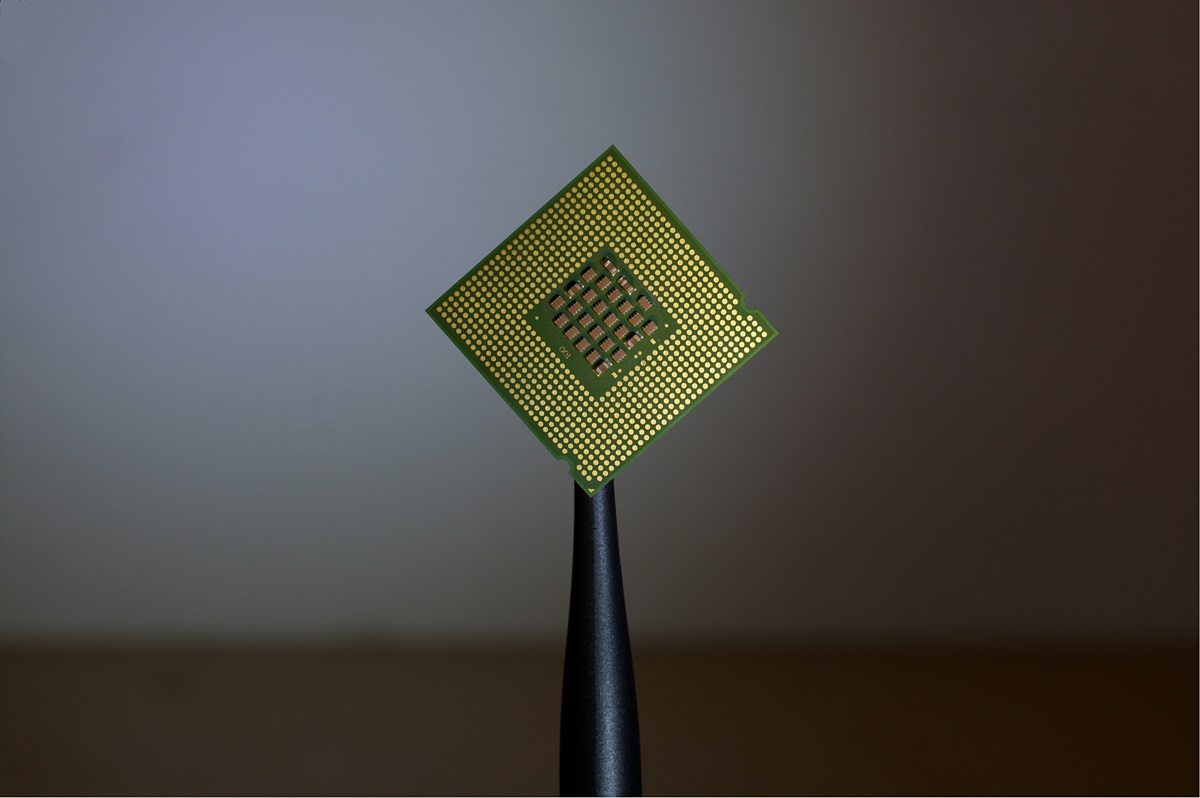

Against the backdrop of geopolitical uncertainties, the semiconductor industry appears poised for a rebound in 2024. Shaking off a lackluster performance in 2023, semiconductor manufacturers, are poised to see a jump in revenues, EBITDA margins, and cash flow generation.

“Barring a deep recession, we expect fab manufacturers, especially those involved in manufacturing advanced node chips and memory chips, to have an improved operating environment and better financial metrics leading to enhanced risk profiles,” forecasts Global Semiconductor 2024 Outlook, aMorningstar DBRS report.

The following leading chipmakers are tapped into secular industry trends as demand for AI, data centres, and high-performance computing applications conspire to create a long growth runway for these players.

Global chip heavyweight, Taiwan Semiconductor TSM boasts nearly 60% market share. Its high-profile customers include Apple, AMD and Nvidia, which use the latest technology in their semiconductor designs.

“The company has long benefited from semiconductor firms around the globe transitioning from integrated device manufacturers to fabless designers,” says a Morningstar equity report.

The rise of fabless semiconductor firms - companies that design chips but don't manufacture them - has been driving the expansion of chip foundries, which has intensified competition.

“However, most of these newer competitors are confined to low-end manufacturing due to prohibitive costs and engineering know-how associated with the leading-edge technology,” points out Morningstar equity analyst Phelix Lee, who puts the stock’s fair value at US$151 per ADR, projects top-line CAGR of 13.5% over the next five years.

Lee identifies two long-term growth factors for TSMC. First, the consolidation of semiconductor firms is expected to create demand for integrated systems made with the most advanced nodes. Second, the organic growth of artificial intelligence, the Internet of Things, and high-performance computing applications may last for decades.

“Even with its dominant market share, the company can deliver above-industry growth through a higher proportion of specialty products, which are currently only produced by Samsung and TSMC at scale,” says Lee, who stresses high-performance computing remains TSMC's largest growth driver.

Further, increasing in-house design of cloud computing and artificial chips by U.S. and Chinese internet giants will benefit TSMC for the next few years, he adds.

Chipmaker Broadcom AVGO boasts over US$30 billion in annual revenue selling 17 core semiconductor product lines across wireless, networking, broadband, storage, and industrial markets. While it is primarily a fabless designer, the sixth-largest semiconductor company globally does some in-house manufacturing for its best-of-breed FBAR filters that are used in the Apple iPhone.

Broadcom’s high-value chip and software businesses are differentiated and moaty. The firm’s “ability to acquire and streamline generates strong profits and cash flow, and fuels its robust dividend,” says a Morningstar equity report, stressing that its execution and operating efficiency drive the firm’s outperformance.

Networking and wireless chip businesses are Broadcom’s strongest suit and are key contributors to the firm’s sustainable competitive advantage.

The report particularly highlights the chipmaker’s technological lead in thin-film bulk acoustic resonator (FBAR) filters, which it sells exclusively into Apple’s iPhone. FBAR filters are critical components for new 5G-enabled smartphones, as they help boost reception at higher frequencies and extend battery life.

“We don’t foresee a new entrant encroaching on Broadcom’s FBAR prowess and believe it would be difficult even for a rival smartphone chip supplier or for Apple itself,” says Morningstar equity analyst William Kerwin, who puts the stock’s fair value at US$970, and forecasts 15% revenue growth through 2028.

The firm’s steady future growth, he adds, will be driven by data centre networking, Apple unit sales, AI and upselling for its software customers.

Advanced Micro Devices AMD designs semiconductors for PCs, gaming consoles, data centres, industrial, and automotive applications, and others. It also supplies the chips found in popular gaming consoles such as the Sony PlayStation and Microsoft Xbox.

The gip giant’s digital semiconductor expertise positions it well to prosper from favourable secular trends in data centres, AI, and gaming. “We consider AMD to be one of two notable firms in graphics processing units (GPUs), which are especially well suited for AI,” says a Morningstar equity report

While AMD may be lagging Nvidia in AI GPUs, its GPU expertise should become increasingly valuable, and lucrative, in the years ahead, the report adds.

AMD's partnership with Taiwan Semiconductor gives it a technological edge over Intel, allowing AMD to capitalize on its outsourced manufacturing model. As rival Intel flounders due to its internal manufacturing approach, “AMD will continue to gain market share over the next three years,” says Morningstar equity analyst Brian Colello, adding that AMD could continue to gain for longer if Intel were to stumble further.

Also, given the growing demand for AMD’s server CPUs and GPUs, suited for AI workloads, the company's “data center business should boom over the next few years,” says Colello, who appraises the stock to be worth US$145.

While Nvidia may capture the bulk of the total addressable market for AI accelerators, estimated to be US$150 billion by 2027, AMD may benefit when AI vendors and customers seek alternatives to keep Nvidia's dominance in check, Colello notes.

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/UA4PJHTFYFFX3FUDUZ6ZHGQ6IY.png)

.jpg)