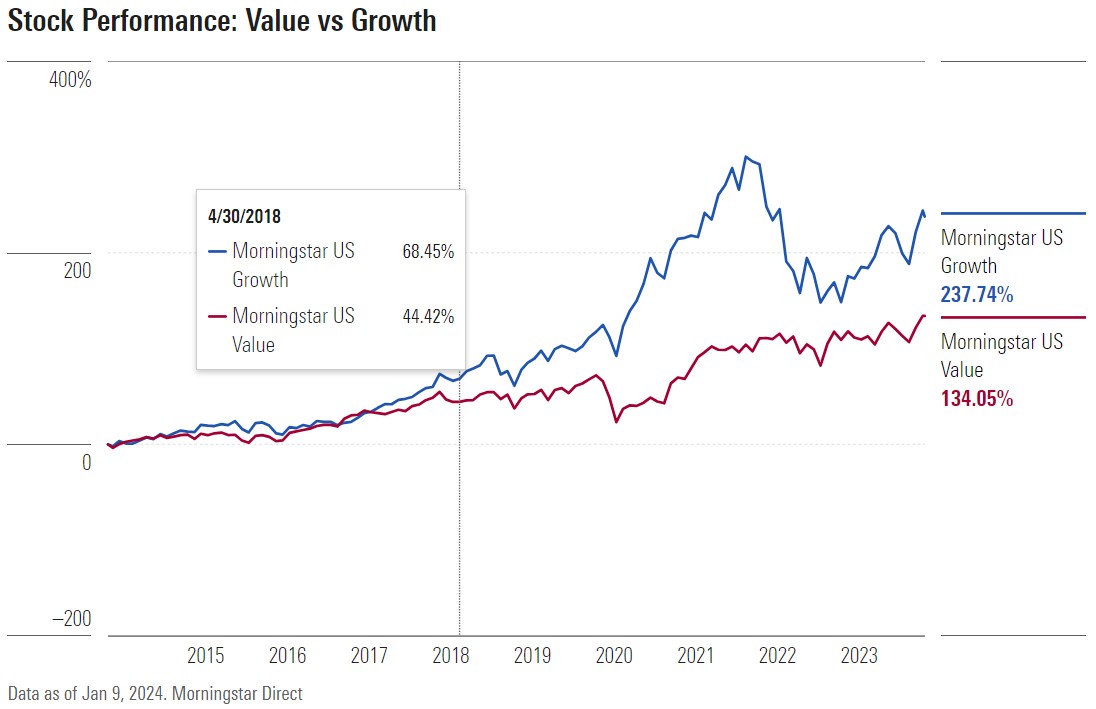

After a year of Big Tech mania, is it finally time for value stocks to shine? These portfolio stalwarts have mostly lagged their counterparts in the growth category and the broader market for years. However, strategists say the right conditions could lead to a breakout for the under-loved category in 2024.

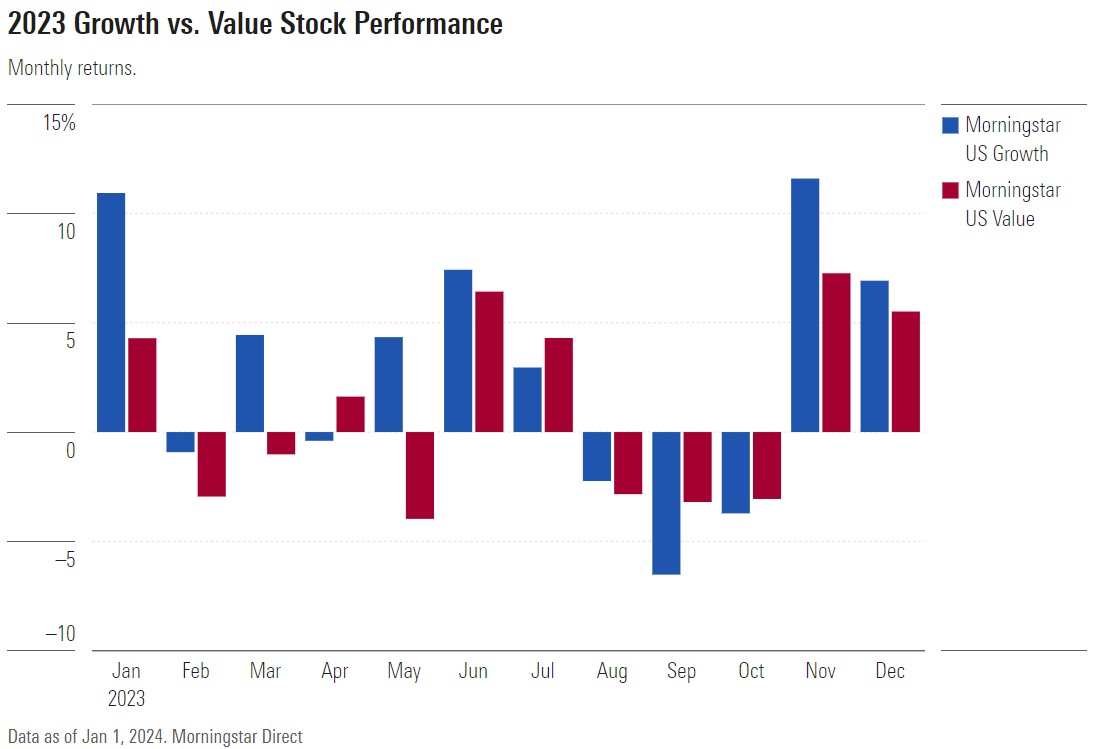

The Morningstar US Value Index returned 12%, and the value-growth blend Morningstar Canada Index returned 12.22% in 2023. That’s pretty disappointing compared with the 26.5% returns from the growth-leaning Morningstar US Market Index, which tracks stocks in every category, and the 38.5% returns on the Morningstar US Growth Index.

But in the wake of 2023′s “everything rally,” there are hints (albeit small ones) that the tables could be turning. Value stocks are flat so far in 2024, while growth stocks have fallen 1.8%.

Here’s what investors need to know about what’s ahead for this less-than-flashy corner of the market.

Value Stocks and Growth Stocks

Investors loosely define value stocks as well-established companies with steady profits that are trading at a discount to what they’re intrinsically worth. They tend to have reliable, sustainable business models and often pay dividends because of their regular cash flows. Think banks, healthcare companies, and industrials.

Growth stocks are companies that investors believe could potentially outperform the market in the future, even if they may be unprofitable or expensive now. They tend to be riskier and more volatile. This group includes the big-name “Magnificent Seven” tech stocks that are familiar to most investors: Nvidia NVDA, Tesla TSLA, Meta Platforms META, Apple AAPL, Amazon.com AMZN, Microsoft MSFT, and Alphabet GOOGL.

Economic conditions over the past decade or so have created an environment in which, with the notable exception of 2022, growth stocks have flourished while value stocks have lagged. “Value stocks love when the economy is booming because they are cyclical, like industrials and energy, or when the economy is doing poorly because they are defensive, like utilities,” explains Ed Clissold, chief U.S. strategist at Ned Davis Research. “But when you have a middle ground of sluggish growth, growth stocks do well.”

The abnormally low interest rates over the past 15 years have added to the imbalance. Lara Castleton, U.S. head of portfolio construction and strategy at Janus Henderson Investors, sums it up this way: “When interest rates are zero, investors are starting to take longer duration equity risk.” This means they’re willing to look to companies with more distant cash flows. They don’t need to focus on value companies, which deliver returns on investment much earlier. “In that environment, growth is what you want.”

Growth stocks got another boost from the COVID-19 pandemic, Clissold explains, when “stay at home” stocks like Apple and Netflix NFLX soared during lockdowns.

2022 Saw Value Stocks Outperform

That all changed in 2022, when the U.S Federal Reserve began raising interest rates to combat runaway inflation. Tech stocks saw the worst of the carnage as investors fled to safety. That year, the Morningstar US Growth Index plunged 36.7% while the Value Index dropped just 0.7%.

“2022 was a fabulous year for value,” says John Stoltzfus, chief investment strategist at Oppenheimer Investment Management. “Rates had been so low for so long, and value was not the place to be for a long time.” But suddenly, with rates high and growth stocks struggling, it was.

What Happened to Value Stocks In 2023?

Those gains didn’t last. Large-growth stocks gained 47.3% last year, blowing away large-value stocks by 36 percentage points—the second-biggest advantage for growth in 25 years.

2023 was a “perfect storm” for value, explains Dmitry Khaykin, a managing director and large-cap value portfolio manager at ClearBridge Investments. The regional banking crisis in the spring took a bite out of financial stocks, which are a major component of the value category, even though rising interest rates should have theoretically favored that segment.

“The fact that the Magnificent Seven ended up being that quality trade” as banks stocks struggled “completely dwarfed any sort of trends underneath the hood,” says Castleton.

Then artificial intelligence “recaptured the hearts and minds of investors” for large-cap growth stocks, Clissold says. The Magnificent Seven soared, lifting up the major indexes even if the rest of the market wasn’t faring nearly as well. Value stocks fell by the wayside once again.

But this time around, there was a silver lining. “In prior periods, it felt like value just couldn’t keep up because it wasn’t big tech,” says Marta Norton, chief investment officer, Americas, at Morningstar Investment Management. But in 2023, value stocks faced their own fundamental headwinds: Bank stocks were cheap because of concerns around interest rates and deposit risk, for instance, while utility stocks fell out of favor as Fed policy pivoted. Those headwinds “opened up opportunities that could flip the narrative,” Norton explains. “That’s what we saw in the second half of the year.”

Value Stocks Are Cheap

Underpinning those opportunities are very cheap valuations.

Among the more than 700 stocks Morningstar covers, value stocks are now considered the most undervalued by our analysts, meaning they are trading at the biggest discounts relative to our assessments of their fair market prices.

Morningstar analysts measure valuation by comparing a stock’s current price to our estimate of its fair value—a metric called the price/fair value ratio. Ratios higher than 1.0 indicate stocks are overvalued, or expensive. Ratios under 1.0 indicate stocks that are undervalued, or cheap.

At the end of 2023, value stocks were the cheapest compared to other areas of the market. That was especially true in the small-cap value category, which carried an average price/fair value ratio of 0.84% at the end of the year, implying a discount of 16% for the category. This is part of why Morningstar chief U.S. market strategist Dave Sekera calls the value category the “best opportunity” for investors right now. Large-cap value stocks hovered close to their fair values at the end of the year, while large-cap growth stocks carried a 15% premium.

Castleton says this valuation imbalance could be a tailwind for value stocks, especially as interest rates return to more normal levels. “When the cost of capital is no longer zero, it matters what you pay for things,” she says. In other words, investors may be less willing to justify the high price premium attached to stocks like the Magnificent Seven now that value stocks have such attractive prices.

Risks and Opportunities for Value Stocks In 2024

Strategists say that the trajectory of the value category in the months and years ahead will in large part depend on the path of interest rates and the economy. The Fed has signaled to the markets that it is likely finished raising rates this cycle and is preparing to cut them. Bond market futures indicate that the first cut could come as soon as March, according to the CME FedWatch Tool. Of course, no one has a crystal ball for the Fed, and changing economic conditions could significantly alter that forecast.

“If rates do come down more than the markets expecting,” Castleton says, “it’s an absolute tailwind for growth.” But if rate cuts are fewer and further apart, “then value should be able to do well.”

The exact path of the economy is impossible to predict, and not all strategists agree on where we’re headed. “We don’t think the economic environment in 2024 is going to be good enough to support value outperformance,” LPL Financial chief equity strategist Jeff Buchbinder recently told Morningstar. “Remember, growth stocks tend to do better with lower interest rates and modest inflation environments. And that appears to be what we’re going to get.”

A period of slower growth could be good for defensive value stocks like utilities and consumer stables, Clissold says, while more cyclical stocks within the category, like financials and energy, would suffer. He adds that a major rally within the value universe would depend on the participation of financial stocks, which comprise the largest portion of the category. “If it looks like interest rate policy is going to be returning to somewhat normal levels” compared with the last decade, he says, “that’d be good for [financials].” He is optimistic overall: “I think there’s a decent shot for value to have a good comeback.”

In light of this potential shift, Norton recommends that investors consider adding some variety to their portfolios, especially after a year of dominance by the Magnificent Seven. “Evening things out a bit is a reasonable approach,” she says.