This article was originally published Nov. 15, 2024.

It’s a misconception that a registered retirement savings plan, or RRSP, is a product that’s marketed by banks, fund companies, and other financial institutions. In fact, it is a legal structure that lets you hold a range of investments issued by any number of institutions.

The most basic type of RRSP investment is a cash deposit in the form of a bank account, term deposit, or guaranteed investment certificate. The next most common type is a proprietary mutual fund, which can be purchased directly from a fund company. But for many investors, a self-directed RRSP is the way to go, since it lets you hold many other types of investments, giving you more opportunities to improve your risk-adjusted returns and achieve your long-term goals.

What’s more, if you are married or living common-law, you should consider the advantages of one spouse contributing to the other’s RRSP to produce equal income streams after retirement, minimizing the taxes on your combined incomes.

Self-Directed RRSPs

This is a trust account with which you can keep your RRSP holdings in one place and have access to a full range of investments. There is a cost in the form of an annual trustee fee, typically $100 or more, although usually considerably less if you have an account with a discount broker. Also, fees are commonly waived for accounts that exceed a specific dollar amount. Robo-advisors may charge a small fee based on the account’s assets under management.

Note that all RRSP-related fees, including management and transaction charges, are not tax-deductible. Depending on the nature of a particular financial institution’s fees, a self-directed plan makes sense for an RRSP worth, say, $40,000 or more.

The following Canadian-based investments are eligible for self-directed RRSPs:

- Cash (savings accounts, term deposits, GICs, Canada or provincial savings bonds, government treasury bills)

- Bonds or debentures (issued by federal, provincial, or municipal governments, or by publicly listed corporations), as well as certain other investment-grade debt instruments

- Government-insured mortgages (subject to restrictions)

- Shares issued by corporations listed on a Canadian stock exchange

- Other securities, such as stock options, listed on a designated exchange (futures contracts are not eligible)

- Mutual funds and segregated funds (that meet eligibility rules)

- Gold and silver bullion

- Certain small-business shares

Foreign Investments in RRSPs

For nearly two decades, there has been no foreign content restriction for RRSPs, which means that theoretically, an entire portfolio can be non-Canadian. (Until 2005, foreign content was restricted, originally to as little as 10% of a portfolio’s value.) These foreign holdings may be in the form of Canadian-domiciled mutual funds that invest outside Canada, such as US equity, international equity, and emerging-markets equity funds. However, the list of RRSP-eligible direct holdings of foreign securities is limited, mostly to shares listed on specified stock exchanges and bonds issued by some foreign governments.

While there have been rumors in political circles that a foreign content limit may be reimposed in the coming years, for now, RRSP investors can invest wherever they like, as long as the investment qualifies.

Contributions to Self-Directed RRSPs

You can contribute in kind to a self-directed RRSP by transferring an investment from a non-registered account. This would be done at the shares’ market value. Note, however, that you would trigger a capital gain because as a trust, a self-directed RRSP account is considered a separate entity. Also, you cannot claim a capital loss when contributing in kind. You could, however, sell the shares you want to transfer on the market, contribute the proceeds in cash, and then repurchase the shares 30 days or more later (thus staying onside with the Canada Revenue Agency’s anti-tax-avoidance rules).

Spousal RRSPs

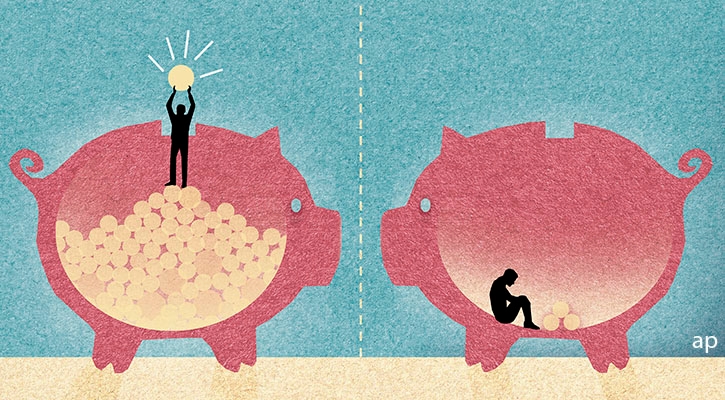

The basic concept of investing through an RRSP is maximizing your returns over time, due to tax-deferred compounding over the long term, and the potential of paying tax at a lower rate on those savings after retirement than you would have paid on that money while you were working.

By allocating part or all of your RRSP contribution to your lower-income spouse’s account, you can create two equal retirement income streams. In theory, this will result in a lower combined income-tax bill when the money is withdrawn through a registered retirement income fund or registered annuity.

A spousal RRSP enables one spouse to contribute to the other’s plan and claim the related deduction on their own tax return. Your contributions to a spousal RRSP do not affect your spouse’s own RRSP contribution room. They can also contribute each year to their maximum limit. As a result, the contributor gains a valuable tax deduction and the recipient can build their RRSP savings.

Spousal RRSPs and other effective income-splitting strategies can also help eliminate or reduce the amount of Old Age Security income clawed back. For the July 2024-June 2025 period, anyone with income over approximately $85,900 during fiscal 2023 must repay at least some of their OAS benefits. The greater your income, the greater the clawback. OAS must be entirely returned to the government if one’s income is about $142,600 or higher (or around $148,200 for those 75 and up).

If you are older than your spouse, you may continue making tax-deductible contributions to a spousal RRSP after the year you turn 71 (the normal deadline for collapsing an RRSP). You can keep making spousal contributions until the end of the year the recipient spouse turns 71.

Money contributed to a spousal RRSP is subject to a three-year attribution rule. This prevents the higher-income spouse from contributing and withdrawing the funds soon after at the spouse’s lower income tax rate. If a contribution is withdrawn from a spousal RRSP during the calendar year the contribution was made (or in the two preceding calendar years), the contributing spouse must pay tax on the amount withdrawn.

In the event of divorce or marriage breakdown, regardless of any spousal RRSP contributions, all pension assets accumulated between the spouses would be combined and split equally, according to provincial family law. Assuming marital harmony, spousal RRSPs and the investment flexibility of self-directed plans can provide a foundation for a comfortable retirement.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar's editorial policies.