This fund is a part of the latest Morningstar Prospects. Read more about Morningstar Prospects here.

CI Canadian Income & Growth is an asset allocation fund that invests mainly in equity, equity-related and fixed income securities of Canadian issuers. According to the fund fact sheet, it is currently expected that investments in foreign securities will generally be no more than 49% of the fund's assets.

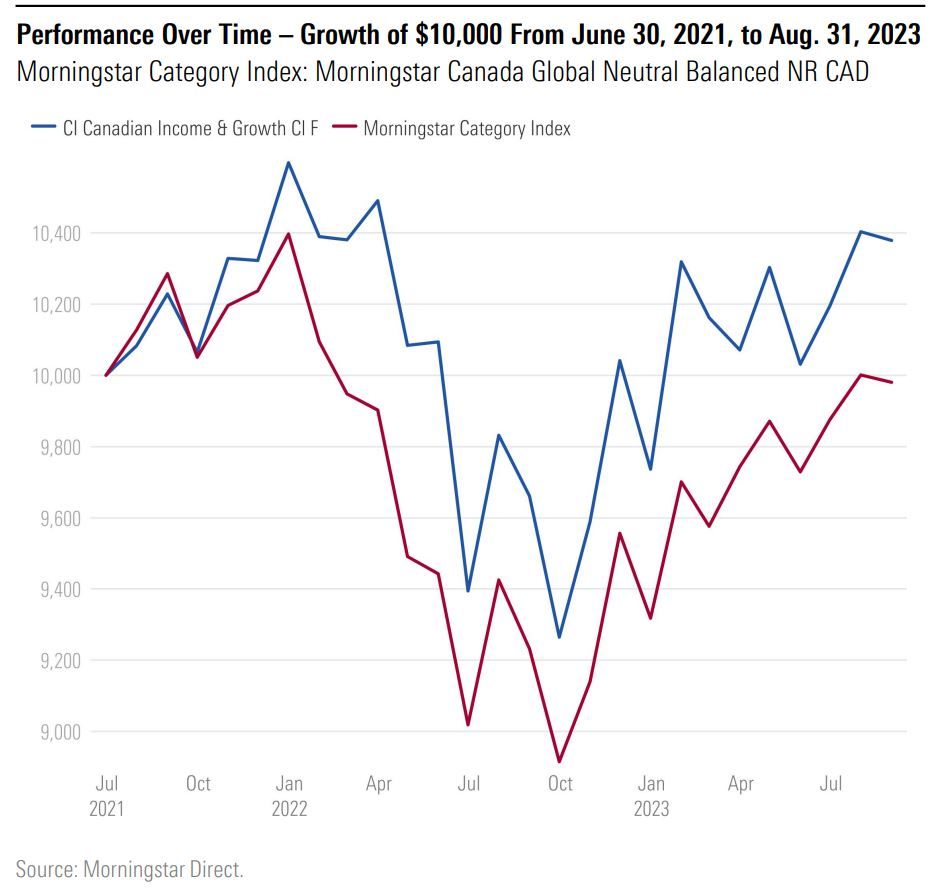

The fund came to the attention of Morningstar analysts Michael Dobson and Danielle LeClair during a review of the global version of this strategy – CI Global Income & Growth, and they found that since portfolio manager Kevin McSweeney took over the equity sleeve in July 2021, performance looks solid. As Dobson recently wrote about the latter, CI Global Income and Growth suffered bumps in the last twelve months, but it hasn’t been quite the disaster as once feared. “Centralization efforts at CI Global Asset Management give the team capabilities potentially lost. The changes in personnel need time to settle,” he said.

So far in 2023, the CI Canadian Income and Growth strategy has outperformed both its index, and peers, with returns of 4.91% for the fund, while the index has returned 4.47%, and the category 2.80%. The fund has a management expense ratio of 1.33%.

Why is CI Canadian Income and Growth Worth Considering?

CI Canadian Income and Growth, as the name suggests, is more Canadian. The stand-alone fund comprises three sleeves – equity, investment-grade bonds, and high-yield bonds – managed by McSweeney, John Shaw, and Geof Marshall, respectively.

“Asset allocation depends on expected return forecasts by the different asset-class leaders from CIGAM. The portfolio managers select securities from a top-down perspective while equity and fixed-income analysts handle bottom-up due diligence,” Dobson and LeClair write.

They note that the fund displays an uncommon combination of top-down and bottom-up analysis in security selection, with equity analysts providing high touch on individual names.

“McSweeney’s unique experience across multiple markets, including corporate credit and infrastructure equity, helps him draw a bead on Canada’s macroeconomic position and position the fund accordingly. The fixed income leads in Shaw and Marshall are also positives, as noted in the global version of this fund. A small position in CI Private Markets Fund represents a foray into less liquid alternatives, which courts marginal risk,” the analysts write.