Editor's Note: A version of this article previously appeared on June 20, 2023.

Small-cap exchange-traded funds can boost returns and improve diversification under the right circumstances. Still, recent results highlight that small-cap investing is not without risks and that those risks are amplified by the shifting structure of the market. Certain small-cap ETFs offer compelling opportunities under a backdrop of declining interest rates and low valuations, but investors should be selective in which ETF they take off the shelf.

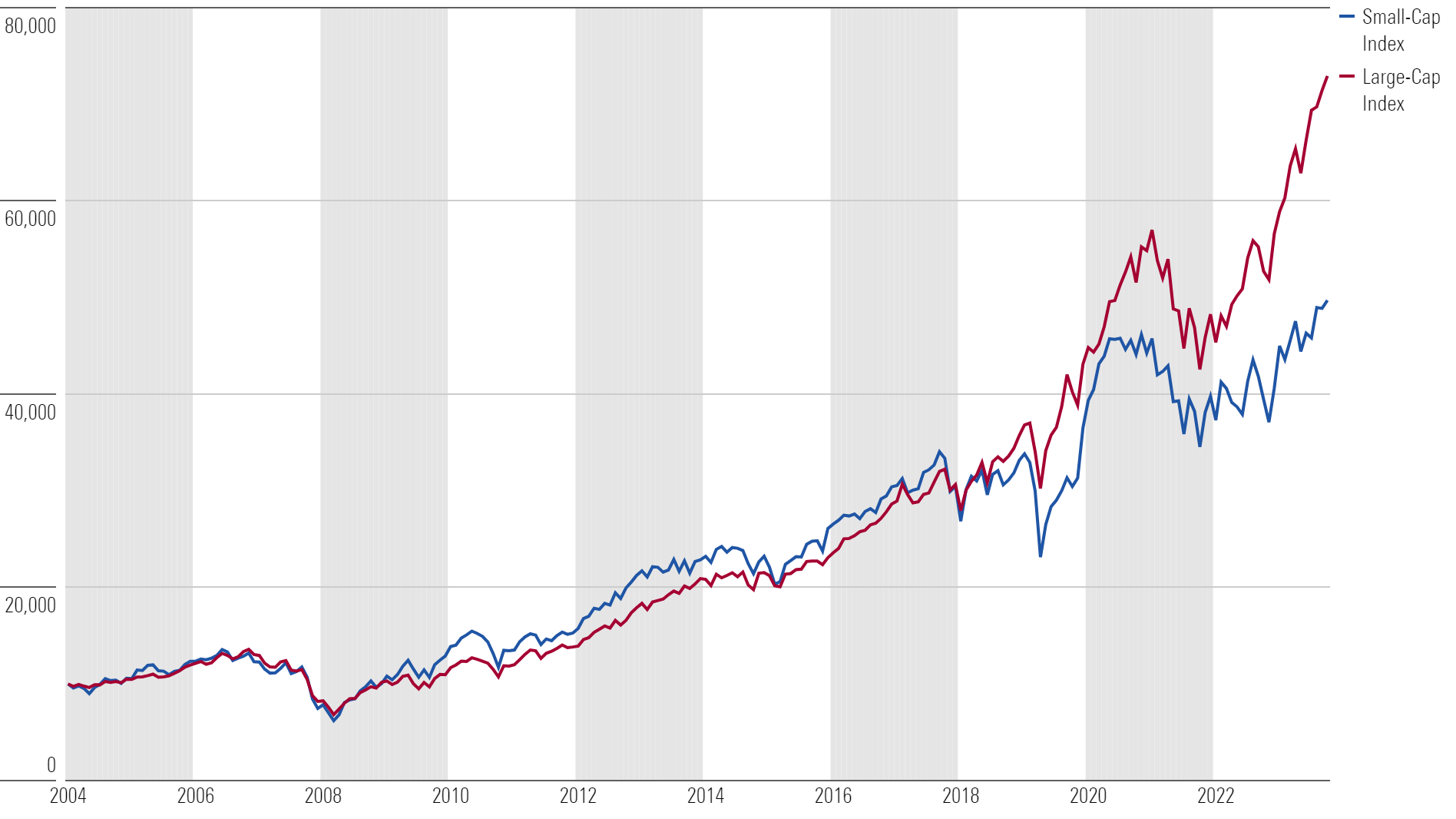

Small-cap stocks have had a tough time keeping up with their large-cap counterparts. The Morningstar US Large Cap Index outpaced the Morningstar US Small Cap Index by almost 2 percentage points annualized over the last 20 years, with the gap widening to nearly 5 percentage points for the last decade. Heightened risk for small-caps and better perceived growth potential of some large-cap stocks likely contribute to this widening deficit.

The Seen Risks of Small Stocks

Small companies are risky in part because they don’t usually possess the same competitive advantages as larger firms. Only 2% of companies in the small-cap index boast a wide Morningstar Economic Moat Rating, compared with 76% of firms in the large-cap index. Financial performance of wide-moat companies is usually more stable and predictable than for narrow- or no-moat companies, helping the large-cap index to one-third less annualized volatility than the small-cap index over the last two decades.

Small caps should have an edge during bull markets, though. The relative size and competitive positioning of small companies allow them to quickly capitalize on new business opportunities. These opportunities may be risky but can lead to big payoffs for firms that execute effectively. Small companies are also more sensitive to interest rates, which can fuel further growth during low-rate environments. Small-cap stocks can perform especially well when markets rise and when interest rates are low, but they may underwhelm when rates are high and markets are shaky.

The Unseen Risks of Small Stocks

There are two less visible risks small-cap ETF investors should be aware of:

- Small-cap stocks are less liquid than large-cap stocks, raising transaction costs, which hurts returns.

- Small-cap indexes may lack the excitement and potential they once had, shifting the investment case.

Choosing an ETF with the smallest average market cap is not a recipe for success. Smaller stocks are more volatile, but they’re also less liquid. The former may amplify drawdowns, and the latter creates a drag on returns.

Index funds periodically rebalance to maintain a close link to their benchmark. At each rebalance, an index fund must buy and sell sometimes billions of dollars’ worth of securities. These trades cost very little for large, liquid stocks like Apple AAPL and Nvidia NVDA, but costs quickly escalate if trading tiny securities with wide bid-ask spreads. These costs detract from returns.

On a rebalance date, an ETF sometimes has no choice but to move a considerable portion of a small stock’s outstanding share count. This is because index ETFs are beholden to their benchmark and have little negotiating power as forced buyers or sellers, sometimes causing them to settle for unfavorable prices. The difference can be pennies, but for hundreds of small stocks with positions totaling billions, it adds up. This makes an index’s approach to rebalancing and turnover particularly important.

Finally, small-cap indexes may be losing their luster. Many promising young companies are choosing to stay private for longer than they used to, seeking growth capital from private instead of public shareholders. If more companies follow suit and don’t seek growth capital in public markets, popular small-cap indexes may lose some of their excitement and potential, shifting the investment case away from: “Tomorrow’s big stocks are today’s small stocks.” Valuations suggest investors see greater potential in larger stocks today.

Assessing the Risks of Small-Cap ETFs

The Morningstar Medalist Rating is conscious of unique risks of small-cap ETFs. Funds tracking indexes that address these risks earn higher ratings than those that don’t.

Index ETFs that screen for minimum liquidity ratios are viewed favorably because they make an index easier to track. Buffer rules at each rebalance are also important because they reduce turnover and associated trading costs. While not the only criteria considered, these are important building blocks of the best small-cap index funds.

Along with other top-rated index ETFs, small-cap ETFs earning Bronze, Silver, and Gold medals are well-diversified, representative of their respective Morningstar Category. They also usually charge a low fee.

Five Undervalued US Small-Cap ETFs

Name | Ticker | Category | Price/Fair Value | Fee | Medalist Rating |

|---|---|---|---|---|---|

iShares S&P Small-Cap 600 Value ETF | IJS | Small Value | 0.90 | 0.18% | Bronze |

Invesco FTSE RAFI US 1500 Small-Mid ETF | PRFZ | Small Blend | 0.92 | 0.39% | Silver |

Schwab US Small Cap ETF | SCHA | Small Blend | 0.93 | 0.04% | Silver |

iShares Core S&P Small-Cap ETF | IJR | Small Blend | 0.95 | 0.06% | Silver |

Vanguard Small-Cap Value ETF | VBR | Small Value | 0.96 | 0.07% | Gold |

Medalist Rating and Price/Fair Value Estimate as of Sept. 30, 2024.

As investor interest moves away from small-caps and towards private equity or large-cap stocks, many small-cap blend and small-cap value ETFs are left undervalued according to Morningstar’s Fair Value Estimate for ETFs. If stock prices converge with their fair value estimates, any of the Medalist ETFs noted above may offer compelling upside.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar's editorial policies.