When your job involves staying on top of developments in the mutual fund industry, you often come across new fund launches of all kinds. So far this year through December 11th, Canadian firms have launched 254 new funds. Among all the innovation and expansion of options, one new fund caught my eye.

On October 3rd, 2023, Fidelity Investments launched the Fidelity Global Equity Plus Fund. The fund uses a sleeve-based approach where three Fidelity portfolio managers each manage a separate component, or sleeve, of the fund.

A multi-sleeve manager structure is not new for Fidelity when it comes to equity funds. For example, Fidelity NorthStar Fund, a fund featured in our 2023 Morningstar Prospects report, also combines three sleeves into one equity strategy, ranks in the top decile of its Global Small/Mid Cap category and earns a Morningstar Medalist Rating of Silver for its fee-based share class.

But what is it about this specific new fund that makes me excited? Here are a few reasons:

The Strength of Three Proven Investment Managers

The fund’s sleeves are managed by Mark Schmehl, Daniel Dupont, and Hugo Lavallée. Each has earned either a High or Above Average Morningstar Medalist People Pillar Rating on their standalone funds.

The managers are firm and industry veterans, each joining Fidelity between 1999 and 2002. The trio worked alongside each other as analysts before they each found success as portfolio managers.

Both Lavallée and Dupont manage top-performing funds in the Canadian-focused equity category. Over the last ten years, Lavallée’s Fidelity Greater Canada Fund has been a top-performing fund and Dupont’s Fidelity Canadian Large Cap is a top quartile fund. Schmehl’s long-term success is also noted in two Canadian-focused equity funds—Fidelity Canadian Growth Company and Fidelity Special Situations Fund which are top decile. His fund featured in Fidelity Global Equity Plus, Fidelity Global Innovators, has been the top-performing fund in the Global Equity category over the last 5 years.

Diversification

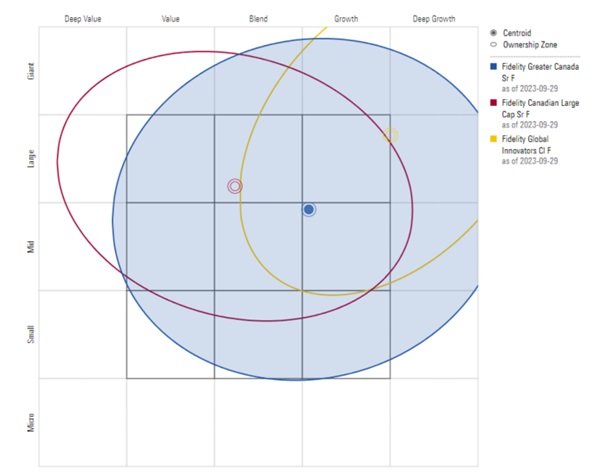

Three distinct yet complementary investment philosophies underpin the trio’s differentiated approaches to portfolio management and provide investors with a well-balanced exposure across styles, sectors and geographies.

Schmehl likes companies or sectors that benefit from secular trends which results in notable weights in technology and growth-oriented stocks. Lavallée’s contrarian investment style results in a portfolio of durable businesses that are facing temporary setbacks creating a fund with exposure to a variety of sectors and markets in both growth and value-style companies. Dupont’s patient approach to protecting capital and commitment to buying quality companies at the right price results in a value-stye portfolio. His portion of the Fidelity Global Equity Plus Fund also includes a 10% allocation to his Fidelity Global Value Long/Short Fund and adds further diversification by providing exposure to long and short positions.

Morningstar Equity Holdings Style Map as of September 2023

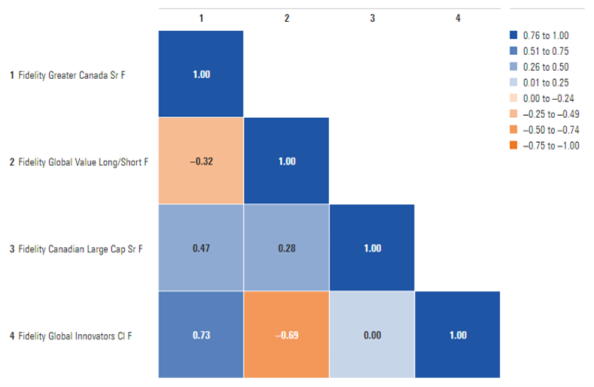

The funds’ relatively low or negative correlation, a measure of the similarity between the fund’s respective performance results, provides a glimpse of the potential benefit of pairing these funds together.

Cost Savings

Global Equity Plus is expected to be cheaper than the sum of its parts. The fund will not report a management expense ratio (MER) until it has a full year of history. The reported management fee for the fee-based share class of the fund is 0.9% and anticipated administrative costs 0.19%, however is 0.05% cheaper than what an investor would pay to replicate the fund by building it using its underlying funds.

By combining these three distinguished managers with complementary investment philosophies into one fund, Fidelity Global Equity Plus Fund provides investors with a well-rounded strategy that should prove resilient in multiple market environments. It is worthy of excitement as it could be a prime example of how a diversified fund confirms Aristotle’s observations about how a sum can be greater than its parts.