:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/P3MDVUXN7VAZVPJZPL3YZ6MCTA.png)

Should you have short-term bonds in your portfolio? Yes. I’d argue that short-term bonds are one of the key asset classes that most investors should own, in addition to cash and large-cap stocks.

In this series on portfolio basics, I’ll explain some of the fundamentals of putting together sound portfolios. I’ll start with some of the most widely used types of investments and walk through what you need to know to use them effectively in a portfolio.

What Are Short-Term Bonds?

Short-term bonds are fixed-income securities with relatively short maturities, generally defined as about one to three years. These bonds are less sensitive to changes in interest rates than bonds with longer maturity dates. Like other types of bonds, short-term bonds are inherently safer than other types of securities, such as stocks. Bonds also rank higher in the capital structure than stocks, meaning their owners are among the first to be paid in the event of the issuer’s bankruptcy.

Short-term bonds can be either taxable or tax-exempt. In this article, I’ll focus on the former; I covered municipal bonds in a separate article.

What Are the Advantages and Risks of Investing in Short-Term Bonds?

The main advantage of short-term bonds is their ability to generate current income with relatively low risk. For this reason, short-term bonds can be a good choice for many investors’ portfolios.

Like other bonds, short-term bonds are subject to two main types of risk: interest-rate risk and credit risk. Because bond prices and market interest rates move in opposite directions, short-term bonds lose value when interest rates rise. Thanks to their short maturities, though, their losses are more muted than those of longer-term instruments. Credit risk—that is, the risk that a company won’t be able to repay its debt—can also be an issue for corporate bonds.

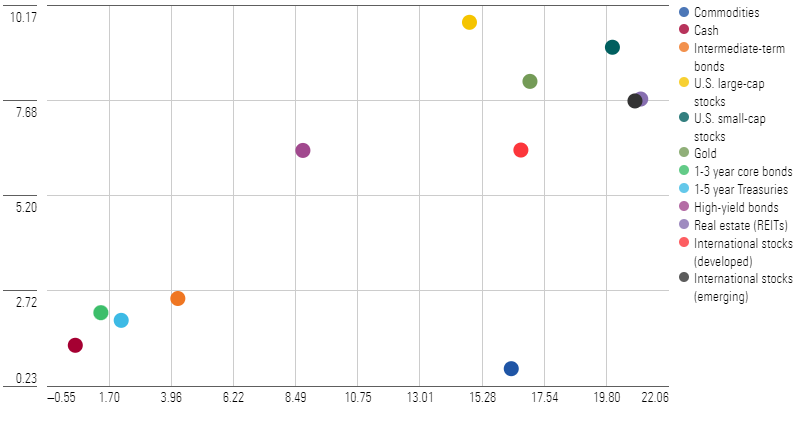

In practice, this means that short-term bonds have generated relatively low returns—but they also court less volatility than any other asset class except cash. The chart below shows annualized returns (y-axis) and standard deviations (x-axis) for short-term bonds as well as other major asset classes over the past 20 years.

Trailing 20-Year Risk and Return: Short-Term Bonds and Other Assets

Source: Morningstar Direct. Data as of Sept. 30, 2023.

Historically, short-term bonds have lost as much as about 7% during periods of rising interest rates. As inflation began rising sharply in 2021, short-term government, short-term bond, and ultrashort bond funds started losing ground, and losses continued throughout 2022 as the Federal Reserve repeatedly hiked interest rates in an attempt to tamp down stubbornly high inflation.

How to Invest in Short-Term Bonds

There are two main ways to invest in short-term bonds: by purchasing individual bonds or by purchasing a fund.

Purchasing individual bonds can be an appealing option because you simply collect your semiannual interest (known as a coupon payment) until the bond’s maturity date when you’ll get the bond’s principal value back. This approach is easy to implement for short-term Treasury notes and bills, which are widely available on most major brokerage platforms.

If you’re purchasing other types of bonds, though, there are a few drawbacks, including higher trading costs in the form of bid-ask spreads. Investors can avoid those pitfalls by getting short-term bond exposure with a mutual fund or exchange-traded fund. The advantages include:

- Lower trading costs.

- Professional management.

- Broader diversification across many different bonds and bond sectors.

- The flexibility to reinvest proceeds at higher interest rates if interest rates are trending up.

For most investors, broadly diversified index funds are the easiest and least expensive way to invest in short-term bonds. Investors in actively managed short-term bond funds pony up annual expenses of about 60 basis points on average, but the typical passively managed fund charges less than a fifth of that.

There are three main short-term bond categories: ultrashort bond, short-term bond, and short-term government bond. All three are relatively safe, but the ultrashort category is the most conservative.

When Do Short-Term Bonds Perform Best?

Like other bonds, short-term bonds perform best during periods of declining interest rates and low or declining inflation. Because of their limited maturities, though, they don’t benefit as much from downward trends in interest rates. As a result, most short-term bond categories had relatively anemic returns over the 10 years through 2021 but held up better than longer-duration categories amid the bond market carnage in 2022.

How Much of My Portfolio Should Be in Short-Term Bonds?

The answer to this question largely depends on your portfolio’s overall asset mix.

If you’re investing for a long-term goal, you’ll probably want to tilt your portfolio more toward stocks. Target-date fund allocations can also be a useful guideline for the appropriate level of bond exposure: The typical target-date fund starts with a bond allocation of about 8% for an investor with 40 years to retirement, gradually increasing the bond allocation to 55% of assets at retirement and 66% of assets 30 years after retirement.

If you’re saving up for a short-term goal, you may want to keep a larger portion of assets in short-term bonds. The three bond categories covered in this article are all suitable as core holdings that could make up a significant portion of your portfolio. If you’re simply looking for broad-based bond exposure and have a time horizon of at least two to six years, you may not need a dedicated short-term bond fund; a more diversified bond exposure such as an intermediate-core bond fund may be all you need.

Are Short-Term Bonds a Good Investment?

Short-term bonds aren’t the best way to generate long-term wealth, but they serve a critical role in providing both current income and helping reduce risk at the portfolio level. They’re also a relatively safe way to save up for shorter-term goals, especially now that bonds are offering more generous yields.

With the exception of investors who are young, saving for a long-term goal, and highly risk-tolerant, short-term bonds can play a useful role in many portfolios.

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VYKWT2BHIZFVLEWUKAUIBGNAH4.jpg)