Palantir PLTR is up 101% over the past 12 months. Ahead of its Q3 earnings, here is Morningstar's take on what to look for and our outlook for the company's shares. (Picture above, founder and chief executive Alex Karp)

What to Watch For in Palantir's Q3 Earnings

Billings: we saw billings acceleration in the previous quarter and would expect similar quarter-over-quarter and year-over-year acceleration in this quarter, especially as we tie this to management’s own commentary on AIP (Palantir's artificial intelligence platform) deals they have announced over the past few months.

Customer additions: similarly, we'd expect an uptick in the number of commercial customers that use Palantir as companies onboard it because of their desire to leverage artificial intelligence (AI). For some context, customers aren't required to be Foundry/Gotham customers to use AIP, so we would expect new customers to be looking at AIP with interest and onboarding Palantir, even if it is in a small capacity initially.

Net retention expansion: recently, Palantir's net revenue retention has fallen. This is a consequence of customers not expanding usage with Palantir during a tough macro environment. However, if AIP's performance matches its promise, we would expect to see an uptick in net retention as well as existing customers expand usage of Palantir's solutions.

Target revision/longer-term guidance on AI's impact on financials: we are looking for more colour on how AIP will affect the firm's growth opportunities in the next couple of years. We expect some tangible commentary on AIP's growth, pricing, and general strategy going forward.

Fair Value Estimate for Palantir Stock

Our fair value estimate for Palantir stock is $11 per share, implying a 2023 enterprise value/sales multiple of 10 times.

We forecast Palantir's revenue to expand at a 23% compound annual growth rate over the next five years as the firm expands both government and commercial operations.

We expect the majority of this top-line growth to be driven by commercial clients as the firm seeks to broaden its commercial client base. While government clients can be sticky, large government contracts create lumpiness in revenue.

As a result, Palantir’s shift to more commercial clients will enable the firm to create a more ratable revenue mix. We also expect the firm to continue expanding sales within its existing client base. We view Palantir’s strong net retention rate as an indicator of this ability.

Palantir's GAAP gross margins have varied widely over the past few years, with 2022 gross margins clocking in at 78.6%. As the firm grows, we expect gross margin expansion. Our forecast is based on Palantir landing higher-margin commercial contracts and scaling its operations (thereby leading to its costs being divided over a larger base).

We see this phenomenon across our coverage as software companies can distribute their costs over an increasing revenue base, driving the cost of sales down as a fraction of sales.

As a result, we are modeling GAAP gross margins to expand to the low-80% range over our 10-year explicit forecast. Palantir has spent heavily on research and sales in the past.

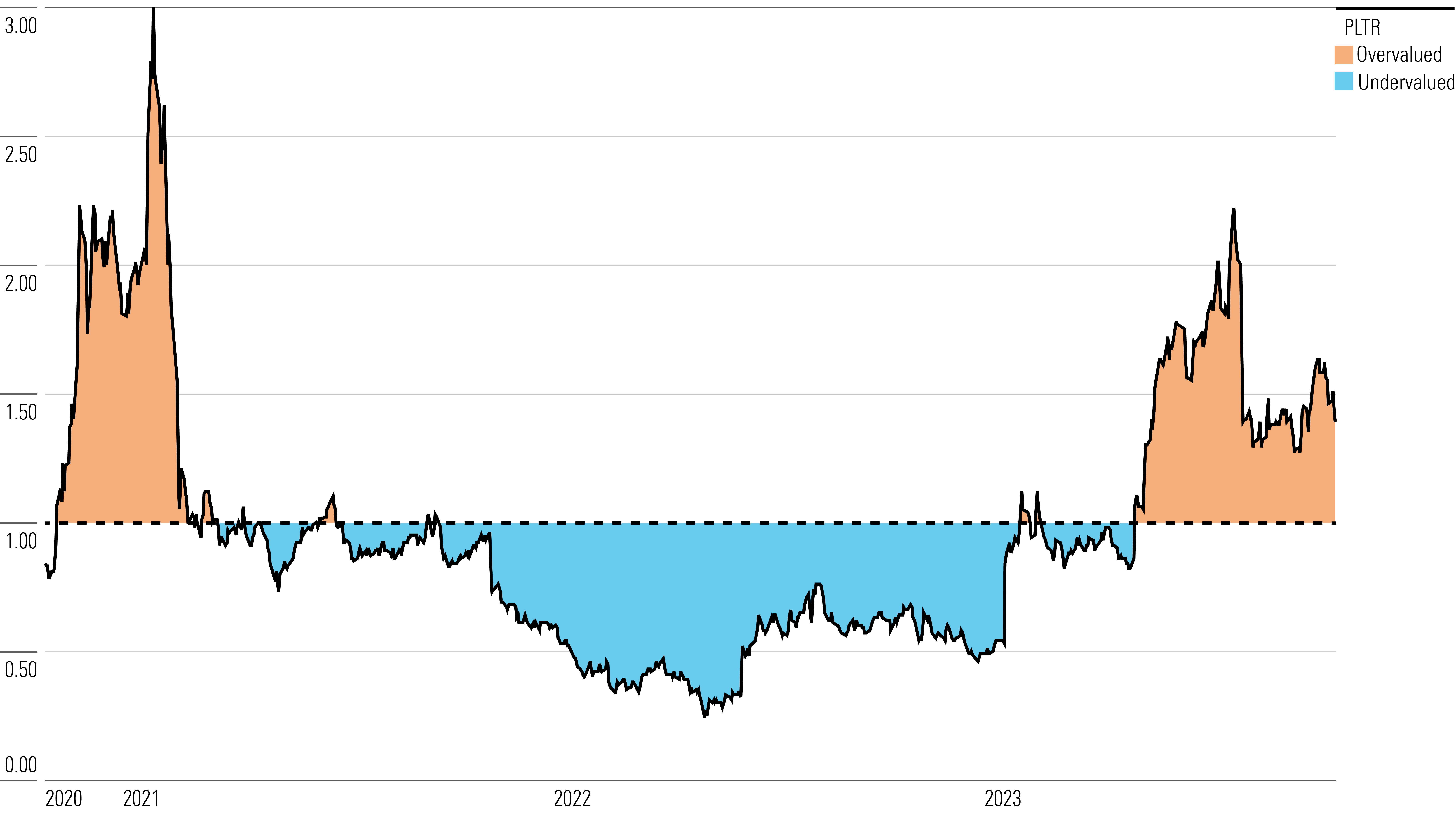

Palantir's Historical Price/Fair Value Ratio

Ratios over 1.00 indicate overvaluation, while ratios below 1.00 indicate the opposite

Read more about Palantir's fair value estimate

Economic Moat Rating

We assign Palantir a Narrow Economic Moat rating owing primarily to strong switching costs associated with its platforms, and secondarily to intangible assets in the form of strong customer relationships the firm has built up over the years.

We think Palantir's two main platforms, Gotham and Foundry, both benefit from high customer switching costs as evidenced by the firm's strong gross and net retention metrics. Palantir has exhibited strong customer growth while diversifying its business away from lumpy government contracts toward commercial clients. As a result, although we forecast a couple of more years of hefty operating losses, we ultimately expect the firm to generate excess returns over invested capital, on the whole, over the next decade.

The primary use case for Palantir, across its government and commercial clients, is the ability to leverage data to develop insights and create efficiencies in an organisation's operations. Gotham and Foundry serve the government and commercial end markets, respectively. More recently the firm has launched a third platform, Apollo, which ensures that Palantir's clients have continuous delivery of Gotham and Foundry, irrespective of whether they have deployed these platforms on the cloud or on-premises.

Within modern large organisations (both commercial and government), Big Data is pervasive. According to our estimates, we believe the amount of total digital data stored worldwide will increase to 620 zettabytes (every zettabyte has a billion terabytes) by the end of the decade, indicating a 10-year CAGR of 28%.

With this backdrop, large organisations are increasingly interested in gleaning insights from the copious amounts of data they’re producing/consuming. While this shift to leverage data to drive efficiencies may seem intuitive, often organisations struggle to turn this data into tangible improvements.

Based on various industry reports, we contend only a minority of AI and machine learning (AI/ML) based analytical solutions deliver business outcomes (in data-science parlance this phenomenon is referred to as GIGO, or garbage in garbage out). Palantir's platforms assist large organisations in making sense of this data while allowing its clients to use any data type (structured and unstructured) from any location (spreadsheets, CRM systems, hyperscalers, on-premises, and Internet of Things sensors).

Read more about Palantir's moat rating.

Risk and Uncertainty

We assign Palantir a Very High Uncertainty Rating because of some key risks we view as potentially impeding the firm's growth trajectory.

While Palantir has landed high-value commercial and government clients over the years, we have found the executive team's execution to be questionable at best. The firm's sales strategy has led to relatively poor customer acquisition, despite being in the commercial space for many years, Palantir's commercial customer count is only slightly more than 200. While the firm has pivoted to a module-based sales model that should bolster commercial customer additions, execution against this strategy remains to be seen.

Our lack of confidence in the executive team (led by founder and chief executive Alex Karp, pictured above) is highlighted by the firm's special-purpose acquisition company investment program that led to more than $300 million of losses for the firm as investments in early-stage companies went south as markets recalibrated in 2022. These investments, based on a quid pro quo of investees becoming Palantir customers, were a bit reckless, in our view.

Read more about Palantir's risk and uncertainty.

PLTR Bulls Say

Palantir has strong secular tailwinds as the AI/ML market is expected to expand rapidly owing to the exponential increase in data harvested by organizations.

With products targeting commercial and government clients, Palantir has a distributed top line with the non-cyclical government revenue insulating its top line during lean times.

Palantir's focus on modular sales could potentially lead to substantially more commercial clients, which the firm could subsequently upsell.

PLTR Bears Say

By not selling to countries/companies that are antithetical to Palantir’s mission and cultural values, the firm has self-restricted its growth opportunities.

It will likely be several years before Palantir will achieve GAAP profitability.

Palantir's executive team has made questionable strategic decisions in the past. While past performance isn't necessarily indicative of future results, we highlight some missteps as a tale of caution for potential investors.

Key Morningstar Metrics for Palantir

• Fair Value Estimate: $11

• Morningstar Rating: 2 stars

• Morningstar Economic Moat Rating: Narrow

• Morningstar Uncertainty Rating: Very High

• Palantir Earnings Date: November 2 2023

.jpg)