:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6ZMXY4RCRNEADPDWYQVTTWALWM.jpg)

Almost every investor believes that over time, stocks will outgain bonds. Those with long-term horizons therefore typically hold mostly equities. For example, the median stock market allocation among target-date 2055 funds, designed for employees who will retire in another three decades, is 91%.

My mindset has been similar. While acknowledging the rebuttal offered by Nobel Laureate Paul A. Samuelson—that although equities usually triumph over time, their losses can be devastating when they do fail—I have argued that this concern is more conceptual than practical. Since 1926, when the Ibbotson Associates database began, U.S. equities have always beaten U.S. intermediate-term bonds over rolling 30-year periods and nearly always over 20 years.

Most academic researchers have also set aside Samuelson’s objection. For example, another (future) Nobel Laureate, Richard Thaler, once suggested to the managers of university endowment funds that they consider putting 100% of their assets into equities. More publicly, Wharton professor Jeremy Siegel has spent the past 25 years advocating “stocks for the long run.” His claim for the superiority of equities over bonds is based not only on Ibbotson’s figures but on stock performance over the previous 120 years.

Specifically, Siegel drew first upon work conducted by Robert Shiller (yet another Nobel Laureate—apparently studying equity returns powerfully advances one’s academic reputation) that tracked stocks back to 1871, then added his own efforts, dating to 1802. The performances computed by Shiller and Siegel looked much like the most recent century’s results. The average annualized rate of return for equities was similar, and again stocks consistently outdid bonds.

The Rebuttal

This year, in a paper that by academic-finance standards has gone viral—over 16,000 views and 100 citations within two months—Edward McQuarrie, professor emeritus at Santa Clara University, tossed a bullfrog into the punch bowl. Based on both his original research and that of others, McQuarrie has amended the existing stock and bond databases to correct the historical records.

(Specifically, McQuarrie expanded upon the groundbreaking research of Richard Sylla of New York University, who had enriched the equity database by combing through hundreds of newspapers, magazines, and out-of-copyright books to 1) locate more securities and 2) reduce survivorship bias. For example, Siegel’s history did not account for the near-bankruptcy of the 2nd Bank of the United States—which, although chartered by the federal government, was structured as a for-profit corporation. As that company was by far the nation’s largest before it collapsed, its omission significantly affected Siegel’s results.)

McQuarrie’s discoveries have challenged the conventional wisdom. Stocks have not outgained bonds throughout the nation’s history. When the Roaring 20s began, McQuarrie’s amended record shows, the cumulative total return for equities equaled those of bonds. From 1793 through 1920, stocks enjoyed no return advantage whatsoever. What’s more, because bonds had been less volatile, they were the superior overall investment, by risk-return measures.

The New Numbers

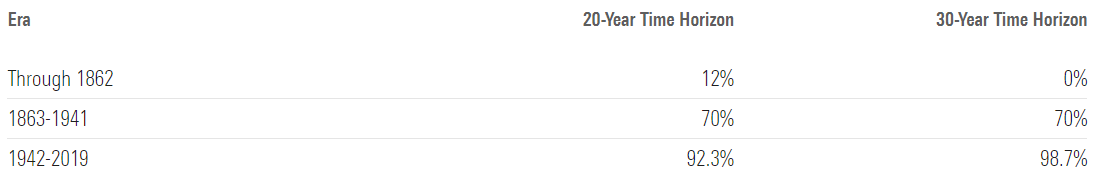

Back in the day, awaiting equities’ eventual payoff called for more than just patience. Often, it required a second lifetime. Employing the updated figures, McQuarrie computed the percentage of monthly periods over which stocks beat bonds. He separated his findings into three eras, presented below.

Stocks’ Winning Percentage

% of Rolling Periods When Stocks Beat Bonds

The lesson for the first era, it seems, is “Beware frontier stock markets!” Yes, such economies often expand rapidly. However, increased overall prosperity need not lead to higher stock prices. Companies might operate unprofitably, with their economic benefits accruing to workers rather than owners. Or perhaps they will generate earnings, but insiders will pocket most of the proceeds. Finally, frontier nations tend to have corrupt governments, which also have their hands extended.

Modern investors would do well to heed the warning. In 2007, Morgan Stanley Capital International launched its Frontier Markets Index, which currently holds 211 stocks from 29 countries, the largest three of which are Vietnam, Romania, and Morocco. If you like the growth opportunity of emerging markets, you’ll like frontier investing even more! Or not. As demonstrated by this chart, the index has lagged far behind developed-markets equities since its inception.

Better, But Still Questionable

From the Civil War through the beginning of World War II, stock performance improved, with equities besting bonds over both the 20- and 30-year periods on 70% of occasions. That showing more closely matched our modern assumptions. Nevertheless, those outcomes fall well short of what today’s investors expect from equities—and have experienced during their investment lifetimes.

McQuarrie states that these results make stocks far from a sure thing. Perhaps stocks will outgain bonds over the ensuing decades, perhaps not. Their reputation for long-term dominance derives solely from their post-World War II returns (in particular, for the 40-year period from the early 1940s through the early 1980s). When the fuller history is considered, that conclusion must be modified.

Strengthening McQuarrie’s claim has been recent research on non-U.S. stocks. Twenty years ago, the available evidence suggested that the real annualized return for (mostly) developed-markets non-U. S. equities was 6.6%, which pretty much matched what was then reported to be the U.S. experience. However, notes McQuarrie, international-stock databases have also been improved. Consequently, that estimate has been shaved to 4.4%. Quite a difference!

Wrapping Up

To return this column from whence it began, Paul Samuelson (rather than John Maynard Keynes or Winston Churchill, who are more typically sourced) was apparently the first to word this common sentiment so succinctly: “When events change, I change my mind. What do you do?” Far be it from me to disagree with my betters. Given that the available information has changed, I am also willing to change my mind about the innate superiority of U.S. equities.

Friday’s column will address whether, in my opinion of course (Professor McQuarrie has his view, as will you), the new evidence requires me to do so.