The stock market has taken a sudden sharp turn lower in August after the broad rally seemed to run low on gas in July. The market’s drop appears to be a combination of weaker-than-expected economic fundamentals – specifically the July jobs report – and negative technical factors.

Considering the market valuation was trading above a composite of our fair value estimate, we are not necessarily surprised to see this selloff. However, while selloffs like this are unusual, they’re not uncommon and not a reason to panic.

As long-term investors, we view market dislocations as an opportune time to rebalance out of overvalued categories and sectors and rotate into undervalued areas. For example, in our third-quarter market outlook, we recommended: “Long-term investors will be better off paring down positions in growth and core stocks, which are becoming overextended, and reinvesting those proceeds into value stocks, which trade at an attractive margin of safety.”

Looking forward, we continue to see the best portfolio positioning to overweight areas that trade at deep discounts to their intrinsic valuations. These areas include value stocks and small-cap stocks, as well as undervalued sectors such as real estate, energy, and traditional communications.

2024 vs. 2022 Outlooks: What’s Different Today?

In our August 2024 market outlook, we noted that our price/fair value metric had peaked at 1.07 in mid-July (one of our highest readings since 2010), close to where the market peaked at the end of 2021. In our 2022 market outlook, we recommended that investors underweight equities, as the market would contend with four main headwinds: rising inflation, rising interest rates, slowing economic growth, and the Federal Reserve tightening monetary policy. As these headwinds played out in 2022, the equity market dropped as much as 22% before bottoming out in October.

However, while our price/fair value metric at the end of July was 1.03, representing a 3% premium to a composite of our valuations, today we think investors should remain at a market-weight position in their portfolios. The situation now is much different than the one in 2022. Of those four factors, three are currently tailwinds and only one remains a headwind.

Inflation

Since peaking in mid-2022, inflation has been on a steady downward trend, and our US Economics teams project that it will continue to moderate this year and drop below the Fed’s 2% target in 2025.

Interest Rates

Interest rates rose from 1.50% to over 4.00% in 2022, but we now forecast that long-term interest rates are on a multi-year downward trend. We project the 10-year US Treasury will average 3.75% in 2025, 3.00% in 2026, and bottom out at 2.75% in 2027.

Easing Monetary Policy

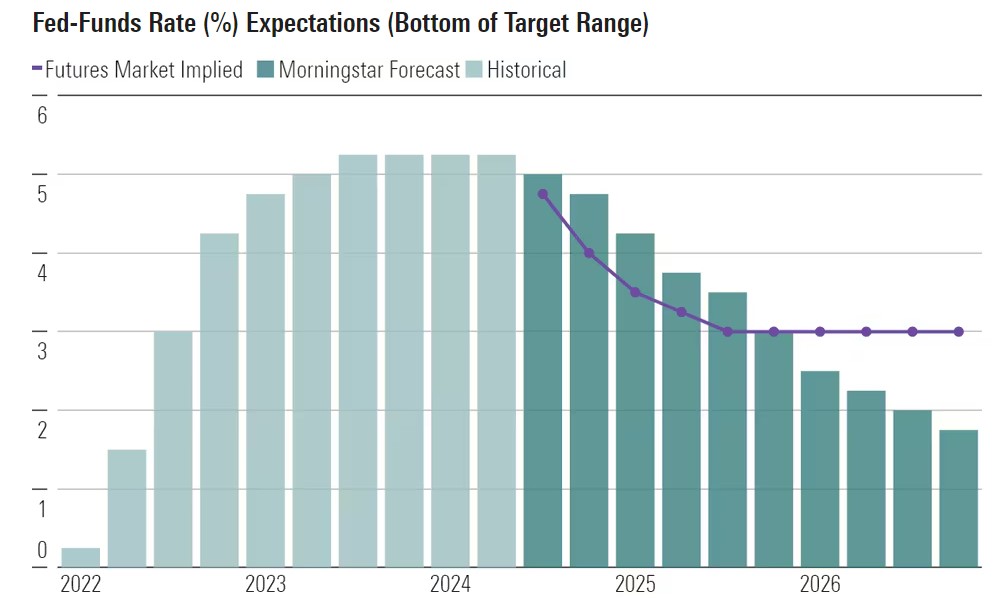

In 2022, the Fed embarked on one of the fastest and steepest monetary tightening policies since the 1980s to defeat inflation. With inflation on a steady downward trend, the central bank can take its foot off the monetary brake and begin to cut interest rates. We expect the Fed to cut at least twice this year, and expect the federal funds rate to drop to a 3.00%-3.25% range by the end of 2025.

Rate of Economic Growth

Of the four headwinds in 2022, only the slowing economic growth rate remains so in the second half of 2024. While the recent jobs report was softer than expected, our US Economics teams continue to expect a soft landing and do not foresee a near-term recession.

We project economic growth to slow through the end of this year and stagnate in the first half of 2025. However, by the second half of next year, we forecast the economy will pick up speed as the impact of easing monetary policy begins to flow through the real economy.

What’s an Investor to Do Today?

Steady as she goes. With the broad equity market trading just a little over fair value, we advocate for investors to position themselves at a market weight within their targeted long-term asset allocations between equity and fixed income. With the rate of economic growth projected to slow for the next few quarters, stock markets could become increasingly volatile this summer and pullbacks could provide an opportunity to move back to overweight equity positions.

Within equity, we still see the best valuation in the value category and small-cap stocks.Undervalued sectors to overweight include real estate, energy, and communications. However, within these sectors, we think individual stock-picking remains vital.

Overvalued areas to underweight include industrials, consumer defensives, technology, and financials. Yet even within overvalued sectors, there are often numerous undervalued opportunities for those investors willing to spend the time to look for them.