As we look ahead to 2024, many of us are on the edge of our seats. Is there still a global recession looming? What will happen to the U.S.’s federal debt of over 33 trillion dollars? Will that number ever get any easier to type?

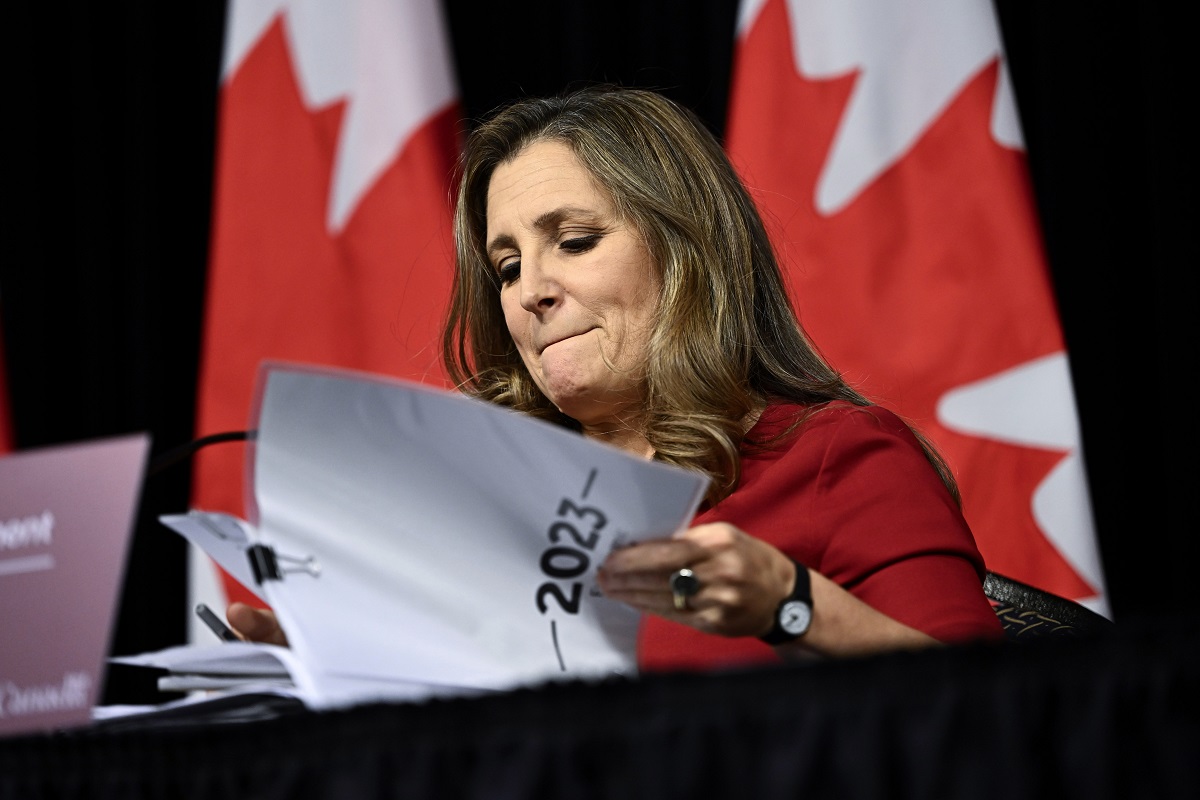

In Canada, the government pledged in its recent Fall Economic Statement to keep a lid on budget deficits and avoid exacerbating central bank efforts to slow inflation back to its preferred 2% target. The Liberal government said it will ensure the budget deficit for the current fiscal year, ending March 31, 2024, doesn't exceed $40.1 billion, and lower the debt-to-gross domestic product ratio after it peaks at 42.7% in 2024-25. Canada is expected to record annual budget deficits in the $40 billion range until 2026-27.

Looking ahead Canadian markets are also likely to be influenced by the country’s largest trading partner, and Jurrien Timmer, Director of Global Macro at Fidelity Investments has some key U.S. trends for investors to look out for.

What’s in Store for U.S. Markets?

“The markets are betting on a soft landing. And the economy in the U.S. has been quite resilient. We are in a late-cycle phase and when interest rates rise, growth tends to slow,” says Timmer. “More than likely, we won’t get a recession, but a slow down,” he says, “And as employment remains tight my sense is that the rare soft landing is the default expectation.”

U.S. Homeowners Resisting Rate Hikes

“In the U.S., homeowners locked in low rates (during the pandemic) for a long time, and that means they are immune to what the Fed is doing,” says Timmer. Many Americans went from adjustable to fixed mortgages.

The COVID refinance boom, which occurred from the second quarter of 2020 through the fourth quarter of 2021, was spurred by a decline in mortgage interest rates of nearly 200 basis points from November 2018 to November 2020.

The 14 million people who executed this strategy will continue to benefit from historically low interest rates, and they will affect mortgage markets in the years ahead.

American Consumer Spending Supporting by Debt Management

Around 70% of the U.S. GDP is consumer spending. And as Timmer points out, people are employed. Debt levels are down. Consumers have managed their debt and those in higher income brackets still have some savings from the pandemic. “People are travelling and spending – there’s no evidence of a recession here,” he says. Timmer has a glass half-full view.

Throughout 2023, there have been a few cases where the core Personal Consumption Expenditures Index (PCE)—a measure of inflation that excludes food and energy prices—rose more than expected, and at a faster year-over-year pace than the previous month.

The Fed has one more chance to raise rates in December, and they will be factoring the PCE Price Index into their decision. Meanwhile, investors will need to factor in the relative outperformance of a few stocks in an uncertain environment.

The Magnificent Seven (Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia and Tesla) dominated the stock market in 2023 and they make up 29% of the S&P 500's market cap. The group is responsible for nearly 70% of the overall equity market’s gains this year, notes Morningstar chief U.S. strategist David Sekera.

Magnificent Seven Make-Up Seventy Percent of Gains

Seven stocks haven't had such a large share of the index's market cap since at least 1980.“If the soft landing does pan out, and the Fed is nearly done raising rates, and market participation broadens. It’s a good scenario for 2024—and you don’t have to bet everything onThe Magnificent Seven.”They’ve dominated for so long, that hopefully there is a good opportunity ahead for small-caps and non-US companies.

Fiscal Dominance

Another theme that Timmer mentioned is Fiscal Dominance. He believes that this new era of Fiscal Dominance, where the US government continues to run a persistent deficit, will continue. “It’s rare to see deficits this big when you’re not in a crisis,” he says, pointing to World War II and the Vietnam war as examples of when the US incurred high amounts of debt.

The current US national debt is just shy of $34 trillion. In 2024, the deficit is estimated to increase by $1,846 billion. “Now, who’s going to buy the debt?” Timmer asks. Canada, Japan, and the U.K. are all running a deficit. “Right now, it’s who’s got the cleanest dirty shirt?”

The Outlook on Bonds

In assessing the outlook for national deficits and debt investments, keep duration in mind, Timmer says. The belly of the curve is an attractive place for bonds. Little worry for rising term premiums at the long end or reinvestment risk on the short end. And a real upside if the Fed cycle pivots.

Timmer leaves us with some bond math to consider:

Bloomberg Agg index (US investment grade) has a duration of 6 and a yield of 5.5%. Duration measures the change in price of bonds for each 1% change in yield. So, if yields fall 1%, an investor makes 6% in addition to the yield of 5.5%, which equals 11.5%. If yields rise 1%, an investor makes -6% + 5.5%, or -0.5%. So, right now, that means the risk/reward for bonds is +11.5% vs -0.5%.

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/P3MDVUXN7VAZVPJZPL3YZ6MCTA.png)