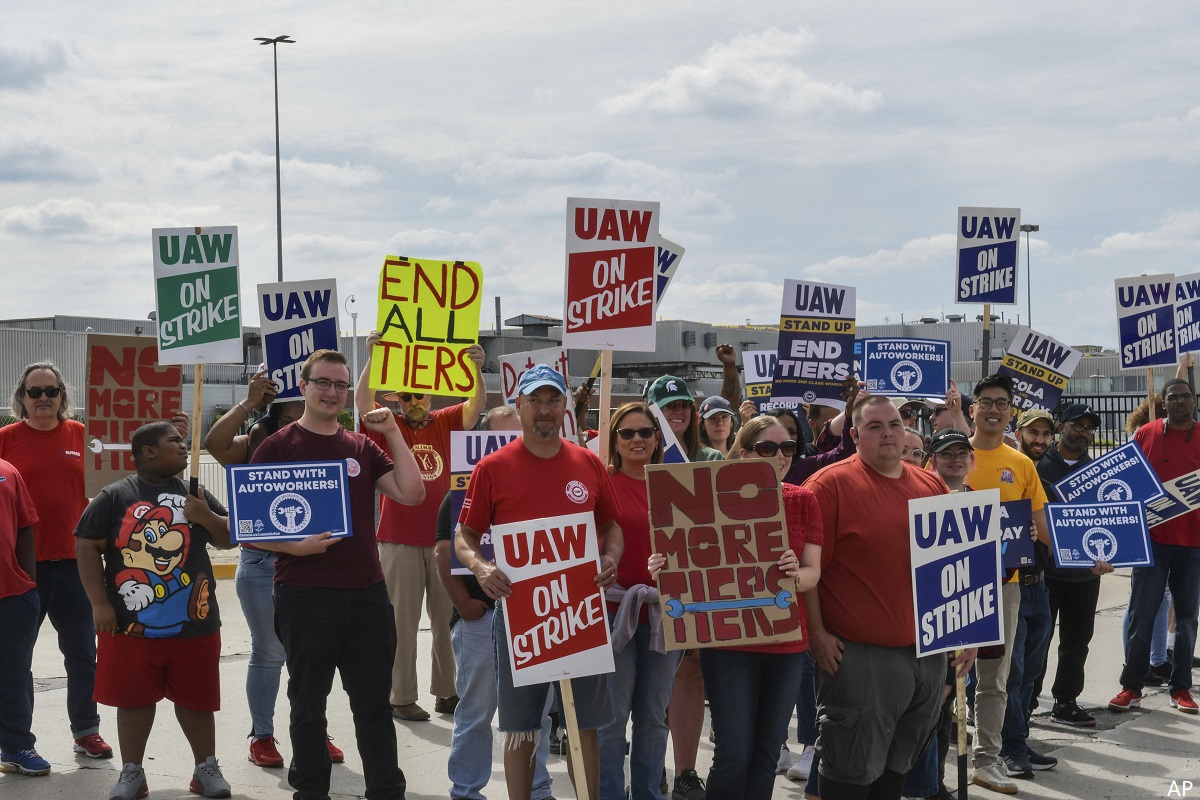

The sides remain far apart on every key issue in the labour dispute between the United Auto Workers and the Big Three automakers: Stellantis STLA, General Motors GM, and Ford F.

The UAW started a targeted strike campaign against all of the Detroit Three on Sept. 15. The union has never struck all three firms simultaneously before. We see 2023 earnings guidance in jeopardy, but we will likely keep our fair value estimates in place until we know what a new contract looks like.

We expect a strike to potentially last several months because of the large gap between the UAW’s desired roughly 35%-40% wage increase and the high teens to 20% already offered at each firm, and also because of the union wanting to reinstate bygone benefits such as pensions, retiree healthcare, a new form of the jobs bank, and 40 hours of pay for a 32-hour workweek that would force the automakers to hire more workers than they’d otherwise need to keep output the same.

Risks to Auto Stock Investors

We see two risks for investors: What does an eventual new contract look like, and how much debt do the automakers have to take on during the strike? However, we think that debt could be repaid quickly if the new contract is not unaffordable for them. More debt will eventually cause market concern and drive down stock prices, but it’s hard to predict how many billions need to be added before that happens. GM and Ford’s cash balances as of June 30 were excellent, so we don’t think more debt is immediately needed.

Long-Lasting Strike Possible

Neither side, in our view, has a reason to capitulate quickly because UAW leadership wants to show its members it’s being tough, while we feel management knows that giving in to all the UAW demands would be severely damaging. In a Sept. 14 interview with CNBC, Ford Chief Executive Officer Jim Farley said Ford would be bankrupt if it applied the 2023 demands across the past four years of the now-expired 2019 contract.

On Aug. 8, Bloomberg News reported estimates from sources that the union’s demands would increase costs by over US$80 billion at each of the three firms, which, in our view, is not how the Detroit Three can remain competitive against foreign automakers and Tesla TSLA. Bloomberg reported that the all-in hourly labour cost at each firm, which includes healthcare and other benefits, is about US$64 versus about US$55 at foreign automakers with U.S. plants and US$45-$50 at Tesla. Under the union’s demands, this labour cost would exceed US$150 at GM and Ford, which, in our view, would put them at a cost disadvantage that they cannot recover from to stay competitive. We estimate that the daily adjusted EBIT loss at GM during a total-company strike would be at least US$86 million and at least US$77 million at Ford.

Strike Is High Risk/High Reward for UAW

We said in our Aug. 25 note that we see striking all three firms at once as high risk/high reward for the union because we calculate that the UAW’s strike fund of about US$825 million would deplete very quickly relative to only striking one firm. The union has struck other firms such as Deere DE and CNH CNHI in recent years and done well for members by doing so, but UAW members totaled just over 10,000 at Deere and just over 1,000 at CNH. The union pays US$500 a week in strike pay, so the fund’s depletion for about 146,000 autoworker members would make a roughly nine-month strike—like the one at CNH in 2022-23—impossible. We estimate the fund would last about six to 11 weeks for a strike at all three firms at once, depending on whether the UAW or the automakers keep paying for healthcare.

However, in a Sept. 13 live video address to members that we watched on YouTube, UAW President Shawn Fain said the union will use a strategy he calls a stand-up strike, which is an homage to the sit-down strikes shortly after the union’s founding in the 1930s. This tactic uses targeted strikes at certain UAW local chapters, and then if bargaining continues to go poorly, the UAW will gradually add more local chapters to the existing strike. He stressed that locals not yet called to strike must continue to report to work until they are called to stand up and strike.

Fain did say he is willing to strike all plants at once but feels stand-up strikes will enable maximum flexibility for the union’s next moves and keep GM, Ford, and Stellantis guessing as to which locals strike next. These strikes will also eventually disrupt production, negating management’s output plans. We also think Fain does not want to publicly acknowledge the strike fund depletion math discussed above, making an all-out strike difficult.

The union also needs to keep strike funds for several other nonautomotive UAW locals on strike already such as at BlueCross of Michigan and WestRock WRK. We saw many YouTube comments alongside the video expressing disappointment that the strike will not be at all plants immediately, but we see the stand-up method as far less risky for the union.

Key Morningstar Metrics for Ford

- Fair Value Estimate: US$20

- Morningstar Rating: 4 stars

- Morningstar Economic Moat Rating: None

- Morningstar Uncertainty Rating: High

The Impact of ‘Stand-Up Strikes’

We expected the stand-up strikes would first be at key automaker powertrain plants in what can also be called a bottleneck strike or a targeted strike. However, the first three UAW locals called to stand up and strike are assembly plants, one at each automaker (GM’s midsize pickup plant, Ford’s Bronco and Ranger plant, and Stellantis’ Jeep Wrangler and Gladiator plant).

Examples of possible key plants that we think the UAW will want to shut include GM’s engine and 10-speed transmission plant in Romulus, Michigan, which supplies V-6 engines and transmissions to a dozen Chevrolet, Cadillac, and GMC vehicles, including the Silverado and Sierra pickups across five assembly plants, four in the United States. GM’s Tonawanda powertrain plant in Buffalo, New York, makes engines for the Corvette and multiple trucks and SUVs. Ford’s Livonia, Michigan, transmission plant and Stellantis’ Kokomo, Indiana, transmission plant are also likely targets.

If these plants and other key automaker-owned parts facilities suffer strikes, it would likely lead to each automaker eventually shutting down all or nearly all North American assembly plants, even though the assembly plant workers would not yet have struck, which slows the UAW strike fund’s depletion while also hurting the companies. So, from the UAW’s perspective, we see a bottleneck strike as more efficient.

A bottleneck strike is a tactic the UAW has done before, including in 1996 and 1998 at GM, though there were no additional waves of striking locals as Fain is now doing via the stand-up strike. The 1998 action was the well-publicized Flint, Michigan, strike that trickled through GM’s supply chain to shut down other plants. That strike action lasted 54 days and cost GM about US$2 billion, or about US$3.8 billion adjusted for inflation. The 1996 strike in Ohio lasted about two weeks.

In 1998, GM filed an unfair labour practices complaint because local union chapters are only supposed to strike for matters at that local rather than for national agreement issues, but the complaint never got heard by the National Labor Relations Board (which currently has three members, two of which are considered Democrats) because the two sides ended the strike before a hearing.

Another tactic could include striking supplier plants, but according to Automotive News, the National Labor Relations Act does not allow a strike at an unrelated company as a way for a union to target its employer, so the UAW would be risking litigation to go this route. We don’t believe the UAW is afraid to break or push the rule envelope in 2023, but a supplier strike probably is not the most intelligent choice versus its current strategy.

Key Morningstar Metrics for GM

- Fair Value Estimate: US$78

- Morningstar Rating: 5 stars

- Morningstar Economic Moat Rating: None

- Morningstar Uncertainty Rating: High

However, a bottleneck strike, in our opinion, puts many UAW members in a bad position, so the UAW is taking a big gamble should a strike last a long time. Normally, if an automaker idles a plant, workers can still get nearly all of their normal pay via a combination of state unemployment benefits and supplemental payments by the automaker. However, in a bottleneck strike, nonstriking workers would not receive strike pay, and they may not receive payouts from the state or their employer, either, once a nonstriking plant is forced to shut for lack of parts. We asked GM to confirm this lack of benefits, but they were unable to comment owing to the sensitive nature of the talks. So, in this scenario, the UAW may not be putting most of its autoworker members in a fair financial position once the automakers are forced to shut down a plant that is not on strike. Striking employees may not have their health insurance paid by their employer, either.

Key Morningstar Metrics for Stellantis

- Fair Value Estimate: US$43

- Morningstar Rating: 5 stars

- Morningstar Economic Moat Rating: None

- Morningstar Uncertainty Rating: High

Automakers Have Massive Liquidity to Withstand Strike

The automakers have excellent liquidity to withstand a strike with GM’s June 30 automotive liquidity at US$38.9 billion, including US$25.3 billion of cash and securities. Ford’s June 30 automotive cash was US$29.8 billion, and its credit line availability is currently likely around US$21.5 billion, as the company on Aug. 17 established a US$4 billion credit line expiring August 2024 that “provides additional working capital flexibility to manage through uncertainties in the present environment,” per Ford’s 8-K filing on Aug. 22.

That sounds like code to us for extra money to mitigate a UAW strike. June 30 industrial liquidity at Stellantis was EUR 63.9 billion. This massive liquidity means the automakers can likely last a long time during a strike that will likely cost each of them billions in lost profit, but it remains to be seen if UAW members’ bank accounts are as strong as their will to fight clearly is.

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/FGC25JIKZ5EATCXF265D56SZTE.jpg)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KEGKFRO24VF67PWV7V2ADNG37U.png)

.jpg)