Wildfires have blazed through Canada’s forests since March this year, creating intense, record-setting damage. The smoke has drifted across America and, recently, to Europe.

In Toronto, where I live and work, the skyline looked apocalyptic for days. Both my throat and lungs were sore. Then we went from forest fires to extreme heat, with the hottest June in 174 years, and then violent rainstorms. I think about my family’s health and the kind of world my daughter and her children will grow up in.

The research and data I’ve worked with for years at Morningstar Sustainalytics are now colliding with our real-world experience.

All this has me thinking again about the world’s preparedness for climate change. Take extreme heat – the silent killer that’s often overshadowed by catastrophic events like flooding, hurricanes, and wildfires. According to the National Oceanic and Atmospheric Administration, the last eight years were the hottest ever recorded for both sea and air temperature. Forecasters say the next five years will be even hotter.

World leaders have vowed to limit global warming to 1.5 degrees Celsius above preindustrial levels by the end of this century. Crossing that threshold could lead to even more severe damage related to global warming.

To achieve the goal of limiting global warming, global greenhouse gas emissions will need to peak before 2025, decline by 43% by 2030, and then fall to net zero by 2050. But current national commitments suggest we won’t make that 1.5 degrees Celsius target.

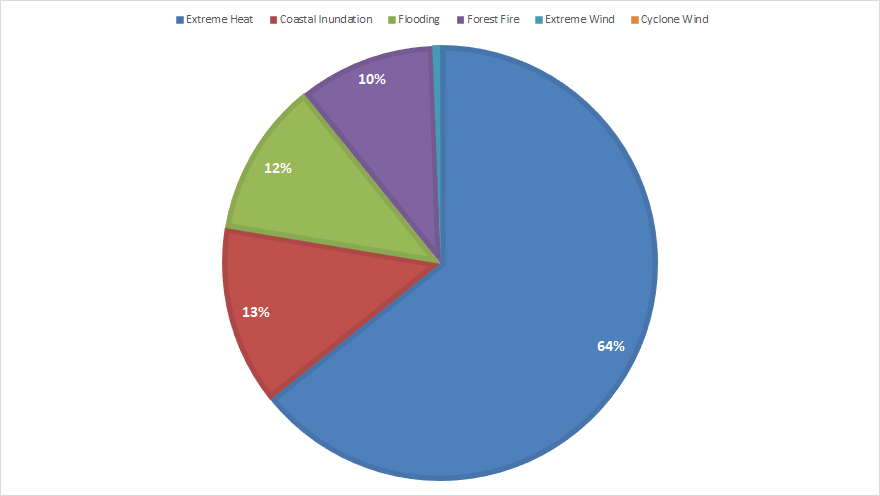

Based on Sustainalytics data about the assets and infrastructure for companies headquartered in Europe, extreme heat is likely to cause nearly 60% of all productivity losses that companies will suffer from physical climate risks. For companies that we cover in North America, that number is 65%. Swiss Re Institute has estimated that climate change could shrink global gross domestic product by as much as 18% by 2050, compared with a world without global warming.

We’ll face real costs, not only to human health and safety but also biodiversity loss, damage to assets, and damage to infrastructure, which will then translate into real business costs and lost productivity, which then translates into economic and investment risk.

Some Hope for Investors

For investors, there is some hope. One is that the investment infrastructure is forcing companies to reckon with climate change. For example, the International Sustainability Standards Board has issued new standards that are expected to be the new global baseline.

They will give companies the ability to provide investors with more reliable data and ensure better compliance with regulation. Over time, as more and more companies adopt this disclosure standard, we’ll get better, more consistent, financially relevant, decision-useful data. The better the data, the easier it is to compare and contrast individual companies.

New tools are also expanding investors' ability to address greenwashing and to identify opportunities as we transition to a low-carbon economy. For example, Sustainalytics' Low Carbon Transition Ratings provide investors with multiple signals to assess how well a company is prepared to reduce its carbon emissions.

The main signal is what we call the "implied temperature rating," or ITR for short, which expresses as a temperature how aligned a company is to a 1.5-degree net-zero pathway by 2050. A company’s ITR shows how much the Earth would warm if all companies in the world exceeded their carbon budget to the same degree. If a company’s ITR is two degrees, three degrees, and above, that company probably isn’t investing in transforming its business model so that it can thrive in the low-carbon world. As the transition accelerates, companies that don’t aggressively transform themselves may find access to capital and insurance reduced, because onetime partners may deem them too risky.

True, the numbers don’t look great at the moment. Our initial assessment of the roughly- 6,000 largest public companies in our universe shows the world is expected to warm above 3 degrees Celsius.

Good Management Can Brighten the Outlook

We can also look at management and strategy. And there lies hope of the company surviving, thriving, and aligning with a 1.5-degree future. We call this the management score. Some industries, like automobiles, have bad implied temperature ratings. Internal combustion engines require fossil fuels. But it also has a high proportion of companies that are investing to shift toward electrification and reduce dependence on fossil fuels.

The management score is a very comprehensive assessment of company actions, policies, strategies, governance structures, investment plans, and so on. This can help investors compare the decarbonization strategies of their holdings to peers and of the funds that hold them. You can see if companies are walking the talk.

Indeed, we recently found the strongest management scores are in telecom services, automobiles, household products, utilities, containers, and packaging. These companies are putting pedal to the metal.

Eventually, our goal is to make these signals available to all Morningstar subscribers. And with the regulatory push, mandated reporting requirements, and pressure from civil society, businesses will need to take climate change and associated risks (such as increased costs, reputational, and legal) much more seriously—and accelerate the journey of investing in their business model transformation to move the dial.

Azadeh Sabour is senior vice president and head of climate solutions at Morningstar Sustainalytics.

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/SNOVSAXAZJHB3A726JIN3TBT2U.jpg)