Although dividend stocks have seen their performance improve this summer, many have lagged the broader market over the past year or more. However, that poor performance provides opportunities for long-term investors to find undervalued dividend payers. That includes companies raising their payouts.

Dividend investing comes in various forms. Investors can look for stocks offering the highest yield, names with a history of stable dividend payouts and strong finances, or companies raising dividends.

For this article, we screened for stocks with increased quarterly dividends, which can signal a company’s confidence in its future finances. We combined this screen with one for stocks trading below their Morningstar fair value estimates, meaning they have attractive prices for long-term investors.

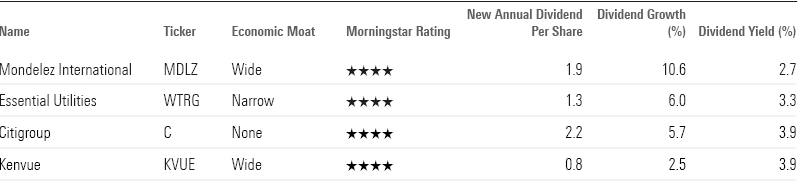

Here are four undervalued companies that increased their dividends in May:

Screening for Undervalued Stocks That Raised Dividends

We started with the full list of US-based companies covered by Morningstar analysts and looked for names that pay investors a quarterly dividend. We then tracked changes between any dividends declared during July. From there we filtered for companies that saw a dividend increase of 5% or more to capture the most substantial changes. Stocks with dividend yields under 2% were then excluded from the group. After that, we picked companies considered undervalued by Morningstar analysts, meaning they are rated 4 or 5 stars.

In all, four undervalued companies with dividend increases made it through the screen.

Here’s a closer look at what Morningstar analysts say about these stocks.

Mondelez International

- Morningstar Rating: 4 stars

- Fair Value Estimate: $75.00

- Economic Moat: Wide

- Morningstar Uncertainty Rating: Low

“Since taking the helm at Mondelez more than six years ago, CEO Dirk Van de Put has orchestrated a plan to drive balanced sales and profit growth by extending the distribution of its fare, fueling investments behind its local and global brands, empowering its local leaders, and increasing the agility with which it brings innovation to market (aims that are hitting the mark). Against this backdrop, Mondelez targets 3%-5% sales growth long term as it works to sell its wares in more channels and reinvests in new products aligned with consumer trends at home and abroad. Further, it has prudently made acquisitions of niche brands to build out its category and geographic exposure, and we anticipate it will continue to pursue inorganic targets when the opportunity arises.

“In assessing Mondelez’s balance sheet strength, we don’t foresee any material impediments to its financial flexibility. In this vein, Mondelez maintained $1.4 billion of cash on its balance sheet against $20 billion of total debt as of the end of June 2024. But given the vast majority of its debt doesn’t mature within the next five years, we don’t think it runs the risk of needing to refinance at current stepped-up rates. Further, we forecast Mondelez will continue to generate robust free cash flow to the firm, averaging more than 14% of sales annually over our 10-year explicit forecast (about $6.5 billion on average each year). And we think that returning excess cash to shareholders will remain a priority. We forecast Mondelez will increase its shareholder dividend (which currently yields 2%-3%) in the high-single-digit range on average annually through fiscal 2033 (implying a payout ratio of about 50%), while also repurchasing around 2%-3% of shares outstanding annually.”

More of Erin Lash’s take on Mondelez can be found here.

Essential Utilities

- Morningstar Rating: 4 stars

- Fair Value Estimate: $43.00

- Economic Moat: Narrow

- Morningstar Uncertainty Rating: Low

“For more than 50 years, Essential Utilities—formerly Aqua America—was one of the few pure-play water utilities in the United States. But its $4.3 billion acquisition of Peoples Natural Gas in March 2020 made the company nearly 50% larger and diversified its earnings mix.

“The gas business contributes about one-third of earnings on a normalized basis. Its asset base is growing faster than that of the water business due to infrastructure upgrades. The gas business has become a critical source of growth as municipal water acquisitions have slowed recently.

“Although water conservation has reduced demand for several decades, Essential has increased earnings and the dividend by replacing and upgrading old infrastructure. Similarly, Peoples Gas should produce steady earnings growth as it replaces and upgrades system infrastructure, even though we expect little usage growth.

“Essential has paid a consecutive quarterly dividend since 1945 and increased it by at least 5% for 30 consecutive years, including a 7% increase to $1.23 per share annualized in mid-2023. We think Essential will be able to continue growing the dividend at a similar rate for the foreseeable future while staying below management’s 65% maximum payout ratio threshold.”

Travis Miller has more on the outlook for Essential here.

Citigroup

- Morningstar Rating: 4 stars

- Fair Value Estimate: $68.00

- Economic Moat: None

- Morningstar Uncertainty Rating: Medium

“Citigroup is amid a major turnaround and remains a complex story. The bank is working through consent orders from regulators, selling off its international consumer operations, and refocusing its wealth unit. Simplification should make the bank easier to understand and structurally more focused, but we think Citi will still trail its peers from a profitability standpoint and struggle to outearn its cost of capital, and the turnaround remains a difficult, multiyear journey.

“Citigroup generally targets roughly 25% of earnings to be devoted to dividends, with flexible share buybacks depending on the investment needs of the business. As the bank has been in the middle of building up capital in response to higher regulatory requirements, dividend increases, and buybacks have been rare since 2020. However, with capital now built up, and as the bank sells off businesses and frees up capital, we see more room for repurchases in 2024. We would expect the bank to prioritize repurchases over dividend raises for now, given where the stock is trading. With the bank now set to spin off the Mexico retail unit (rather than sell it outright), this will no longer be the same share repurchase catalyst.”

Click here for more of Suryansh Sharma’s take on Citigroup.

Kenvue

- Morningstar Rating: 4 stars

- Fair Value Estimate: $26.00

- Economic Moat: Wide

- Morningstar Uncertainty Rating: Medium

“Kenvue is the world’s largest pure-play consumer health company by revenue, generating $15 billion in annual sales. Formerly known as Johnson & Johnson’s consumer segment, Kenvue spun off and went public in May 2023. We expect Kenvue, with the freedom to allocate capital and invest as a standalone entity, to prioritize growing its 15 priority brands (including Tylenol, Nicorette, Listerine, and Zyrtec) to drive future growth. We forecast the company to spend roughly 3% of sales on research and development, on par with some of its wide-moat competitors, to launch innovative products, specifically in digital consumer health. Recent examples include the Nicorette QuickMist SmartTrack spray and Zyrtec AllergyCast app.”

More on the outlook for Kenvue from Keonhee Kim is available here.