Criticisms of the upcoming climate change summit, known as COP28 are rife.

For one, critics have seized on the incongruousness of hosting a summit aimed at keeping the world on the path to curb global warming in a major oil state. The chief executive of the Abu Dhabi National Oil Company, or Adnoc, is even presiding over the event itself, and that's not even mentioning the emergence of leaked documents that suggest the United Arab Emirates plans to do oil deals at the conference.

The result can only be tension. But there are tensions elsewhere too. For example, the "loss and damage" fund earmarked for developing nations hit the hardest by climate change is stalled by disagreements. Former US Vice President Al Gore recently declared that the "deck [is] stacked against COP28."

Oil Stocks Preparing for a Warmer Future

At the same time, major fossil fuel company ExxonMobil [XOM] recently announced that it is acquiring Pioneer. Likewise, Chevron [CVX] is buying Hess. These firms are betting not only on continued demand for oil but also robust prices – the estimated breakeven per-barrel oil price to justify these purchases sits between $70 and $80, which exceeds Morningstar equity analysts' long-term oil forecast of $60 per barrel.

Against that backdrop, it's no wonder there's still debate whether the conference can advance its net-zero goal of keeping the world on the path to limiting global warming to 1.5 degrees Celsius by the end of the century. If it can't, what might that portend for oil supply and demand? In this piece, we'll explore potential alternative scenarios to net zero and which oil and gas companies appear to be well-prepared for a warmer future.

The World we Want vs. The World as it Might be

I'm a big college football fan and a proud alumnus of the University of Notre Dame. I would absolutely love to see Notre Dame win the national championship. But I'm also a realist – the odds of this are long in most years – so I'm certainly not willing to put money on it.

Investing is similar. After all, net zero is a worthy goal, backed by science, sentiment among younger generations, and various stakeholder groups. It offers a hopeful vision for the future, and one that I share. But as an investor, it behooves us to prepare for multiple scenarios, some of which wouldn’t meet my hopes. Just as I wouldn't bet the house on the Fighting Irish to win it all, I try to be clear-eyed about the different paths the climate future could follow and the investing implications they might have.

Oil Demand Could Decline by 2050, But Not by Much

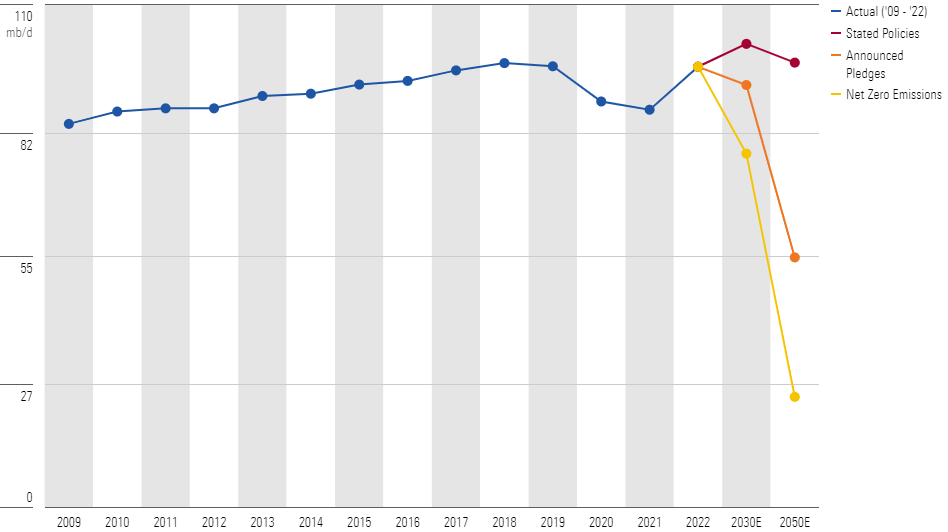

What paths are we talking about? The International Energy Agency's (IEA) World Energy Outlook presents three potential scenarios for global energy:

1. Net-zero emissions, which predicts a massive fall in oil demand and resulting carbon output by 2050;

2. Governments’ current stated energy policies, which predicts a smaller fall in oil demand;

3. Nations’ announced pledges, which is a middle ground between the first two.

The IEA also notes the Net Zero Emissions pathway would limit global warming to below 1.5 degrees Celsius by 2100 but also cautions this scenario has become less likely in recent years. The Announced Pledges scenario is estimated to lead to 1.7 degrees of warming, while the Stated Policies outlook is set to lift temperatures 2.4 degrees.

Why don't these pathways paint a rosier picture? In a word: demand.

To be sure, the IEA's most recent outlook estimated 2030 demand of 77.5 to 101.5 million barrels per day, which at the midpoint would represent a roughly 7% decline from last year's level. But the top end of the range still suggests growth. And by 2050, the IEA projects minimal declines, with demand of 97.4 million barrels per day slightly exceeding the 96.5 million barrels per day demanded in 2022.

In other words, despite many stakeholders' pledges to reduce carbon emissions and oil usage, limited political willpower – alongside resistance from oil and gas producers – make it unlikely that net zero will be achieved.

Consequently, investors should be willing to reconsider companies in the oil value chain that were previously thought to be unprepared for a future in which oil demand would decline substantially to meet net zero.

Which Oil & Gas Stocks Are Prepared for Climate Risk?

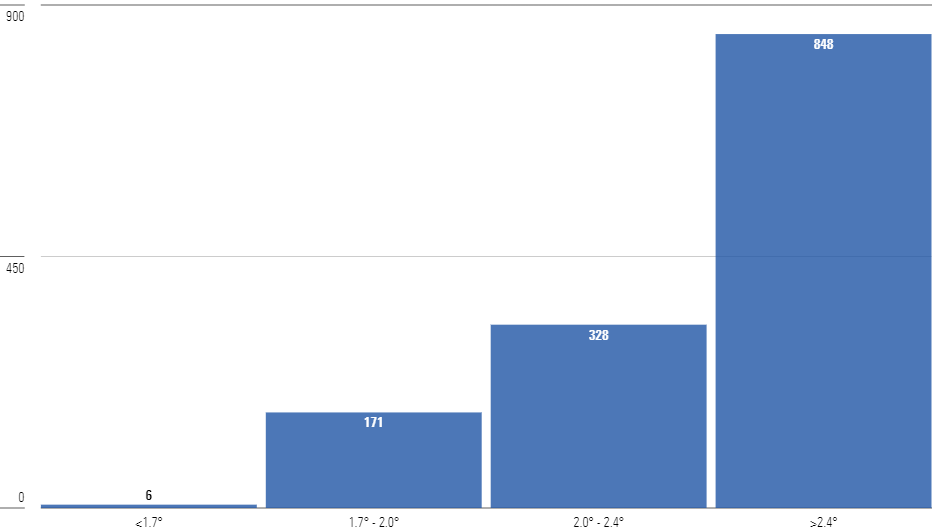

One way to examine oil companies' preparations for various scenarios is through their commitments to reduce carbon output. Here, we can use Morningstar Sustainalytics' Low Carbon Transition Rating, or LCTR, which measures companies' carbon reduction commitments and assigns an implied temperature rise based on their magnitude.

Per the LCTR, no companies followed by Morningstar equity analysts are found to have an implied temperature rise of less than 1.5 degrees, meaning none is fully prepared to transition to a net-zero economy.

But perfection might be the enemy of progress. About 37% of covered companies – including a third of covered energy companies – have made carbon-reduction commitments that put them on a path to less than 2.4 degrees of warming, in line with a future as outlined by the IEA's Stated Policies scenario.

What does this mean for investors? If net zero is truly unachievable and the world recenters on a higher temperature goal, these companies' transition plans to a below 2.4-degree future are less out of step, and arguably present less risk, than other covered companies whose plans imply higher temperature rises.

To be sure, it's not like these firms that are prepared to meet an envisioned 2.4-degree scenario are out of the woods. Should the future unfold that way, we should probably expect more climate hazards like forest fires, floods, or hurricanes. Those events can result in significant physical damage to infrastructure and productivity losses for companies, which Sustainalytics assesses on a five-point scale: Significantly Below Average, Below Average, Average, Above Average, and Significantly Above Average.

By taking those physical-risk assessments into consideration, we can zero in on firms that are not only prepared for the 2.4-degree scenario but also are not expected to incur heavy damage to their physical assets or infrastructure.

The Case for TC Energy, Diamondback, and Tenaris

Ultimately, I found three oil and gas companies prepared for a 2.4-degree warming scenario that trade at attractive valuations and are unlikely to face heavy physical asset damage risk:

• Canadian natural gas pipeline firm TC Energy [TRP];

• Oil equipment manufacturer Tenaris [TEN];

• Permian Basin producer Diamondback Energy [FANG].

Each firm has made carbon-reduction commitments that Sustainalytics analysts estimate are aligned with a temperature rise of less than 2.4 degrees, physical asset risk rated Average or Below Average in most categories, and a share price/fair value estimate ratio less than 1.0.

Final Thoughts

Despite governments, regulators, investors, and other stakeholders pushing for ongoing carbon emission reductions, there remains continued debate about the ability for the world to hit net zero and ultimately limit global warming to 1.5 degrees Celsius by 2100.

If this goal becomes untenable because of a continued high level of oil demand, investors should consider companies' own commitments and the physical damage of potential climate hazards. Seeking out stocks that are prepared for a scenario in which oil demand falls by only a minimal amount in the coming decades, and combining with attractive valuations, allows investors to consider environmental risks while still seeking reasonable returns.

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/2LP7U4OXYVCPTOW5ABPSYWP4OI.png)

.jpg)