Nearly one year ago, ChatGPT rolled out to the public. The ensuing artificial intelligence (AI) boom has fuelled big rallies in the stock market – and in some ways, even bigger expectations.

"While many exciting technological innovations have emerged in recent years, the rise of generative AI might prove to be the most impactful one since the dawn of the internet," says Brian Colello, technology sector director for Morningstar.

"Currently, the most important catalyst across technology is generative AI," says Dan Romanoff, senior equity research analyst for Morningstar Research Services.

"Software companies are developing and incorporating next-generation AI capabilities within their solutions. Cloud providers are introducing new services and ramping up capacity. Semiconductor firms, notably Nvidia (NVDA), are experiencing surging demand for AI and data center chip applications."

Investors have latched onto this theme, and, during the first half of 2023, stocks for companies deemed to have AI potential rallied strongly. However, a number of key players in the space remain undervalued, according to Morningstar analysts.

Undervalued AI Stocks

• Snowflake (SNOW);

• Cognizant Technology Solutions (CTSH);

• Salesforce (CRM).

And of course, there are two big household names that investors hunting for AI stocks can’t ignore. Both are trading at fair values.

• Nvidia (NVDA);

• Microsoft (MSFT).

How to Invest in AI Stocks

The underlying question for many investors is how to play the AI boom. "We expect AI implementations across all types of software, services, business processes, and consumer experiences," says Colello.

"These ongoing AI investments should provide upside for semis and the related supply chain, data management vendors, cloud computing and infrastructure leaders, software vendors, and IT services firms."

Morningstar analysts have broken the AI space down into four broad themes: generative AI, AI data and infrastructure, AI software, and AI Services. Within those are further subthemes. Here are some examples of subthemes, with representative stocks:

• Semiconductor processors – Nvidia (NVDA);

• Outsourced chip manufacturers – Taiwan Semiconductor Manufacturing (TSM);

• Chip equipment vendors – Applied Materials (AMAT);

• Peripheral chipmakers – Marvell Technology (MRVL);

• Data center infrastructure – Arista Networks (ANET).

AI Stock Rally

The boom in AI stocks took off after the release of ChatGPT, which allows the public to access AI tools for their personal use. This further fuelled the existing race between companies to offer their own versions of AI helpers within their products and platforms.

The increase in popularity and demand for AI is reflected in the performance of the Morningstar Global Next Generation Artificial Intelligence Index, which has risen 64.7% in 2023 through November 16, compared with the Morningstar US Market Index's gain of 18.4% over the same period. Prior to this year, the index outperformed the broader market over the trailing 12-month period, coming in at 50.7% to the broader market’s 13.7%.

Morningstar Global Next Gen AI

Source: Morningstar Direct, Morningstar Indexes

Undervalued AI Stocks

We screened the Next Gen AI Index for prominent undervalued names. Of the 49 stocks in the index, 38 are covered by Morningstar analysts. Big 2023 rallies have left some in overvalued territory, such as Broadcom (AVGO) (up 77% this year), Arista (up 77%), and Palantir Technologies (PLTR) (up 211%).

Until this past week, Advanced Micro Devices (AMD) was counted among the undervalued names. But with a recent push higher that extended a rally to more than 80% gains in 2023, its stock moved into fairly valued territory. Colello notes AMD’s potential as an AI play: "they should emerge as the number-two chipmaker behind NVDA for AI processors."

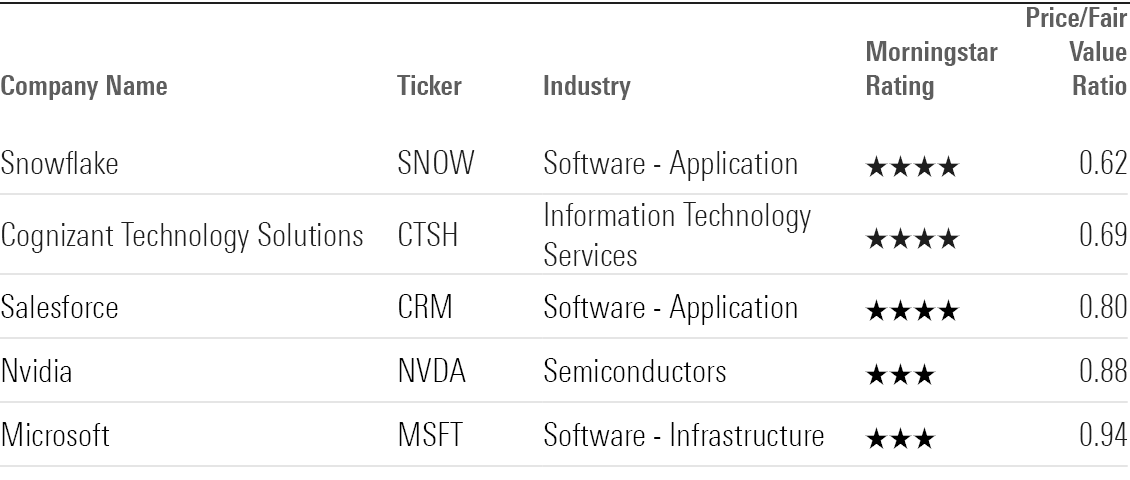

However, eight stocks are still considered undervalued, bearing 4- or 5-star Morningstar ratings. The most undervalued stock is Snowflake, which is trading at a 38% discount.

Colello highlights three of these companies as having dominant AI themes in their outlooks. We also include Nvidia and Microsoft, given their key roles in the development of AI.

Artificial Intelligence Stocks

Snowflake

• Fair Value Estimate: US$231.00;

• Economic Moat: None.

"In just over 10 years, Snowflake has culminated into a force that is far from melting, in our view. As enterprises continue to migrate their workloads to the public cloud, significant obstacles have arisen, compromising the performance of data queries, creating hefty data transformation costs, and yielding erroneous data. Snowflake seeks to address these issues with its platform, which gives all of its users access to its data lake, warehouse, and marketplace on various public clouds. We think Snowflake has a massive runway for future growth and should emerge as a data powerhouse in the years ahead.

"The rise of the public cloud has resulted in an increasing need to access data from different databases in one place. A data warehouse can do this, but it still does not meet all public cloud data needs – particularly in creating AI insights. Data lakes solve this problem by storing raw data that is ingested into AI models to create insights. These insights are housed in a data warehouse to be easily queried. Snowflake offers a data lake and warehouse platform, which cuts out significant costs of ownership for enterprises.

"Even more valuable, in our view, is that Snowflake's platform is interoperable on numerous public clouds. This allows Snowflake workloads to be performant for its customers without significant effort to convert data lake and warehouse architectures to work on different public clouds."

-Julie Bhusal Sharma

Cognizant Technology Solutions

• Fair Value Estimate: US$94.00;

• Economic Moat: Narrow.

"We think Cognizant is in a very similar boat to the other IT services firms we cover, in that they will benefit from AI because enterprises will look to them for implementation of AI solutions, which can be very complex and include much risk.

"In addition, many IT services firms have their own in-house AI solutions (like Cognizant's Neuro AI solution). While we see the whole industry as benefitting, Cognizant stands out because we think it is significantly undervalued due to unmerited discounting for mistakes the firm made in the past, when it was slower to develop cloud solutions.

"We assign Cognizant a narrow moat, stemming from its intangible assets and customer switching costs associated with its services. Its intangible assets come from its technical expertise, gained from putting enterprise solutions to work across hundreds of companies and refining its solutions with every new deployment. One example of this can be seen in its strong AI services."

-Julie Bhusal Sharma

Salesforce

• Fair Value Estimate: US$255.00;

• Economic Moat: Wide.

"We believe Salesforce represents one of the best long-term investment opportunities in software, particularly as the company should provide investors with a nice balance between revenue growth and improving profitability. Even as revenue growth has decelerated over time, we believe a new focus on margin expansion should continue to compound strong earnings growth for years to come. We model a five-year compound annual growth rate, for total revenue of 12% through fiscal 2028, which we think will be driven by strength in platform and marketing clouds, along with AI innovation.

"Salesforce has not made the same headline-grabbing splash that some other software vendors have in recent months with various AI announcements. It does not have to, as it has been an AI leader for years. The firm first introduced Einstein in 2016, and it has since become embedded in the company's platform, and it's been available in all the company's clouds for years. Einstein currently makes 194 billion predictions every day, compared with 8.5 billion Google internet searches per day, so the scale involved is already massive.

"We view the arrival of AI Cloud as important for both Salesforce and its customers, as it allows customers to use large language models that are provided by Salesforce, brought by themselves, or from third-party providers, such as OpenAI. To advance trust – which we think is critical to secure customer buy-in – AI Cloud uses techniques to prevent company data from being viewed by Salesforce and from being ingested into generic LLMs, thereby becoming part of the larger AI."

-Dan Romanoff

Nvidia

• Fair Value Estimate: US$480.00;

• Economic Moat: Wide.

"Nvidia has a wide economic moat, thanks to its clear leadership in GPUs and the hardware and software tools needed to enable the exponentially growing market around AI. In the long run, we expect tech titans to strive to find second sources or in-house solutions to diversify away from Nvidia in AI, but most likely, these efforts will chip at but not supplant the company’s dominance.

"Nvidia took an early lead in AI GPU hardware, but more importantly, it developed a proprietary software platform, Cuda, and these tools allow AI developers to build their models with Nvidia. We believe Nvidia both has a hardware lead and benefits from high customer switching costs around Cuda, making it unlikely for another GPU vendor to emerge as a leader in AI training.

"We think Nvidia's prospects will be tied to the AI market, for better or worse, for quite some time. We expect leading cloud vendors to continue to invest in in-house semis (with Google and Amazon leading the way), while CPU titans AMD and Intel will work on GPUs and AI accelerators for data centers. However, we view Nvidia’s GPUs and Cuda as the industry leaders, and the firm’s massive valuation will hinge on whether (and for how long) the company can stay ahead of the pack."

-Brian Colello

Microsoft

• Fair Value Estimate: US$370.00

• Economic Moat: Wide

"Microsoft is one of two public cloud providers that can deliver a wide variety of platform as a service/infrastructure as a service solutions at scale. Based on its investment in OpenAI, the company has emerged as a leader in AI. The company has also enjoyed great success in upselling users on higher-priced Office 365 versions, notably to include advanced telephony features. These factors have combined to drive a more focused company that offers impressive revenue growth with high and expanding margins.

"We believe Azure is the centerpiece of the new Microsoft. Even though we estimate it is already an approximately $58 billion business, it grew at an impressive 30% rate in fiscal 2023. Azure has several distinct advantages, including that it offers customers a painless way to experiment and move select workloads to the cloud, creating seamless hybrid cloud environments. Since existing customers remain in the same Microsoft environment, applications and data are easily moved from on-premises to the cloud.

"Microsoft can additionally leverage its massive installed base of solutions as a touch point for an Azure move. Azure is also an excellent launching point for secular trends in AI, business intelligence, and the Internet of Things, as it continues to launch new services centered around these broad themes.

"We raised our fair value estimate for Microsoft to $370 from $360 after it reported good results and guidance for its fiscal first quarter of 2024. Shares are up following earnings, leaving the stock just inside 3-star territory. Microsoft is a name we want to own, but we don’t see a huge valuation layup."

-Dan Romanoff

AI Stock Performance

Source: Morningstar Direct, Morningstar Indexes

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/7WLK3HWLZBFR7NKI45PXWUD6OI.jpg)