.jpg)

This quarter’s Canadian Sustainable Fund Landscape Report has a new look and feel to go with some very interesting developments in the space.

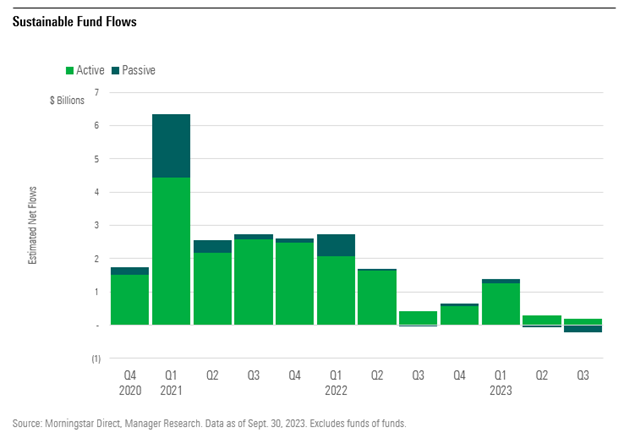

Overall, the sustainable fund segment remains of strong interest to investors gathering more than $1.6 billion in new assets over the last year but saw outflows in the third quarter. In total, our data indicates Canadians pulled $22.4 million out of sustainable funds. Although this was the first quarter of net outflows since Q2’20, overall assets remain at elevated levels and the decline in quarterly growth was less pronounced than it was for the Canadian market broadly. You can read the whole report here.

Some interesting trends in the report include:

1) Active Sustainable Funds Dominate

Savvy investors would be aware of the ever-present debate regarding the value of active versus passive funds, but the stance is clear when it comes to sustainable funds – active is the preferred way to go. For the second consecutive quarter, sustainable passive funds suffered outflows shedding over $208.1 million during the third quarter while active funds continued to gather assets bringing in over $185.7 million over the period. One fund in particular, the BMO MSCI USA ESG Leaders ETF ESGY accounted for over 60.8% of total outflows from passive sustainable funds and has seen the largest outflows of any sustainable fund this year.

2) Bond Funds Benefitted from Positive Net Inflows

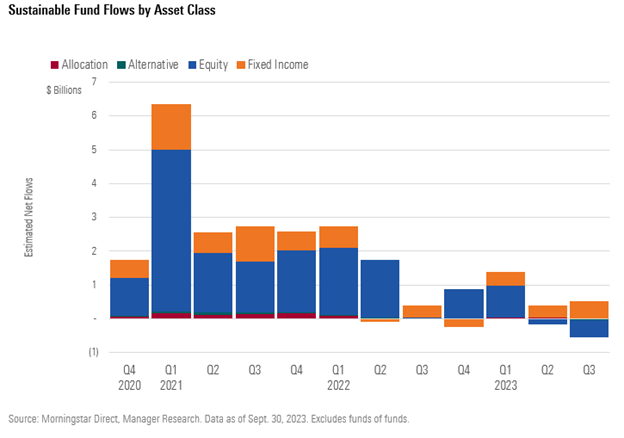

Despite the overall state of the sustainable funds segment being in outflows, sustainable bond funds gained net new money for the third consecutive quarter, adding nearly $506.2 million in assets. This followed a broader market trend as investors sought to lock in attractive yields. The NBI Canadian Sustainable Bond Fund ETF NSCB stood out as the top recipient for the second quarter in a row adding over $601.2 million of new assets over the last 6 months. Nuveen Global Green Bond Fund also deserves mentioning, as the fund gathered the second largest new flows in the third quarter—over $40.5 million – despite only being launched on Sept. 11th, 2023.

3) Top Asset Managers Remain the Same, but Competition is Heating Up

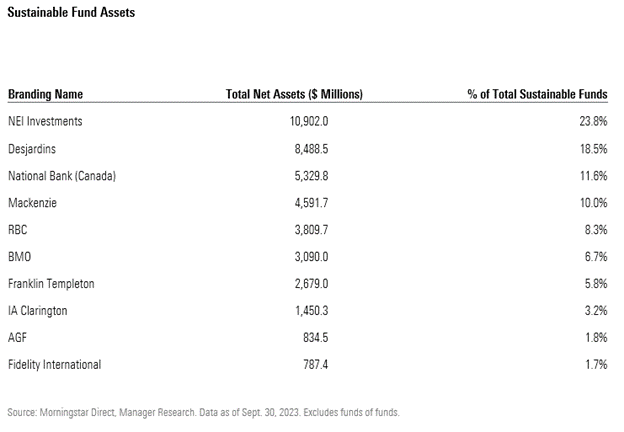

NEI Investments and Desjardins remain the largest asset managers for sustainable funds in Canada, but National Bank is also rising in the ranks. At the end of the third quarter, the firm had over $5.3 billion in assets, representing an 11.6% market share. This represents a growth of 65% in assets since the end of 2022, enough to overtake Mackenzie as the market’s third-largest sustainable funds asset manager. When looking at other participants, Canada Life and Bridgehouse, who each represent less than 1.0% of sustainable assets, stood out for their product launches this quarter. Canada Life’s five newly launched funds were the most for any asset manager and included offerings across multiple asset classes. Bridgehouse’s September launch of the Nuveen Global Green Bond Fund was also notable due to the sizeable assets it gathered over such a short amount of time.

4) Underperformance Plagued Sustainable Funds this Quarter

Although many sustainable funds remain in good standing over the one-year period—47% land in the top of their respective peer groups—over 70% of funds landed in the bottom half of their respective peer groups in the third quarter. Results for sustainable allocation funds were meaningfully weaker than other asset classes, with 77% of funds underperforming their average peer. Sustainable fixed-income funds saw the strongest results, with nearly half of the funds beating their average peer.

Despite outflows and underperformance, it is clear investors are still looking for sustainable funds that fit in their investment portfolio, and asset managers remain eager to oblige.

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6ZMXY4RCRNEADPDWYQVTTWALWM.jpg)