Morningstar Prospects is a list of up-and-coming or under-the-radar investment strategies that Morningstar Manager Research monitors to potentially bring under full coverage. In Canada, Morningstar Manager Research analysts cover more than 125 different strategies across equity and allocation strategies. However, this is only a fraction of the 2,700 options available to Canadian investors.

Enter Morningstar Prospects, a list that allows us to share what we believe are the most promising members of our research “bench.” Find the list here.

Our analysts Michael Dobson and Danielle LeClair aim to cover the funds in which Canadians have the most money and interest. Many other funds with impressive returns, differentiated approaches, or familiar investment teams fly under the radar and may deserve more attention, and this list highlights those strategies.

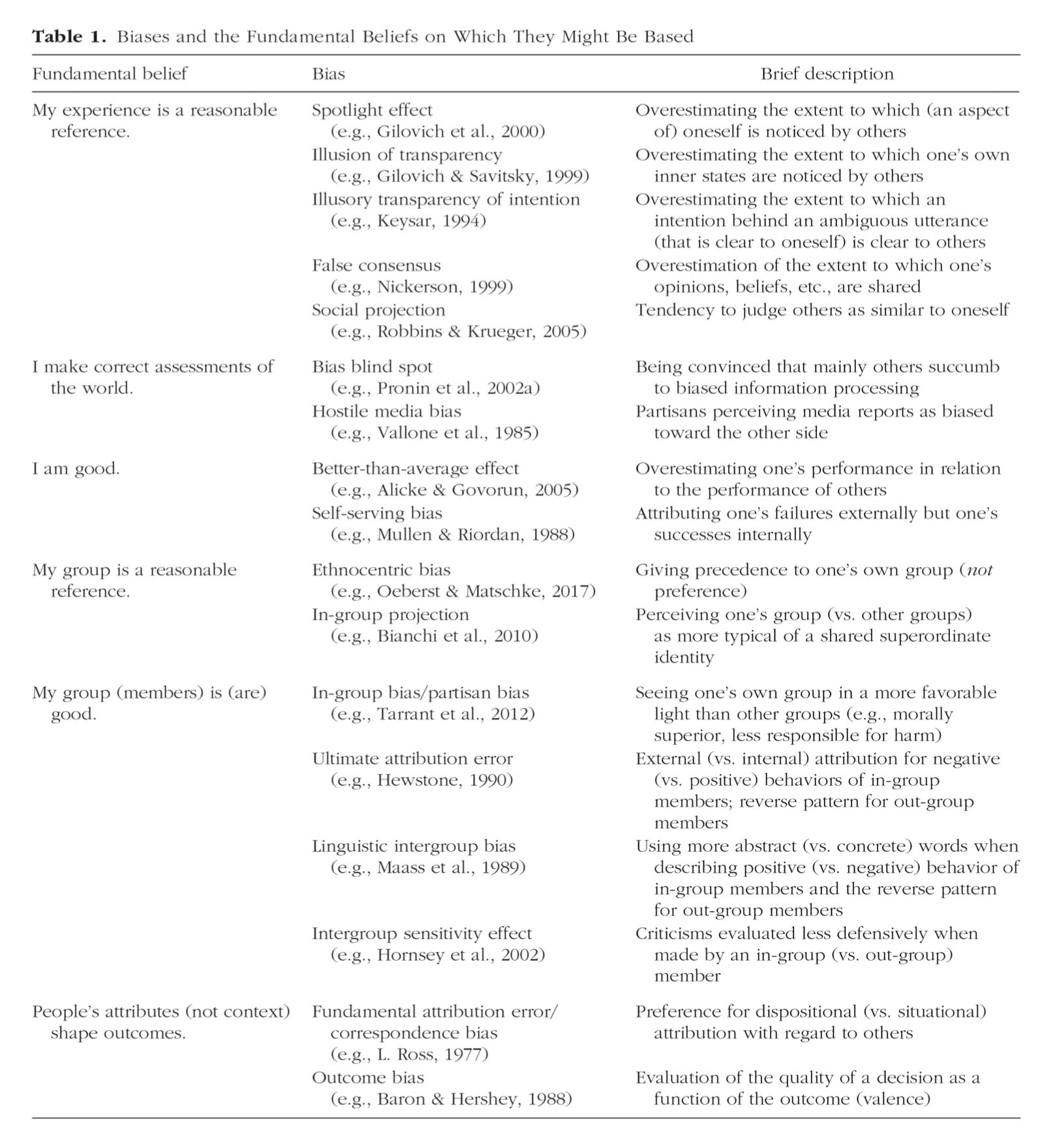

How Do Funds Make the Morningstar Prospects?

Dobson and LeClair compile and maintain the Morningstar Prospects list. Funds make the cut after the analysts consider a variety of quantitative and qualitative factors, including:

- Management experience,

- Key differentiators within the investment strategy,

- Performance, and

- Fees.

Morningstar Prospects have some or all of these characteristics:

- A unique strategy or process;

- An existing strategy with new, possibly transformative, management;

- A new strategy run by a manager with a long track record elsewhere;

- An under-the-radar strategy that has an established track record but is not well known.

The list of funds and strategies in Morningstar Prospects is reviewed and updated every six months. Some strategies may graduate to full analyst coverage, while others won’t make the cut and could be dropped from the list because their fundamentals deteriorate, there are material and negative changes, or they are unlikely to graduate in the near future.

What Funds Are in the Canadian Version of Morningstar Prospects?

In this first edition of Morningstar Prospects, Dobson and LeClair highlight three allocation strategies, five equity strategies, and three fixed income strategies. In terms of strategies by the fund house, Fidelity’s offerings lead the list, with five strategies in Morningstar Prospects. Leith Wheeler has two strategies, while PIMCO, BlueBay, AGF and CI have one each.