Cutting-edge products riding a wave of transformative technology. Staggering growth and a sky-high profit margin. Stocks rocketing to the moon.

These descriptors might bring to mind semiconductor designer Nvidia NVDA, whose stock has tripled in value over the past year. But they could also apply to Cisco Systems CSCO in the 1990s. And Cisco's fate offers investors a cautionary tale.

After the company went public in 1990, Cisco stock surged more than 1,000 times over the decade, striking a high of US$80 on March 27, 2000. But then it was hit hard by the collapse of the dot-com bubble, plunging to a low of $8.60 on October 8, 2002.

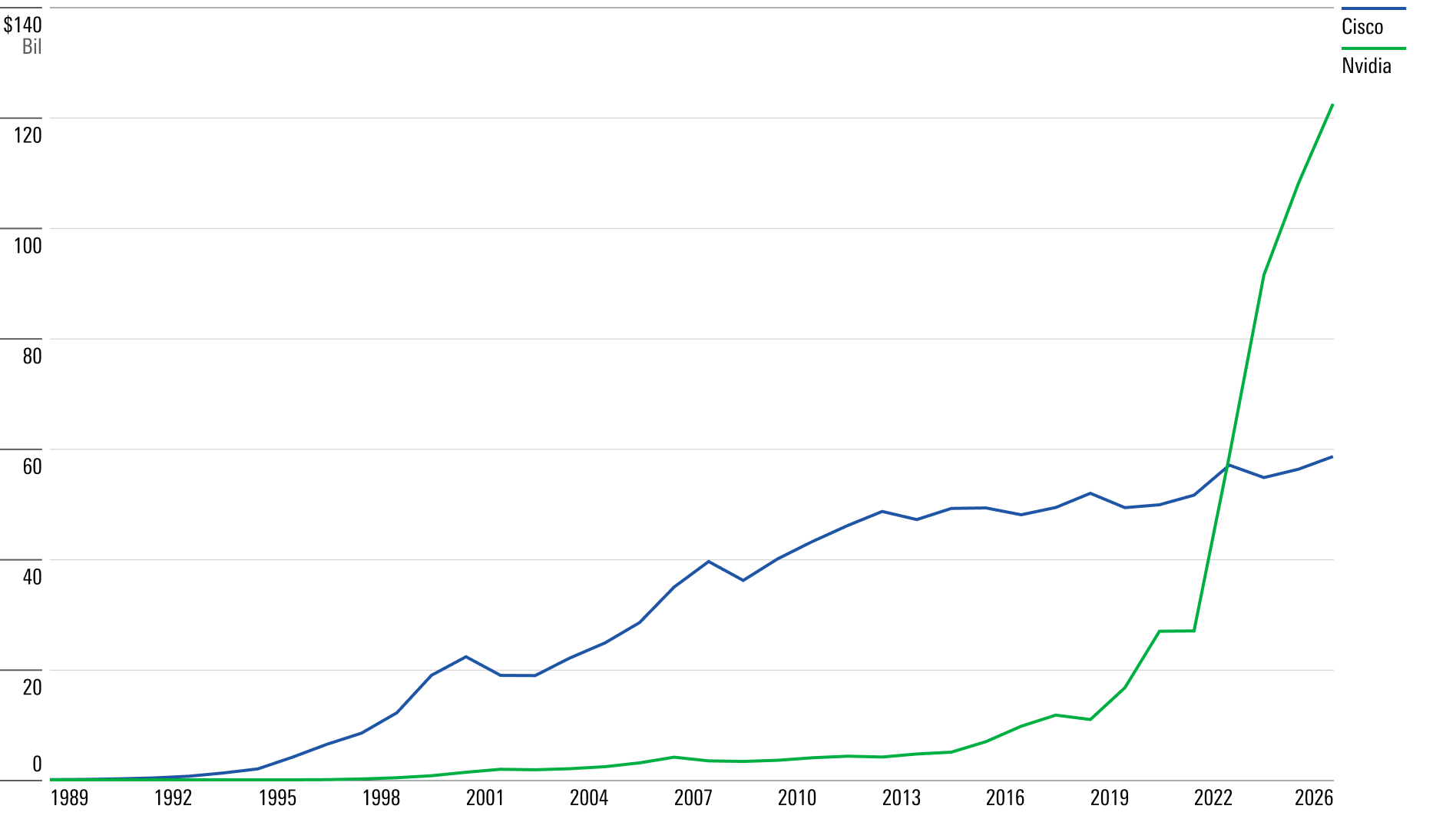

More than 20 years later, Cisco is yet to reach its March 2000 peak. Over the past decade, its stock has returned 11% per year, in line with the Morningstar US Market Index (10.9% dividend included) but below the Nasdaq Composite Index (14.6% dividend included).

Will Nvidia meet the same fate? Or will it achieve the kind of long-term performance seen by other innovators like Apple AAPL? Investors must consider the differences between the companies' business models, as well as the market backdrop now versus then.

Nvidia may be riding a wave of interest in artificial intelligence – as its chips play a dominant role in the technology – but, more broadly, stocks are still recovering from the 2022 bear market. Regardless, some, such as fund managers Chris Mack and Rick Schmidt at Harding Loevner, see parallels between Nvidia now and Cisco in the 1990s.

Nvidia's Massive Growth

As Mack and Schmidt note, Nvidia's business has changed significantly in a brief period. Between 2017 and 2022, the company's total revenue went from US$7 billion to US$27 billion. That growth is only accelerating. This fiscal year, the firm's annual revenue is expected to more than double to US$58 billion, and that figure is estimated to cross the US$100 billion mark by 2026. That's a factor of growth of 14 times in 10 years.

Nvidia's market value has expanded even faster, growing from roughly US$32 billion in 2017 to US$1.2 trillion now. That's a multiple of 37.5 times in just six years.

The main driver of this growth is the company's data center business, because of the dazzling demand for computing power from hyperscalers and AI workloads. This segment represents 56% of Nvidia's revenue in 2023, up from 12% in fiscal 2017. By 2026, its share of revenue should reach 82%, according to the consensus.

The Rise and Fall of Cisco Stock

In the early 2000s, Cisco had a similar superstar status, with exceptionally fast-growing revenue and profits. In The Halo Effect, author Phil Rosenzweig recalls how the company was hailed as "the king of the internet."

The factors leading to Cisco's prestige included chief executive John Chambers' charisma, the company's acumen at identifying, acquiring, and integrating targets that helped diversify and complement its product offerings, and its "extreme customer focus," according to a May 15 2000, article in Fortune. Cisco became one of the most valuable companies in the world, with a market value of US$555 billion, surpassing Microsoft MSFT. However, this did not last. The firm wasn't immune to the downturn in the economic cycle, nor to telecom operators' massive capital expenditure cuts after the internet bubble burst.

Nvidia: Elevated Expectations?

With Nvidia's solid fundamentals and expectations for rapid growth, investors appear convinced its story won't end any time soon. The stock is a must-have for many portfolio managers and is part of many hedge fund portfolios, according to a Jefferies report.

According to FactSet, the average target price of all the analysts who cover the stock is US$666 per share, compared with a closing price of US$481. At its current share price, Nvidia is trading at a 12-month forward EV/sales multiple of about 22 times, compared with a historical average of 6 times (which is more than 2 standard deviations above the mean). Cisco reached such a multiple of 27 times in April 2000, versus a historical average of 6 times (and a current ratio of three times).

According to Morningstar's director of technology Brian Colello, "Nvidia was a much larger and more stable business prior to its booming growth, [while] Cisco was a startup growing impressively but off a smaller base."

He adds: "much of Cisco's revenue came from purchases and builds in anticipation of internet growth. With Nvidia, we see its GPUs put to use right away to train AI models."

Also, "Nvidia's GPUs inherently have shorter useful lives than Cisco's networking gear, which we think reduces the likelihood of overbuilding." Colello thinks Nvidia’s stock is fairly valued after the company's third-quarter earnings and bullish forecast for its fourth quarter.

More generally, when considering market conditions, it is difficult to claim whether markets are in a bubble. Some niche industries, such as AI, might be closer than others, according to the latest survey of institutional investors from Bank of America (although it is of lesser importance than high inflation, geopolitical systemic credit events, and global recession risks).

Provided the world economy does not slow more than expected and the United States experiences a soft landing on inflation, market conditions could remain favourable and valuations could remain elevated. But it's possible that if inflation does not fall closer to the Federal Reserve's target range, higher-for-longer interest rates might devalue highly priced stocks, including AI-related ones.

Fundamentals also need to be considered. So far, Nvidia has enjoyed a quasi-monopoly position in the AI space, translating into high demand and solid pricing power. "Nvidia’s growth is occurring during a time of rising interest rates, perhaps going against the grain of robust capital expenditures," says Colello. "Cisco was riding a nice economic wave [in the '90s], but many of Nvidia's customers are cutting spending elsewhere to buy its GPUs."

Nvidia's competitors, like Advanced Micro Devices [AMD] and Intel [INTC], are trying to catch up and take advantage of the fat profit margins in the AI space. History suggests that whatever the prospects, over the long run, both valuations and fundamentals tend to return to the mean, since highly profitable industries tend to attract competition, provided new entrants can differentiate from incumbents and grab market share.

Morningstar believes Nvidia has a wide moat "thanks to its intangible assets around graphics processing units and, increasingly, switching costs around its proprietary software, such as its Cuda platform for AI tools, which enables developers to use Nvidia’s GPU to build AI models." For long-term investors, fundamentals should be the most crucial factor when deciding whether to buy a stock, while valuation fluctuation provides opportunities to buy it when it becomes cheap. Whatever your view on Cisco's track record, that's one condition Nvidia is certainly not fulfilling at the moment.

.jpg)