings for index funds. If you enjoy playing in the stock market it's reasonable to set aside some extra money in your budget as gambling money, it just shouldn't be money you're relying on for retirement... Stock picking shouldn't be used for long-term savings, but just like it's OK to spend a couple of dollars on a lottery ticket every now and then, it's OK to use some play money to buy stocks If that's the sort of thing you enjoy.”

3. Canadian Investors on Reddit Recommend Individual Stocks When You Have Specific Knowledge About a Sector

“Very specific domain knowledge and network. But even then, if it is a large conglomerate with a diverse holding, your knowledge may not give you any advantage because there are so many other things going on.”

“You actually have knowledge and understanding of a specific company or market sector above the average investor. 2) You get a discount (employer shares for example). 3) Gifted stock. 4) Inheritance.”

“Do your homework(DD on your stock and books about the market in general), don’t invest more than you’re willing to lose, be wary of social media for tips on the day - use it to gauge sentiment but know there are a lot of paid actors - nobody talks about a stock repeatedly without having a financial interest in it. Profit potential and risk are important to look at. Indices and ETFs are nice, but most of the juicy profit is in individual stocks and leveraged ETFs, and they’re also the most risky. So balance your portfolio for the risk you’re willing to take now (you can always rebalance your portfolio as you age and your risk aversion is higher). Self-directed will help to maximize your profit if you’re willing to work at it every day with no guarantees(maximum risk), and if you don’t mind making 4-5% a year then managed will put your mind at ease.”

“If you have a deep understanding and network in the industry. I have a friend who invests successfully in junior oil & gas, but this person has close relationships with many CEOs, and large investors, and worked the fields. I'd say this is an informational advantage / legal insider that 99% of people don't have. Most people in that 1% are still disillusioned that they really understand what's going on though. If you have an insane portfolio size, you can buy individual stocks to minimize MER, even then the impacts are negligible and likely not worth the rebalancing time.”

4. For Tax Reasons!

“If you file US taxes in addition to Canadian taxes, then a reason to avoid Canadian mutual funds is the US tax treatment of such funds. And a reason to avoid US mutual funds is the Canadian reporting requirements for them. ETFs do not get the bad treatment of mutual funds, but individual stocks are even more in the clear.”

“Taxation. If you own a single index and you need to sell, you have no choice in what to sell, but owning individual securities allows you to rebalance and manage the capital gains / losses in a way more suited to your individual needs. In addition, Canadian dividends are incredibly tax efficient.”

The taxation part I think it's an important one, I find it simpler to calculate and keep track of the ACB of single stock (but I'm probably biases since I have very few of them).

5. When You Want to Be a Company Owner

“Direct ownership stake in a company you believe in, receiving dividends and potentially warrants on said stock, ability to vote on company policy, potential for higher gains, and if the stocks you're buying are properly correlated to a bear market they can provide some defense against your portfolio completely falling in tandem with the overall market... When you buy ETFs you own absolutely no part of the companies that the ETFs invest in.”

What Does Morningstar Think about the Reddit Investing Advice?

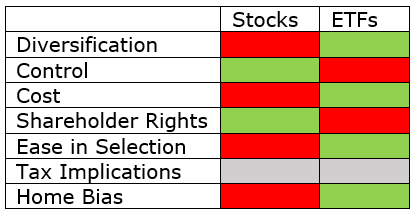

A lot of these points make sense. In a nutshell, these are the pros and cons of investing in stocks vs. ETFs:

Advantages and Disadvantages of Stocks

“From the portfolio management perspective, holding individual stocks in your portfolio allows a great deal of control over your investment decisions,” says Ian Tam, Director of Investment Research at Morningstar Canada. “Plus, with stocks, investors who want to actively participate in a company’s growth also get shareholder rights, in particular when voting proxies issues that you feel strongly about,” Tam says.

Access to all this comes with a lot of work. “Assuming that you have a sound investment process in place to ensure a diversified portfolio of stocks, the main disadvantage in holding stocks is maintenance,” says Tam. “Stock prices move quickly, and ensuring you maintain target stock weights within the sleeve of your equity portfolio and also within the context of your overall asset allocation requires disciplined work.”

And there are costly pitfalls, both operational and psychological, to watch out for if you want to DIY. “Particularly in Canada, liquidity risk can also be an issue. Outside of the largest 60 or 75 names in Canada, investors can expect to see a meaningful bid-ask spread when trading, (meaning you will end up paying more than the last trade price when buying, and getting less than the last trade price when selling, especially in larger quantities),” says Tam, adding that if you want to be in a driver’s seat, you’ll also have to control your mind to be able to sift through today’s 24-hour news cycle without forming a bias.

Advantages and Disadvantages of ETFs

ETFs on the other hand, remove much of the control – and temptation – by packaging stocks based on either indexes, computer algorithms or active management direction similar to what you might get in a mutual fund.

For one, the need to do your own diversification is reduced. “Equity ETFs remove the need to re-balance within the equity portfolio as this is done for you automatically to ensure you are exposed to the ETF’s prescribed allocations to each position,” says Tam.

Also having a hybrid approach where you’re partnering up with a computer or human in your stock picking can mean achieving more. “Actively managed ETFs also enable retail investors to benefit from professional money managers who have the resources and experience to effectively manage your portfolio,” adds Tam.

This all comes at a reasonable price. “ETFs have much lower costs than mutual funds,” says Heath. “Stock ETFs have management expense ratios (MERs) of under 0.1% in many cases, compared to mutual funds, with average costs approaching 2%.”

But the saying “you get what you pay for,” applies to ETFs. Investors in passively-managed ETFs should know that the low-fees mean automation and the potential for errors, especially in subjective and rapidly changing areas like ESG investing.

Both stocks and ETFs can be easily accessed. Discount brokerages also make it relatively inexpensive to trade stocks (in Canada this can drop to as low as $5 per trade), says Tam. And the same goes for ETFs, easily purchased for free (in exchange for a management fee).

On the costs, depending on your target sector, ETFs can be a handy way to invest in a certain sector or country without having to pick individual stocks, let alone incur the cost to buy several individual stocks and get diversification, says Ian Tam. Trading commissions can add up fast.

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KWYKRGOPCBCE3PJQ5D4VRUVZNM.jpg)