:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/737HCNGRFLOAN3I7RKGB7VPEKQ.png)

Apple AAPL is scheduled to release its fiscal third-quarter earnings report on Aug. 3, after the close of trading. Here’s Morningstar’s take on what to watch for in Apple’s earnings and stock.

Apple Stock at a Glance

- Fair Value Estimate: $150

- Morningstar Rating: 2 stars

- Morningstar Economic Moat Rating: Wide

- Morningstar Uncertainty Rating: High

What to Watch for in Apple’s Quarterly Earnings

We’ll be looking at three main areas:

- iPhone sales: In Morningstar’s opinion, iPhone is still the most important business at Apple. The firm was concerned about currency and macroeconomic headwinds in the June quarter, which may weigh on revenue, so we’ll be interested in the picture for demand in the near term. That said, this quarter’s report will be the least important one for investors this year because June revenue and any September forecast pertain to the iPhone model (in this case the iPhone 14) launched about ten months ago. We suggest investors pay closer attention to Apple three months from now, once the company introduces the iPhone 15 and other new products.

- Services revenue: Apple expected macroeconomic headwinds to weigh on digital advertising and gaming, but it’s possible the global economy was better than feared in recent months, so the company might be in good shape here. More importantly, we’ll want to see ongoing traction in paid subscriptions, as we like to see Apple users subscribe to more and more services, keeping them tied to the iOS ecosystem.

- Artificial intelligence: Most tech companies are touting their AI efforts/opportunities or being pressed by investors on how AI will affect their businesses. AI is embedded within Apple’s products, such as Siri and predictive text. It’s unlikely that Apple will mention any new AI models on its earnings call. Still, we may hear more about the company’s investments to support AI, large language models, or its data centers in general. Ultimately, Apple will need to make healthy in-house research and development investments to leverage AI and keep up with other tech titans.

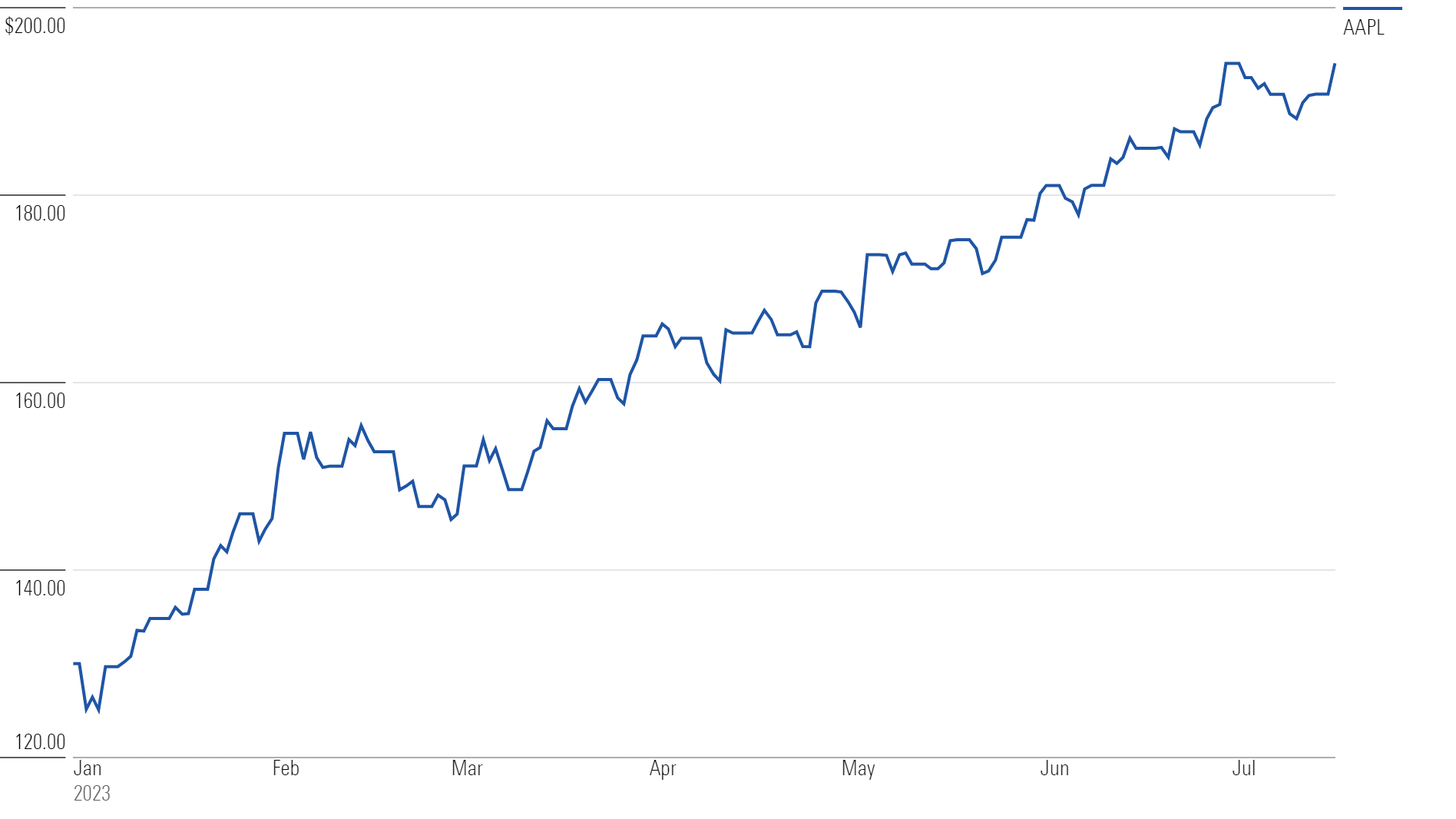

Apple Stock Price

Source: Morningstar Direct. Data as of July 17, 2023.

Fair Value Estimate for Apple

With its 2-star rating, we believe Apple stock is overvalued compared with our long-term fair value estimate.

Our fair value estimate for Apple is $150 per share, indicating a price/earnings ratio of 25 times for the fiscal year 2023. Despite expecting a 2% decline in total revenue for that year, mainly due to decreases in iPhone, iPad, and Mac revenue, we view these declines as reasonable after several strong years driven by work-from-home and learning-from-home trends during the COVID-19 pandemic.

We anticipate gross margins to remain in the 42%-43% range, supported by Apple’s premium pricing strategy and stable iPhone margins. While the higher-margin services segment is expected to grow, we anticipate lower-margin products like the Apple Watch to offset their impact. The shift to internally designed chips for Mac personal computers and increased research and spending in innovation are factors that we believe help maintain Apple’s position as a leader in the premium smartphone market. Over our five-year forecast period, we project operating margins to remain around 30%.

Read more about Apple’s fair value estimate.

Apple Historical Price/Fair Value Ratios

Ratios over 1.00 indicate when the stock is overvalued, while ratios below 1.00 mean the stock is undervalued.

Source: Morningstar Direct. Data as of July 17, 2023.

Economic Moat Rating

Apple has a wide economic moat due to its strong advantages in switching costs, intangible assets, and network effects associated with its iOS ecosystem. Its asset-light business model is expected to generate excess returns on capital for the next decade and potentially even the next 20 years.

Apple’s primary moat source is high customer switching costs, driven by the essential role of smartphones in users’ lives and the seamless integration of iOS across multiple Apple products. The company’s expertise in hardware, software, semiconductors, and services further enhances its competitive advantage, making it difficult for competitors to replicate the integrated user experience provided by the iPhone and other Apple devices. The large installed base of iOS users attracts developers to build new apps for the platform, contributing to network effects. These factors, along with a strong premium pricing strategy, are expected to maintain Apple’s dominant position in the market.

Read more about Apple’s moat rating.

Risk and Uncertainty

We assign Apple a High Morningstar Uncertainty Rating. As the largest company in the world, it faces significant competition and uncertainty.

The consumer hardware market is highly competitive due to short product cycles and customer demand for superior features. While Apple has been successful with its walled garden approach, across all market segments it competes with Chinese original equipment manufacturers such as Oppo, Vivo, Xiaomi, and Honor, as well as South Korea’s Samsung. There is a concern that customers are holding onto their phones longer, leading to potential stagnation or decline in smartphone unit sales, especially once emerging markets saturate or consumers turn to mid-tier devices.

Apple’s ability to charge premium prices for hardware that is no longer unique may be at risk if it fails to innovate, and competition from peers who sell hardware at cost to gain market share poses a threat.

Read more about Apple’s risk and uncertainty.

AAPL Bulls Say

- Between greater smartphone penetration in emerging markets and repeat sales to current customers, Apple has plenty of opportunity to reap the rewards of its iPhone business.

- Both Apple’s iPhone and its iOS operating system have consistently been rated at the head of the pack in terms of customer loyalty, engagement, and security, which bodes well for long-term customer retention.

- We think Apple is still innovating with the introductions of Apple Pay, Apple Watch, Apple TV, and AirPods. Each of these could drive incremental revenue, but more crucially help retain iPhone users over time.

AAPL Bears Say

- Apple’s decision to maintain a premium pricing strategy may help fend off gross margin compression, but it could also limit unit sales growth, as devices may be unaffordable for many customers.

- If Apple were to ever launch a buggy software update or subpar services, it could diminish the firm’s reputation for building products that “just work.”

- Apple is believed to be behind firms like Google and Amazon in AI development (notably Siri voice recognition), which could be problematic as tech firms look to integrate AI to deliver premium services to customers.