Third-quarter earnings season has been shaping up much as we expected. With the US economy running at a faster rate than anyone expected at the beginning of the quarter, most companies have had no problem either meeting or beating consensus. The problem has been with guidance for the fourth quarter. Although the economy has been running hotter than expected, it is still generally expected to slow in the fourth quarter. As such, many management teams have been providing conservative revenue guidance in anticipation of this slowdown.

Yet, cost-cutting efforts put into place earlier this year in anticipation of this slowdown have been yielding positive results, allowing management teams to call for stronger operating margins. For those companies that have reported strong third-quarter earnings but weaker-than-expected guidance, stock price movement has been largely muted. However, considering earnings should have been relatively easy to meet or beat, any company that has missed its earnings has seen its stock plummet. At the index level, the market has dropped approximately 2% between the time earnings season began in earnest through the end of October 2024.

Key Takeaways

- Macrodynamic tailwinds propel stocks higher and may keep valuations elevated until earnings catch up.

- Small-cap stocks and the value category remain the most attractive.

- The energy sector is set up for positive risk/reward outcomes.

US Stock Market Valuation

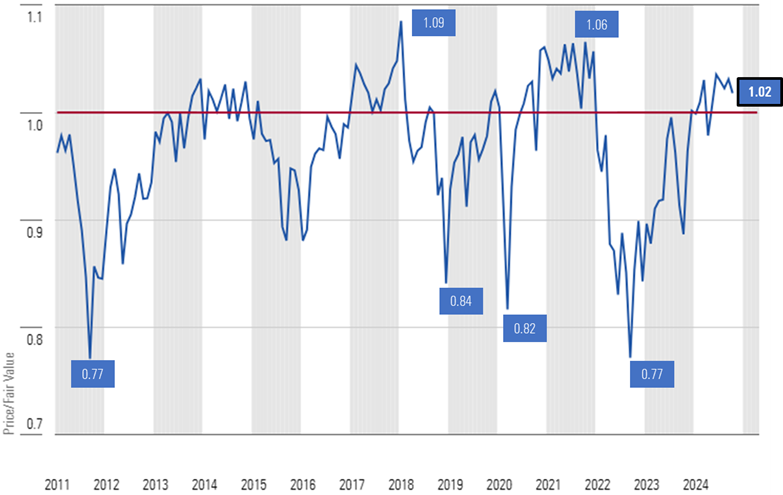

As of Oct. 31, the price/fair value metric of the US stock market was 1.02, representing a 2% premium to our fair value estimates. Since the end of 2010, the market has traded at this much of a premium, or more, only 20% of the time.

As the market valuation remains above fair value, we don’t foresee much near-term appreciation potential at the index level. However, market dynamics are such that the market may be able to stay overvalued until earnings catch up to valuations. As such, we advocate to remain market-weight US equities at your target allocation based on your risk tolerance and investment objectives. In this environment, we think positioning has become increasingly important, overweighting those areas that remain undervalued or fairly valued, and underweighting those areas that are overvalued.

Market Dynamics

Although the market is trading at a premium to our fair value, we expect that there are strong enough tailwinds to overpower headwinds and keep stocks at elevated levels until earnings catch up to valuations.

These tailwinds include:

- Moderating inflation: Morningstar’s US economics team projects that inflation will continue to moderate over the intermediate term and forecasts that inflation will fall below the Federal Reserve’s 2% target in 2025.

- Declining long-term interest rates: The yield on the 10-year US Treasury bond has bounced higher since the Fed began easing monetary policy with a 50-basis-point cut. Morningstar‘s US economics team expects this backup in rates will be short-lived and projects that long-term interest rates will decline over the next few years. The team’s current forecast is for the yield on the US 10-year US Treasury Bond to average 3.60% in 2025, 3.20% in 2026, and bottom out at 3.00% in 2027.

- The Federal Reserve will continue easing monetary policy: Our economics team expects the Fed will continue to cut interest rates. Our current projection for the federal-funds rate is a range of 3.00% to 3.25% by the end of 2025.

- The European Central Bank is also in the process of easing monetary policy and cutting interest rates.

- Recently, China has announced a wide range of government fiscal and monetary stimulus measures that are expected to help bolster its economic growth.

Aside from elevated valuations, the only major headwind to the US stock market right now is our forecast for the rate of economic growth to slow, which in turn will weigh on earnings growth rates. Morningstar’s US economics team projects that the economy will enter a soft landing as the rate of economic growth slows but does not enter a recession. Our current forecast is for real GDP to expand by 1.5% in the fourth quarter of 2024, 1.5% in the first quarter of 2025, 1.4% in the second quarter of 2025, and then gradually reaccelerate in the second half of 2025.

Positioning Increasingly Important

In light of expensive valuations, in conjunction with our expectation for the economy to slow, we think positioning has become increasingly important.

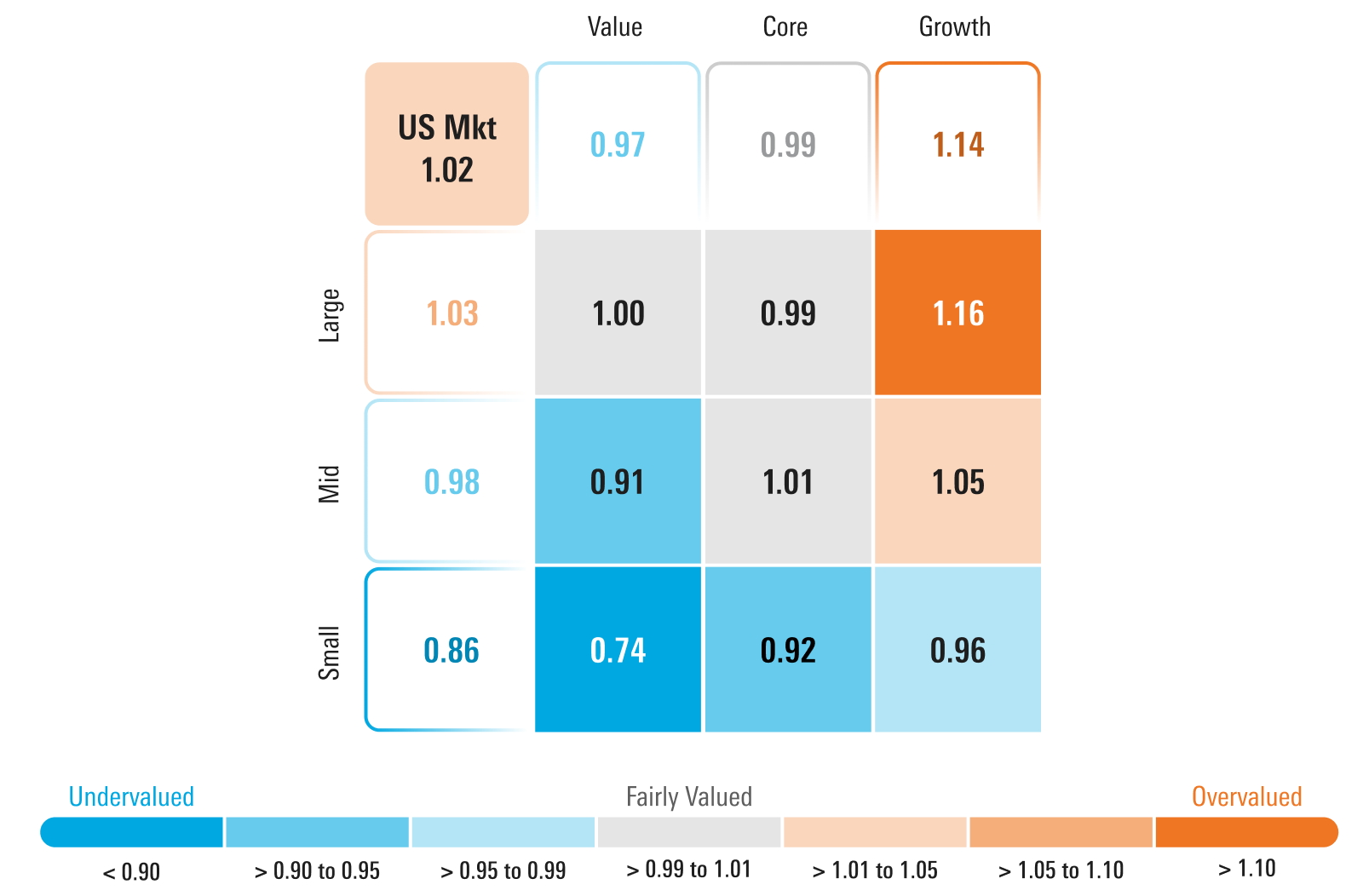

As of Oct. 31, by capitalization, small-cap stocks remain attractive, trading at a 14% discount to fair value. Mid-cap stocks trade near fair value at only a 2% discount, and large-cap stocks are at a 3% premium. Of note, large-cap stocks have traded at this much of a premium or more only 12% of the time since 2010. The last time was in late 2021, right before the market began its slump in 2022. According to these valuations, we advocate an overweight in small-cap stocks, market weight in mid-cap stocks, and underweight in large-cap stocks.

By style, growth stocks are trading at a 14% premium to a composite of our coverage, and core stocks are trading at only a 1% discount. Value stocks remain more attractively priced at a 3% discount to our valuations. Of note, since 2010, growth stocks have rarely traded at such a large premium over our fair values. The last time was in August 2020 as the disruptive tech bubble was inflating. According to these valuations, we advocate overweighting value stocks, holding a market weight position in core stocks, and underweighting growth stocks.

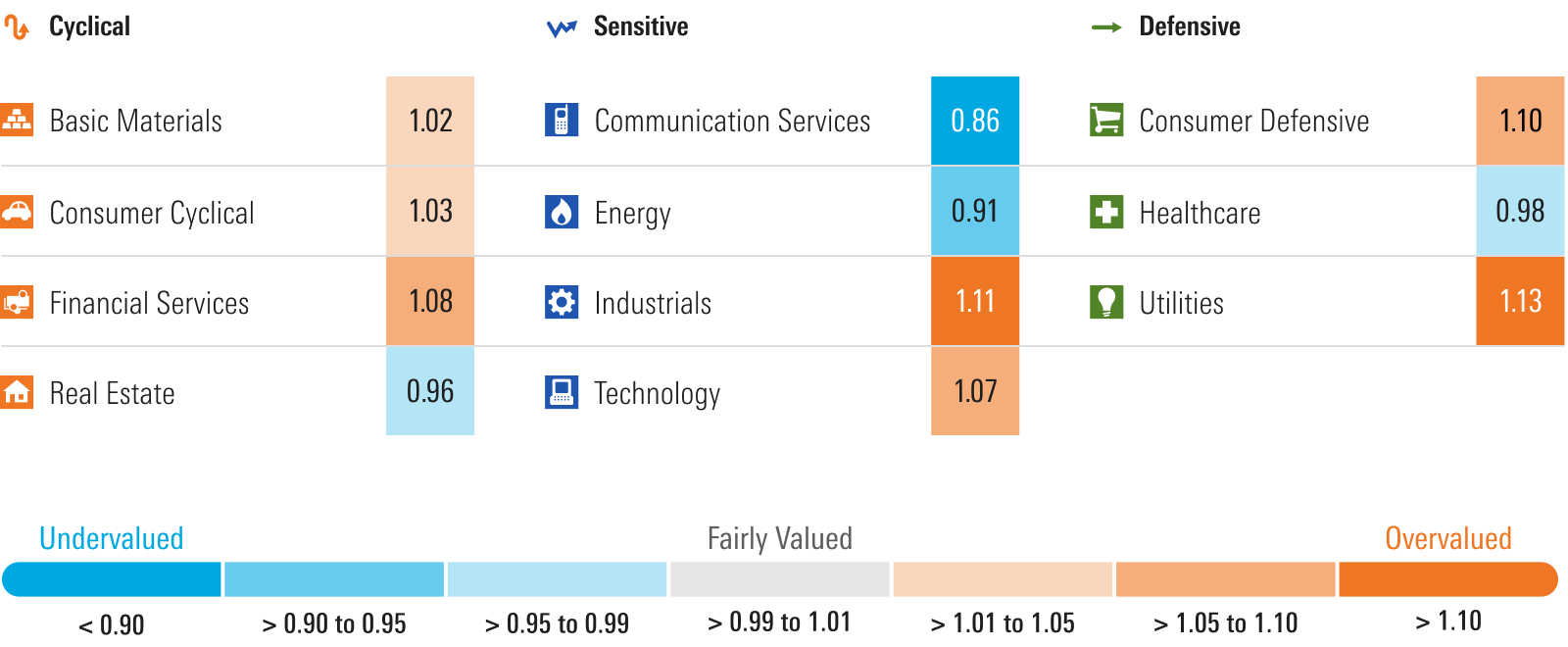

Valuations by Sector - Undervalued Opportunities

As the broad market becomes increasingly overvalued, only two sectors remain undervalued. The communications sector is the most undervalued, trading at a 14% discount to fair value. Of note, within the communications sector, Alphabet GOOGL, which has a Morningstar Rating of 4 stars, accounts for 40% of its market cap. Considering that Alphabet represents such a large percentage of the sector’s market capitalization, its 22% discount skews the sector valuation down. Elsewhere in communications, we continue to see value in traditional communications stocks such as Verizon VZ. Verizon is rated 4 stars, trades at a 21% discount to fair value, and has a dividend yield of 6.4%.

Energy is the second most undervalued sector, trading at a 9% discount to fair value. Energy stocks have been under pressure as oil prices remain on a downward trend. Even so, the current price of oil at $69 per barrel is still above our $55 midcycle forecast that we use in the longer-term forecasts in our model. The risk/reward dynamics here look positively skewed to us. If oil prices stay at current levels or move higher there is significant upside leverage. If oil prices slide to our forecast, you are still buying these stocks at a significant margin of safety. Within the energy sector, examples of undervalued oil producers include 4-star-rated Chevron CVX, which trades at a 15% discount to fair value, and 4-star-rated Devon Energy DVN, which trades at a 19% discount.

Overvalued Sectors to Sell

Five sectors are trading well into overvalued territory, but the reasons for their overvaluations differ by sector.

The utilities sector has been one of the best-performing sectors thus far this year, rising 31% through Oct. 31. However, after starting the year in undervalued territory and then rallying, it is now the most overvalued sector, trading at a 13% premium over fair value. Overvaluation runs rampant across the sector, and only a handful of utilities stocks remain undervalued. Our current pick is 4-star Evergy EVRG, which trades at a 10% discount.

Industrials is the second most overvalued sector. It trades at an 11% premium over fair value. Within the industrials sector, airlines, construction, industrial distribution, and transportation are some of the most overvalued industries. With economic growth to slow and remain sluggish over the next three quarters, we are especially wary that elevated valuations could quickly correct downward.

Consumer defensive is the third most overvalued sector, trading at a 10% premium to our fair value. However, it should be noted that the overvaluation is concentrated, as three stocks that each account for approximately 10% of the sector’s market cap are significantly overvalued. Both Costco COST and Walmart WMT are rated 1 star and trade at 62% and 46% premiums over fair value, respectively. These two stocks trade at 50 times and 33 times our 2024 earnings estimates, respectively. Procter & Gamble PG is rated 2 stars and trades at a 16% premium. As an indication of how skewed the sector valuation is to these three stocks, when excluding them the sector trades at a 6% discount to fair value, indicating there are multiple other stocks that we think are undervalued. Examples include 5-star-rated Kraft Heinz KHC at a 41% discount and 4-star-rated Constellation Brands STZ at a 20% discount.

Technology has risen 28% thus far this year, which is an especially astounding feat after rising 59% last year. Following this two-year rally, the sector is now trading at a 7% premium to fair value. Within technology, there are still a few attractive opportunities, such as 4-star-rated Microsoft MSFT, which trades at a 17% discount to fair value. However, just as we saw in the late 1990s when anything related to the internet skyrocketed, we find a number of stocks that have been bid higher in conjunction with the demand for artificial intelligence stocks. Yet, according to our analysis, many of these will not benefit enough from AI to justify the current valuations. One such example is 1-star IBM, which trades at a 49% premium to fair value.

The financial-services sector, especially banks, is poised to benefit from a steepening yield curve as the Fed eases monetary policy. The market has already priced in this benefit as the sector trades at an 8% premium to fair value. Similar to the utilities sector in which overvaluation is broadly spread across the sector, there are only a handful of undervalued stocks left, and those are not for the faint of heart.

Sectors Near Fair Value

The remaining sectors trade within the range we consider fairly valued, and stock picks are generally story stocks whose valuation is based on idiosyncratic issues.

Within the basic-materials sector, a few of our picks include 5-star-rated FMC FMC, which trades at a 41% discount to fair value, and 4-star rated Dow DOW, which trades at a 29% discount to fair value.

Among the consumer cyclical sector, we continue to find value in 4-star-rated Carnival CCL. Even though this stock has risen 19% this year, it remains at a significant margin of safety below its long-term intrinsic valuation.

Overall, healthcare trades at fair value, yet the broad sector valuation is skewed higher by Eli Lilly LLY. Eli Lilly’s stock is rated 1 star as it trades at a 43% premium to fair value. While Lilly’s fundamentals are soaring in the short term owing to high demand for its weight-loss drugs, we expect that additional weight-loss drugs will be approved by the FDA over the next few years and will pressure volume and pricing. Within healthcare, we look to medical-device makers such as Medtronic MDT, which is rated 4 stars and trades at a 20% discount to fair value.

After being the most hated asset class in 2022 and early 2023, real estate has finally begun to recover. Real estate has risen 10% and currently trades 4% below fair value. We’d steer clear of most urban office space but find value in real estate with defensive characteristics. One example is 4-star-rated Healthpeak Properties DOC, which trades at a 26% discount to fair value. Healthpeak owns a diversified portfolio of properties spread across mainly medical office and life science assets, plus a handful of senior housing, hospital, and skilled nursing/postacute care assets.

What’s an Investor to Do?

With the broad market trading at a premium to fair value, we think positioning has become increasingly important. Investors should consider overweighting the areas we view as undervalued and underweighting those that are overvalued. In today’s market, we see the most attractive valuations among small-cap stocks and in the value category. By sector, communications and energy trade at the most attractive discounts to our fair values.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar's editorial policies.