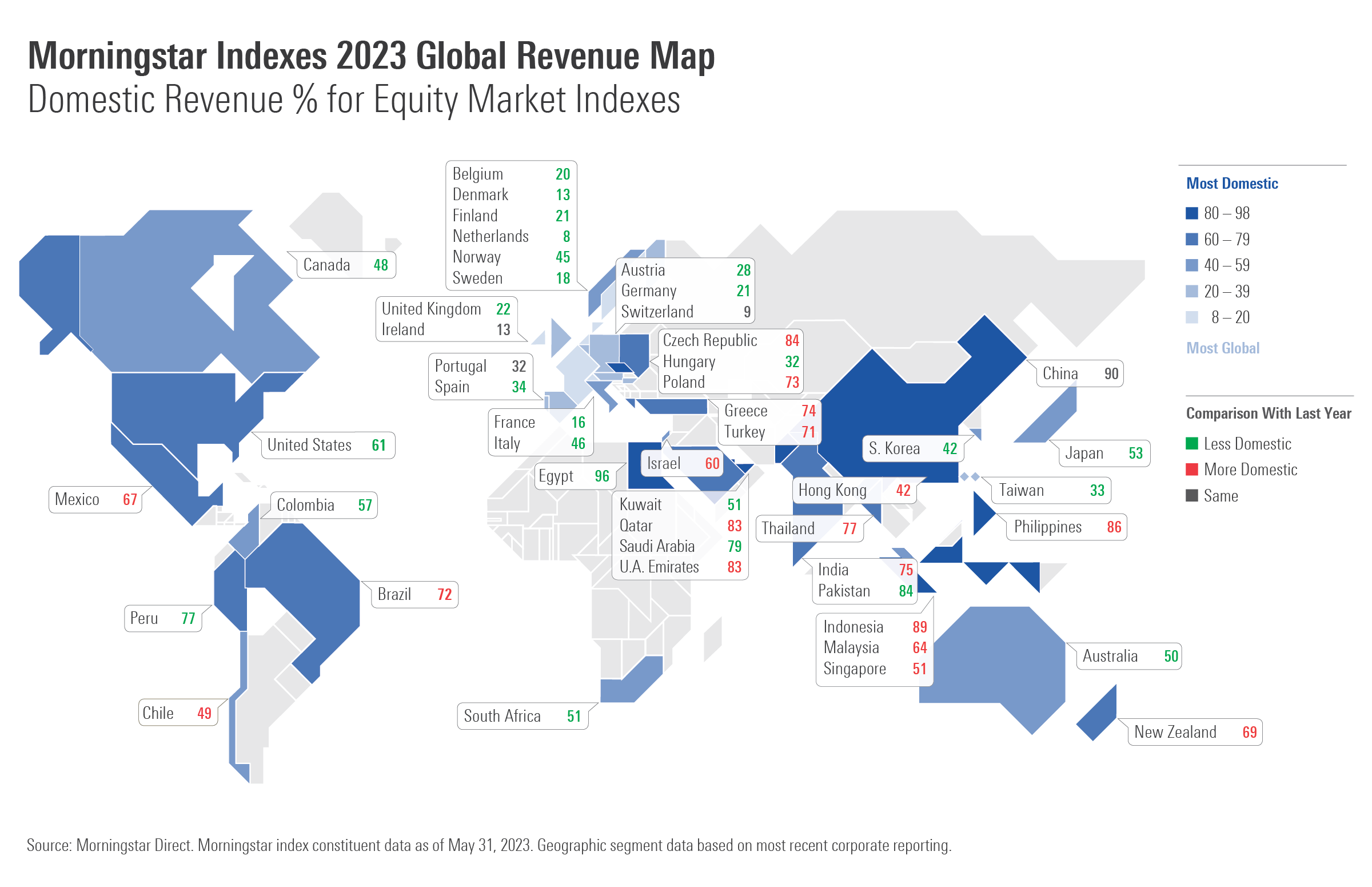

Canada, like many developed equity markets, has globalized its revenue sources. According to Morningstar Indexes’ annual study, 48% of the revenues from the Canadian equity market are sourced domestically—down from 50% in 2022 and 53% in 2019. Canada joins the U.S., Japan, Australia, and most of Western Europe in having become less domestic. So, despite the pandemic and geopolitics, globalization does not seem to be reversing.

Countries Are Globalizing Because Companies Are Globalizing—At Least in Developed Markets

To understand how revenue streams for the Morningstar Canada Index have globalized, consider Bank of Montreal Financial Group, one of the largest companies in the market. In its last fiscal year, BMO earned the majority of its revenues from the U.S. for the first time. In the previous fiscal year, Canada represented nearly 60% of BMO’s revenues.

In the U.S., Meta Platforms, owner of Facebook, Instagram, and WhatsApp, has seen its share of revenue sourced outside the U.S., grow over the years—the Asia Pacific region is its largest international market. Thanks to Meta and others, the Morningstar US Market Index has gone from 66% domestic in 2019, to 62% in 2022, to 61% today.

European markets are the world's most global in their revenue sources. The Netherlands, Switzerland, Ireland, Denmark, France, Sweden, Belgium, Germany, Finland, the U.K., Austria, and Spain all earn more than two thirds of their revenues from outside national borders. These markets have generally become even more global over the past several years. Companies like ASML Holding, Nestle, CRH, Novo Nordisk, LVMH, Atlas Copco, Anheuser-Busch InBev, Siemens, Nokia, and AstraZeneca have all diversified their revenues geographically.

Emerging Markets—Less Global and Less Globalizing

Emerging markets, China foremost among them, tend to be more domestic in their revenue sources. Egypt, China, Indonesia, the Philippines, the Czech Republic, Pakistan, Qatar, and the United Arab Emirates are the most domestic in their revenue sources of the 48 countries studied. Most have not globalized in recent years. Banks, telecom, and utilities, which tend to be more domestic than technology and healthcare-related companies, largely dominate these indexes.

Two outliers among emerging markets are South Korea and Taiwan, which source the majority of their revenues internationally. These are technology-heavy markets. South Korea's international revenues are largely driven by Samsung Electronics, a global leader in smartphones, semiconductors, TVs, and more. The Morningstar Taiwan Index is dominated by Taiwan Semiconductor, the world's largest contract chip manufacturer.

Globalizing Revenues Parallel Rising Correlations

Increasingly globalized revenue sources, especially among developed markets, parallel rising correlations across equity markets. Lower correlations between developed and emerging markets are logical, given the domestic-revenue orientation of many emerging markets. For many investors, globalized revenue sources blur the lines between the home market and international portions of a portfolio.

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6ZMXY4RCRNEADPDWYQVTTWALWM.jpg)