As previously announced, today we made an enhancement to the Morningstar Medalist Rating, our comprehensive forward-looking rating system for managed investments. The enhancement refines how we estimate the potential value that managed investments can deliver to investors after fees, with those estimates determining the Medalist Ratings we assign.

Today’s enhancement changes the Medalist Ratings we’ve assigned to around 15% of managed investments globally, with most of those changes being downgrades. In addition, we expect another 3% of vehicles to eventually see a rating change as a result of the enhancement in the next year or so.

In this article, we’ll walk through what’s changed at a high level and provide a more detailed impact analysis by asset class, investment approach, and Morningstar Category.

What’s Changed

The enhancement affects the Medalist Ratings we’ve assigned to around 26,000 managed investments globally, or about 15% of the rated universe. Ratings downgrades outnumber upgrades by a roughly 4-to-1 ratio.

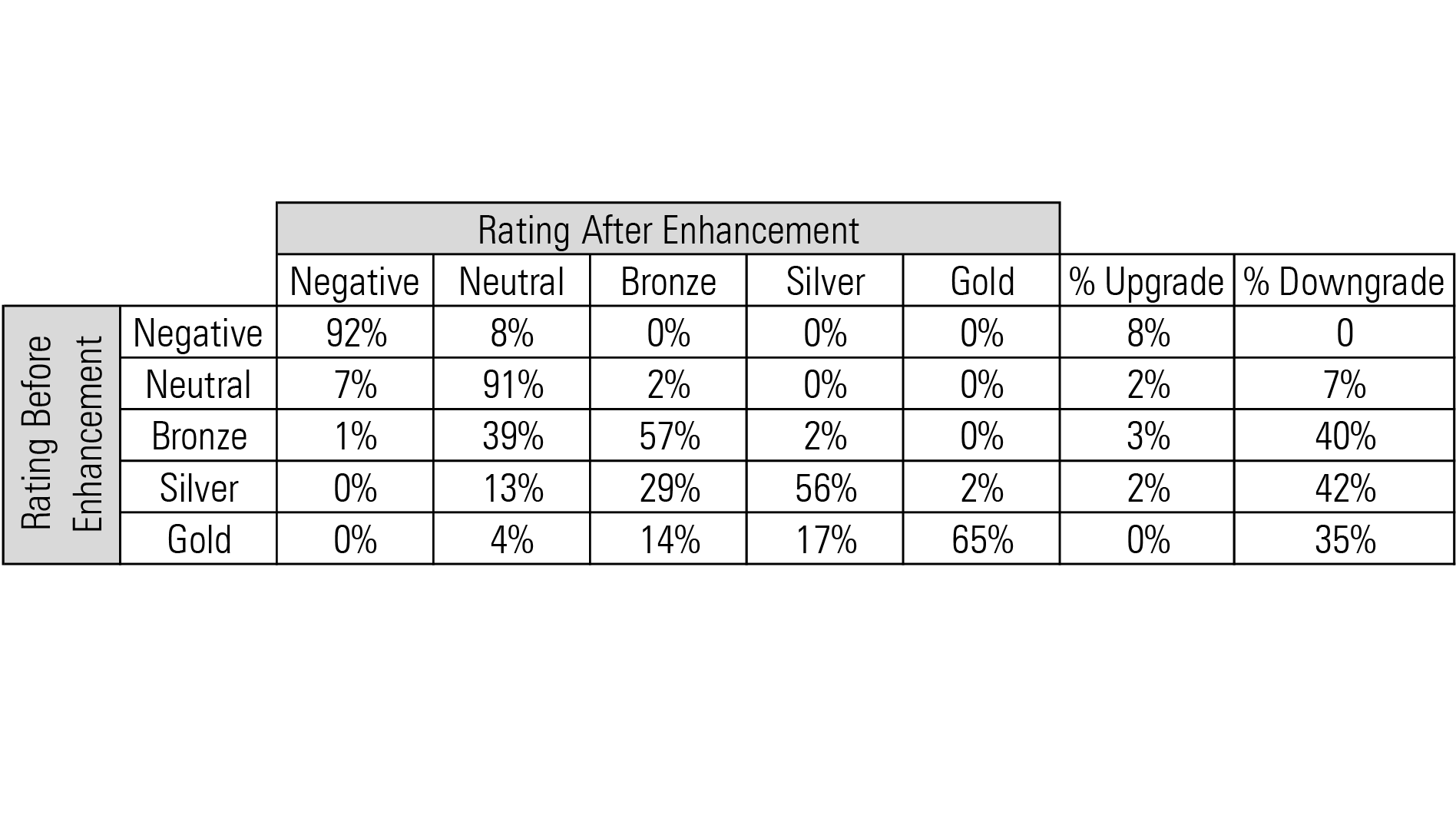

Most of the managed investments seeing rating changes are vehicles not covered by Morningstar analysts.(1) Among these, Gold-, Silver-, and Bronze-rated vehicles are seeing more changes than vehicles rated Neutral and Negative, with one-rung downgrades being the most common, as shown in the impact matrix below.

For instance, among vehicles assigned a Bronze rating before the enhancement, roughly 57% are retaining that rating, while about 40% are seeing a downgrade to Neutral or Negative and 3% an upgrade to Silver or Gold, and so forth for the other rating cohorts.

Why are higher-rated vehicles seeing a heavier impact? We reserve Bronze, Silver, and Gold ratings for vehicles that we expect to add value after fees. The enhancement generally lowers our estimates of how much potential value that managed investments of various types can add. In some cases, this will mean a managed investment we formerly expected to add value after fees will no longer be expected to do so, warranting a downgrade.

Over the next year or so, we also expect the enhancement to change the ratings assigned to vehicles that our analysts cover.(2) Taken together, these changes will shift the Medalist Ratings distribution further toward Neutral and Negative.

Impact by Asset Class

The enhancement is having a bigger impact on Medalist Ratings assigned to managed investments in the equity and allocation asset classes than those in fixed income.

For instance, around 21% of rated equity vehicles globally are seeing a rating change, with the lion’s share of changes being downgrades. By contrast, only 12% of rated fixed-income vehicles are seeing a change, and about one third of those changes are upgrades.

Why are equity and allocation vehicles being hit harder by the enhancement? We formerly estimated the potential value that a managed investment of a given type could generate based on the historical dispersion of excess returns versus the benchmark before fees.(3) The enhancement shifts away from dispersion in favor of a measure that considers the historical likelihood and magnitude of a strategy generating positive before-fee excess returns.

Equity and allocation strategies have tended to generate a wider range of outcomes before fees. When we used dispersion as a proxy for potential value, it therefore tended to reward these types of strategies. But when we replaced dispersion with the new measure of potential value as part of this enhancement, it meaningfully lowered our estimates of how much value these types of strategies could potentially deliver before fees.(4)

Impact by Investment Approach

The analysis of the ratings impact by investment approach—that is, active versus index—is somewhat complicated by the fact that we made a separate enhancement to the way we assign Process Pillar ratings to equity index vehicles not covered by analysts.(5)

Given this, we’ll focus on expected changes to the ratings of vehicles covered by analysts.

In summary, we expect around one fourth of actively managed vehicles covered by analysts to see a rating change, nearly all of them downgrades. By contrast, we expect about 8% of covered index funds (excluding strategic-beta strategies) to be affected, with rating changes split about 50/50 between upgrades and downgrades.

We expect covered active vehicles to see a heavier ratings impact for much the same reason we are seeing a higher impact among equity and allocation vehicles: There is a higher dispersion of before-fee excess returns among active vehicles, and as we move away from a dispersion-based measure of potential value to one that considers the likelihood and magnitude of adding value before fees, it affects active vehicles to a greater degree.

Impact by Morningstar Category

To analyze the impact of the enhancement on the Medalist Ratings of vehicles by Morningstar Category, we tallied up the number of ratings by major region and peer group. The following tables show the expected number of upgrades and downgrades by region and Morningstar Category as a percentage of all rated funds in that region and peer group.

Footnotes

- Most of the managed investments affected thus far are vehicles not covered by Morningstar manager research analysts. We update the Medalist Ratings of uncovered funds every month and thus picked up this enhancement as part of the most recent monthly update of those ratings.

- For vehicles covered by Morningstar analysts, the analysts update their Medalist Ratings every year or so. This enhancement will not take effect with covered vehicles until analysts update their assessments. As such, we expect the enhancement to take effect over the next year or so as analysts gradually update their coverage.

- Specifically, we regressed each vehicle’s rolling 36-month before-fee returns versus a style-appropriate index, repeated that for all other vehicles of that type, sorted the resulting alphas from smallest to largest to form a distribution, and then divided the difference between the before-fee alphas at the 25th and 75th percentiles by two.

- This is because, in a number of cases, the distribution of before-fee outcomes skews negative. Thus, while there might be a wide dispersion of outcomes before fees, those outcomes might have been negative more often than not.

- The enhancement that modifies how we assign Process Pillar ratings to equity index vehicles that our analysts don’t cover resulted in numerous downgrades to those vehicles’ Medalist Ratings. This is illustrated in the chart below, which shows the percentage breakdown of rating upgrades and downgrades by investment approach among uncovered active and index vehicles.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar's editorial policies.