Mackenzie Bluewater Canadian Growth Balanced wasn’t always the successful fund it is today. A key course correction nearly a decade ago helped make it, as well as the standalone equity fund, one of the top funds in its category.

For most of its existence, the Mackenzie Bluewater team (started as an outside subadvisor until bought by Mackenzie in 2016) managed the strategy’s stock and bond sleeves as well as Canadian Growth Balanced’s overall asset allocation. It was an awkward fit. Bluewater’s forte was stock picking – the Mackenzie Bluewater Canadian Growth fund, a standalone strategy that also represents the equity sleeve of Canadian Growth Balanced, handily beat category peers for years. After a few stumbles, Mackenzie decided to give the bond portfolio for the fund and other balanced strategies to its in-house fixed-income team. Since then, Mackenzie Bluewater Canadian Growth Balanced has ranked among the top-performing funds in its category and the equity fund itself also improved materially.

Overextended Stock Pickers

The Mackenzie Bluewater team specializes in equities. Long-time manager Dina DeGeer, who has worked on the strategy since its 1996 inception, and Bluewater founder Bill Kanko came from then-named Trimark, a firm known for its security selection strength. Choosing bonds and setting asset allocation was not at the center of their circle of competence and it showed.

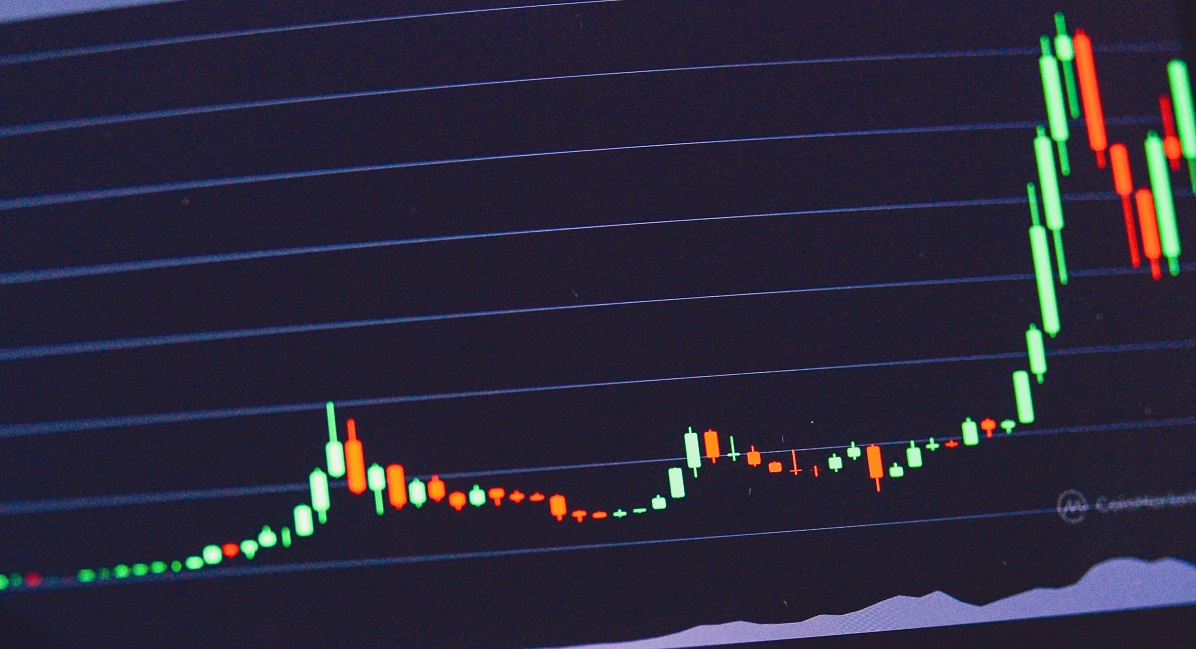

Choppy allocation changes and big cash stakes led to middling returns. From Jan. 1, 2009, to Dec. 31, 2014, Canadian Growth Balanced F underperformed its category benchmark – Morningstar Canada Equity Target Allocation – by 1.2 percentage points per year. The fund’s cash stake, according to Morningstar Direct, reached a high of 26% in the second quarter of 2011 and averaged 12% over the period which hampered returns.

Let Bond Managers Manage Bonds

Mackenzie decided in 2014 to take the fixed income and allocation responsibilities from all its boutiques’ balanced funds including Canadian Growth Balanced. Since then, fund allocation changes have been smoother, and the Bluewater team has been able to focus on its strengths – average cash holdings dropped to 7% and the F share class has beaten the category benchmark by 1.3 percentage points per year.

This also benefitted the Mackenzie Bluewater Canadian Growth fund. Excess return against the Canadian Focused Equity category from Jan 1. 2015 to July 31. 2023 rose to 4.8 percentage points per year annualized, a large jump from the previous period.

Mackenzie Bluewater Canadian Growth Balanced stands on much better footing now than it did for most of its existence. Now, stock pickers pick stocks and leave asset allocation and fixed-income portfolio management to Mackenzie’s experts in those areas. The solution looks simple in hindsight, but it helped turn around a fund that was failing and now stands out among its peers.

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VYKWT2BHIZFVLEWUKAUIBGNAH4.jpg)