The electrical grid is being heavily strained by a rebounding economy and artificial intelligence use. That’s creating demand for grid plays, according to Calamos Investments portfolio manager Tony Tursich, who specializes in sustainable equities.

Electrification, as well as the shift away from carbon-generated electricity, is a long-term growth trend, Tursich says. Supply must increase to meet electricity needs, meaning the grid must expand as well. But that’s happening too slowly; the electricity infrastructure is outdated. Tursich figures that electrical transmission grids must increase by about 1.2 million miles each year, even though expansion projects today often take five to 15 years to plan and complete. Estimated costs to upgrade the grid range from $600 billion to $800 billion a year until 2030.

Tursich dubs himself a “diversified core quality investor” who seeks companies with good returns on capital, returns on equity, and high margins, and that are increasing revenue faster than their peers. He also looks for companies exposed to four long-term secular growth megatrends:

- Electrification.

- Decarbonization, including decarbonizing the electricity grid.

- Digitalization and digital storage.

- Automation, to streamline processes and reduce human error.

“All these trends have been supercharged by AI,” Tursich says. Energy demand is increasing so quickly that nuclear energy, once a target of skepticism, is now in demand. For example, Three Mile Island, the nuclear power plant in Pennsylvania that was the site of a partial meltdown in 1979, is reopening to power Microsoft MSFT data centers, according to a statement from Constellation Energy CEG.

“We need clean baseload energy to power” AI projects, Tursich says.

These projects are “putting stress on the power system and stress on the grid, amplifying the growth and need for electrification,” he adds.

Here are three of Tursich’s picks connected to strengthening the grid that will benefit over the years as spending increases.

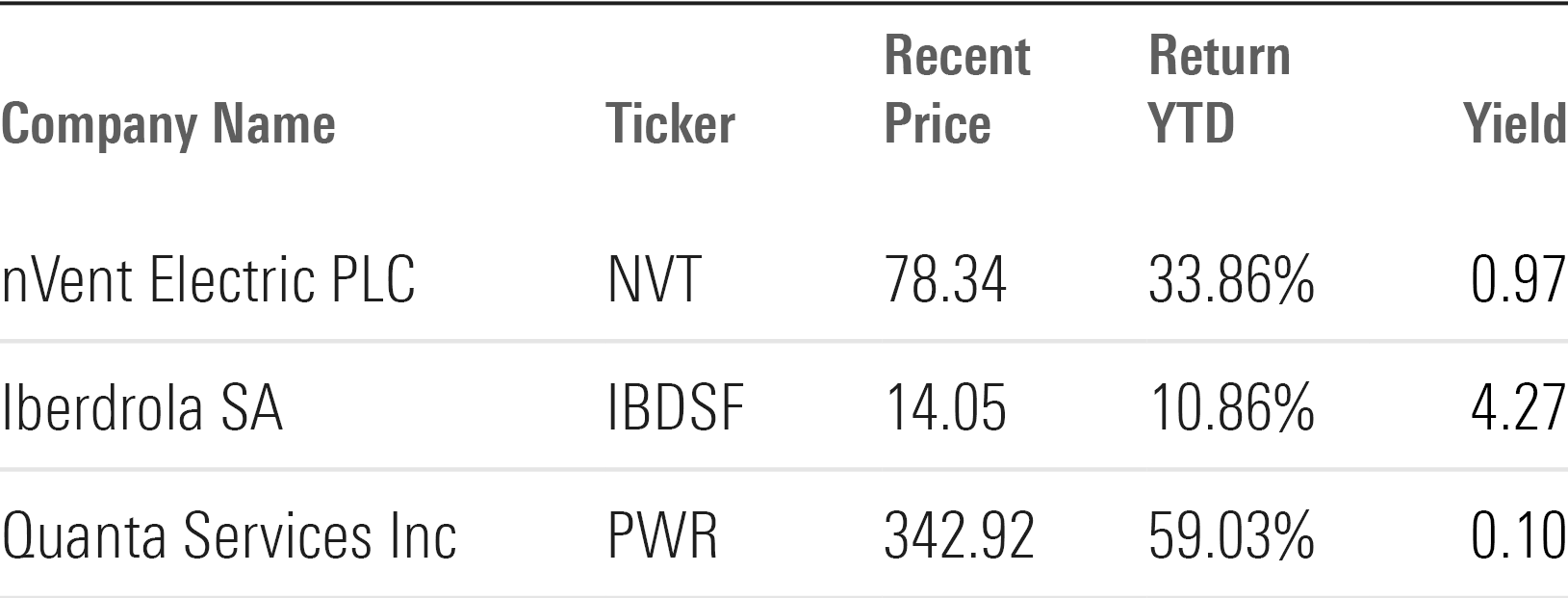

nVent Electric NVT

London-based nVent makes, installs, and services electrical enclosures and electrical fastenings. “It provides the packaging that secures the power infrastructure in place,” Tursich says. North America accounts for the majority of sales. NVent also sells to data center and grid infrastructure operations, for example, new products are designed to run Nvidia-powered AI servers.

NVent plans to sell its thermal management operation in 2025. Divesting “will allow the company to reinvest in strategic and higher growth areas, such as data center power and cooling solutions, now about 20% of total revenue,” Tursich says.

At a recent $78.34 per share, NVent trades 31% above Morningstar’s fair value estimate.

Iberdrola IBDSF

The Spanish electric utility is the world’s largest owner of wind farms, which account for 40% of its portfolio. It has electric utility operations in nearly 40 countries and a portfolio of hydro, wind, natural gas, and nuclear power plants. About 50% of its power generation capacity is in Spain. It also owns and operates electricity and distribution networks in the UK, Brazil, and the US.

Iberdrola “has been investing heavily in their networks and building out grid infrastructure in the US, Europe, and Latin America and connecting renewable power plants like wind farms and solar farms to the grid,” Tursich says. “They have a long runway for growth with very predictable cash flows.”

He adds that “investors will be rewarded with a dividend yield north of 4% that is growing at around 9%.”

At a recent $14.05 per share, Iberdrola trades near Morningstar’s quantitative fair value estimate of $13.97.

Quanta Services PWR

Quanta Services is a Houston, Texas-based engineering and construction contractor that’s benefiting from the need to upgrade and modernize the electric grids in the US and Canada. It has a skilled labor force knowledgeable in such areas as grid hardening and expansion, pipeline replacement, and the 5G telecom buildout.

“They have the people power,” Tursich says. “It’s great to have electric infrastructure, but you need the labor force to put it together.” For example, one new area of expertise is new power lines that reduce wildfire risk. Quanta’s labor force is 6 times as large as its nearest competitor, says Tursich. It has invested heavily in training and education. “There’s a huge need for that work, which isn’t going away any time soon.”

Of the three picks, Quanta’s revenue is increasing the fastest, “with steady double-digit growth rates into the foreseeable future,” Tursich says. Its current price/earnings ratio is 63, and its price/forward earnings is 33. Tursich acknowledges that the multiple is “above its historical average.” Still, he adds, “Holding for the long-term will mitigate the current high price as the company compounds profits at a high rate.”

At a recent $342.92 per share, Quanta trades at an 82% premium to Morningstar’s fair value estimate.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar's editorial policies.