:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/MNPB4CP64NCNLA3MTELE3ISLRY.jpg)

While cryptocurrency has a reputation for drawing investors from outside the mainstream, the biggest winners of the newly launched spot bitcoin funds are two of the best-known names in the industry.

Since spot bitcoin exchange-traded funds began trading on Jan. 11, investors have poured US$12.1 billion into them, of which over 80% has gone to either BlackRock’s iShares brand or Fidelity Investments.

“They’re both massive asset managers with incredible reach and the strongest distribution networks …everyone is a client of iShares, and other firms don’t have platforms like Fidelity,” says Bryan Armour, director of passive strategies research for North America at Morningstar.

Meanwhile, the Grayscale Bitcoin Trust, now ETF—the favored crypto-tracking ETF for investors before the advent of spot bitcoin funds—has seen US$17.2 billion go out the door. Grayscale, which heavily lobbied the Securities and Exchange Commission for permission to launch spot bitcoin ETFs, has seen the assets in its fund plummet to US$17.6 billion from US$27.2 billion in February.

“It’s been a very successful launch for spot bitcoin ETFs overall, albeit with some wild price swings,” says Armour. “The nine new bitcoin funds gathered significant inflows, while Grayscale’s newly converted ETF saw major outflows.”

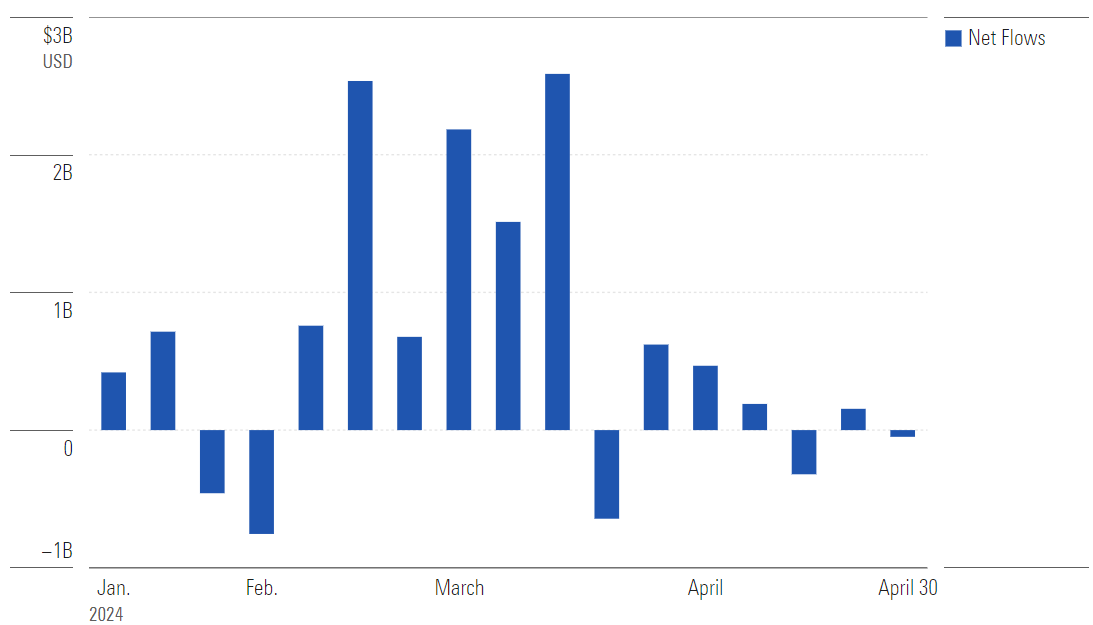

Net Inflows for Spot Bitcoin ETFs

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/2QZX5ZFBZRFXTM5YZKXXIEB5IQ.png)

Source: Morningstar Direct. Data as of April 30, 2024.

The Long Road to Spot Bitcoin ETFs

The SEC’s approval of the first spot bitcoin ETFs in January was a long-awaited development for crypto enthusiasts and fund companies looking to join the fray. Before then, the SEC prohibited ETFs from directly owning bitcoin. Investors who didn’t want to buy and hold the cryptocurrency directly could either invest in the Grayscale Bitcoin Trust or gain exposure through ETFs that tracked the price of bitcoin via futures, such as the US$2 billion ProShares Bitcoin Strategy ETF BITO. These two types of investments had downsides. Grayscale Bitcoin Trust had a 2% expense ratio fee, and both methods often struggled to track bitcoin’s price because of their structures.

The Grayscale Bitcoin Trust was the only way US investors could invest in bitcoin directly rather than through futures, besides holding the cryptocurrency itself. This was because the SEC didn’t allow spot bitcoin ETFs—funds that hold the asset directly, as opposed to tracking it via futures markets. It rejected multiple proposals to open spot bitcoin ETFs after the first application in 2013.

Grayscale sued the agency in 2022 over its refusal to let Grayscale convert its trust into an ETF. The next year, Ark Investments and BlackRock BLK attracted more attention by asking for approval to launch spot bitcoin ETFs. Grayscale won its case in August of 2023, and on Jan. 10, 2024, the SEC approved 11 ETF proposals. The next day, 10 of them, including Grayscale’s newly converted ETF, began trading.

Total Weekly Net Flows for All Spot Bitcoin ETFs

Jan. 11, 2024 through April 30, 2024.

Source: Morningstar Direct. Data as of Apr 30, 2024.

Spot Bitcoin ETFs Winners and Losers

Since all the funds hold the same asset, they have roughly the same performance, with returns for all hovering around 28% as of the end of April since their launch in January.

Despite this nearly identical performance, investor responses to the new ETFs have ranged widely. The iShares Bitcoin Trust ETF IBIT has taken in US$15.6 billion from investors since its launch and has US$16.5 billion in assets. Fidelity Wise Origin Bitcoin ETF FBTC has seen US$8.2 billion come in, with assets standing at US$9.2 billion.

Funds from smaller players like ARK and Bitwise also raked it in. The ARK 21Shares Bitcoin ETF ARKB pulled in US$2.2 billion and now has US$2.6 billion in total assets. Investors put $1.8 billion into Bitwise Bitcoin ETF BITB, which sits at US$2 billion in assets.

Expense Ratios for Spot Bitcoin ETFs

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/Q3ZPOTE3PBEERDR6YBMBHQ4R3M.png)

Source: Morningstar Direct. Data as of April 30, 2024.

The most obvious loser of the rollout has been Grayscale. Investors have pulled US$17.2 billion from its ETF. While Grayscale lowered its ETF’s fees from 2.0% to 1.5%, that is still six to seven times higher than the other spot ETFs, whose expense ratios range from 0.19% to 0.25%.

Most of the funds temporarily cut or even eliminated fees during the early launch period. iShares’ fund cut its expense ratio to a discounted rate of 0.12%, while others, including Fidelity’s fund, cut theirs to zero for differing introductory periods. Each fund has a different introductory offer, and the discount for each expires at a different date.

“Grayscale didn’t want to kill the goose that laid the golden egg. They’d earned more than $1 billion in fees from GBTC over the years,” Armour explains. He adds, “Maybe they thought they could be a SPY- [SPDR S&P 500 ETF Trust] or QQQ [Invesco QQQ Trust]-like liquidity vehicle, being the fund ‘where the traders go.’ They likely also thought the costs of switching due to capital gains would be high enough to keep people in the fund.”

The author or authors do not own shares in any securities mentioned in this article.