Hydrogen will play a key role in the energy transition, as a clean energy source that helps industry to decarbonize. Despite the hype, hydrogen investors have suffered setbacks in recent years, and the sector continued to lag the broader market this year. It’s unclear how the new US administration under President-elect Donald Trump will handle the Inflation Reduction Act of 2022, which includes incentives for clean hydrogen. But hydrogen investments are worth keeping on your radar as an important element in the carbon transition

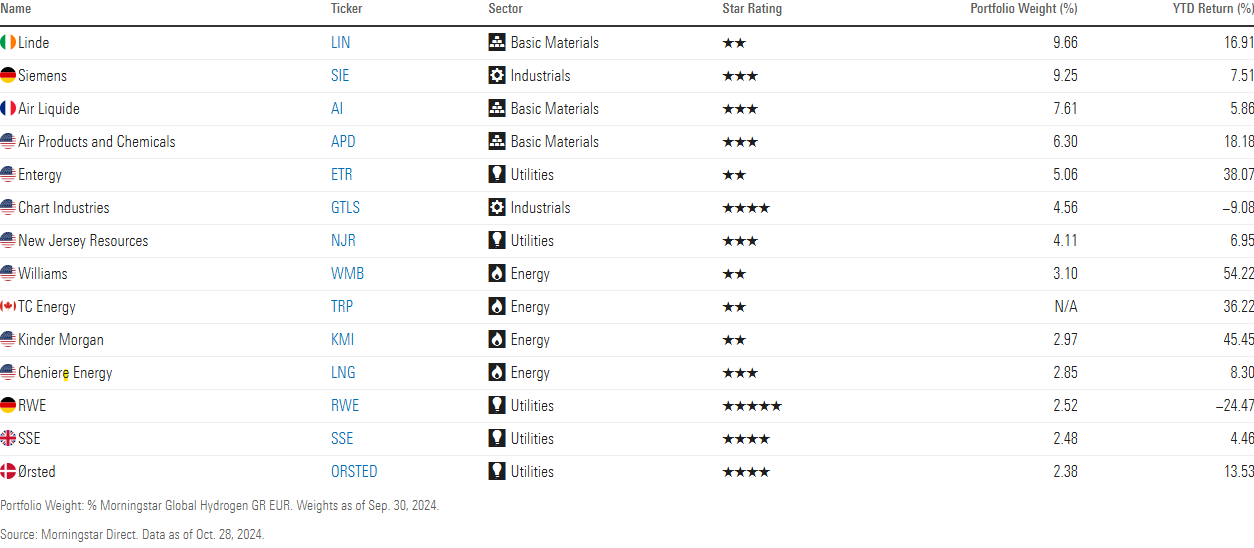

After three negative years, the hydrogen sector finally picked up in 2024. The Morningstar Global Hydrogen Index has gained around 4.86% in US dollars for the year to date, still underperforming the broader market. The index tracks various companies that are positioned to benefit from hydrogen production, storage, and transportation as well as fuel cell technology, including industrial companies, utilities, basic materials, and energy companies.

The largest individual contributor was the US utility Entergy ETR. The stock has gained 45.28% since the beginning of the year, contributing 2.21 percentage points to the hydrogen index’s gain, as the company benefits from higher demand for electricity as well as investments in clean energy and grids. Among other things, it’s investing in Monarch Energy’s planned 300 megawatt green hydrogen project.

At the other end of the spectrum is Plug Power PLUG, a manufacturer of hydrogen fuel cell systems. The stock is down 56.22% for the year to date and detracted 2.31 percentage points from the performance of the hydrogen index, as the company continues to burn cash.

Why Hydrogen is Important

How President-elect Trump will handle the IRA is uncertain, but Morningstar analysts see industrial gas companies as the main beneficiaries of the hydrogen boom. “Amid the energy transition toward a low-carbon economy, hydrogen has emerged as a key pathway to reducing carbon emissions,” wrote Krzysztof Smalec, equity analyst at Morningstar, in “The 2024 Industrial Gas Industry Landscape” in September.

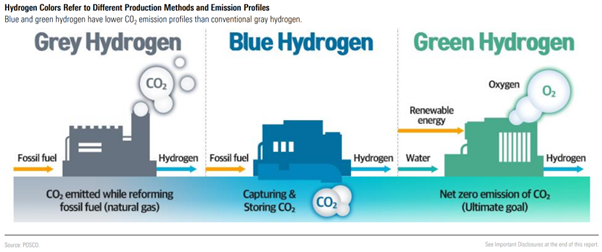

“We expect industrial gas firms to participate across the entire spectrum of hydrogen production (including gray, blue, and green hydrogen) and distribution (including trucks, pipelines, and shipping). We anticipate the transition from gray to blue and green hydrogen to be gradual, and we think that industrial gas firms can leverage their well-established conventional hydrogen businesses to capitalize on new opportunities created by the energy transition.”

Gray hydrogen is generated from natural gas using a process called steam reforming. In blue hydrogen production, the carbon generated by the process is captured and stored underground. Finally, green hydrogen, also called “clean hydrogen,” is created using surplus renewable energy.

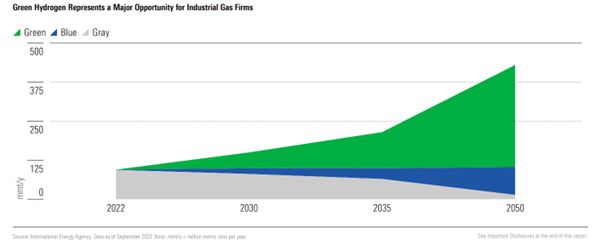

The International Energy Agency’s “net zero by 2050″ scenario assumes that global demand for hydrogen should increase to around 430 million tons per year by 2050, which is 4.5 times higher than in 2022. While the transition to a hydrogen economy is not exactly smooth, Smalec expects growth opportunities in blue and green hydrogen.

Why Hydrogen Demand Has Been Slow

The market is still in its infancy. In its October 2024 Global Hydrogen Review 2024 study, the IEA said that politicians are slow to create measures to boost demand in key sectors such as heavy industry, refineries, and long-distance transport.

The ramp-up has been sluggish. In 2023, global hydrogen demand reached just over 97 million tons, according to the IEA, and is expected to reach almost 100 million tons in 2024. The slight increase is more a consequence of general economic trends than of successful policy implementation.

According to the IEA report, “Hydrogen demand remains concentrated in refining and industry applications, where it has been used for decades. Its adoption in new applications where hydrogen should play a key role in the clean energy transition—heavy industry, long-distance transport, and energy storage—accounts for less than 1% of global demand, despite 40% growth compared with 2022.”

Hydrogen production reached 97 million tons in 2023, of which less than 1% was low emissions. Based on announced projects, low-emissions hydrogen could reach 49 million tons per year by 2030 (up from 38 million tons per year in the Global Hydrogen Review 2023).

In the European Union, hydrogen is expected to play a key role in the energy transition. As part of its REPower EU strategy, the EU has set the target of producing 10 million tons of hydrogen and importing 10 million tons by 2030. By 2050, renewable hydrogen is expected to cover around 10% of the energy needs of EU member states and significantly decarbonize energy-intensive industrial processes and the transport sector, according to officials in Brussels.

What are the best hydrogen stocks?

Where are the investment opportunities emerging for long-term investors? Industrial gas companies, in particular, are poised to benefit from new opportunities in hydrogen. The global industrial gas firms covered by Smalec—Air Liquide AIL, Air Products & Chemicals APD, and Linde LIN—all have wide Morningstar Economic Moat Ratings—the ability in the opinion of our analysts to keep competitors at bay over the long term. The three companies account for about half the global industrial gas market.

“The outlook for blue hydrogen remains solid,” maintains Smalec. “As far as green hydrogen is concerned, some of the early excitement has slowed down due to higher capital costs and regulatory uncertainty. There have been some green hydrogen project delays and cancellations, as companies are taking a more realistic and selective approach, but industrial gas firms tend to pursue higher-quality projects, so we still expect them to capitalize on opportunities in green hydrogen in the long run,” Smalec wrote in an email.

One caveat: The three stocks are currently trading in overvalued territory, as are those of other major players in the market. Here is an overview of the constituents of the Morningstar Global Hydrogen Index.

Our analysts favor Chart Industries GTLS. The US company has focused on expanding its specialized product portfolio to include high-growth areas such as hydrogen and liquefied natural gas, according to Morningstar analyst Brian Bernard. “The firm made several attractive investments and joint ventures with key partners that let it increase the amount of in-house content it uses for larger projects, lowering costs and providing more control over delivery times,” says Bernard. The stock plunged in early August and is currently trading in undervalued 4-star territory.

Investors can also find opportunities in European utilities, though renewable stocks fell in Europe Wednesday morning. But SSE SSE is expected to benefit from higher returns in the next regulatory period for the British transmission networks, which begins in April 2026. The stock is currently trading in the 4-star territory.

Headwinds for Hydrogen Stocks

It is too early to assess the Trump administration’s impact on the sector. However, on the other side of the pond, the EU is set to push along its renewable agenda, though Brussels’ hydrogen ambitions may not be moving fast enough to cap energy costs for the manufacturing sector. “Overall, we do not anticipate a significant surge in green hydrogen projects across Europe, largely due to deindustrialization following the energy crisis,” Morningstar equity analyst Tancrede Tulop explains.

Companies in the fuel cell sector, such as Plug Power, face other long-term headwinds. As Morningstar equity analyst Brett Castelli explains: “We view two of the greatest long-term risks as competition from battery electric technology and competition from industry incumbents. We view battery technology as posing the greatest risk to the truck market, which is anticipated to be among the largest sources of hydrogen demand long term. In addition, competition from well-capitalized competitors—particularly truck OEMs and industrial gas companies—pose a credible threat to Plug.”

Tesla TSLA stock’s reaction to Trump’s victory may be a case in point. The stock surged by more than 30% in premarket trading Wednesday, amid hopes around Elon Musk’s role in the coming administration.

There is currently one exchange-traded fund available for the hydrogen theme in the US; Global X Hydrogen ETF HYDR, however, has been down by 33% this year, reflecting the poor performance of its second-largest constituent, Plug Power.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar's editorial policies.