As sustainability-aware investors look ahead to 2025, six themes are likely to dominate their lists. They include environmental, social, and governance regulations, carbon-transition investing, sustainable bonds, the reshaping of the global ESG fund landscape, biodiversity finance, and the ethics of artificial intelligence. We discuss them below.

A Testing Year for ESG Regulations

We expect 2025 to be a critical juncture for the EU’s credibility, particularly with the forthcoming results of the Sustainable Finance Disclosure Regulation review and the first wave of Corporate Sustainability Reporting Directive reporting. Corporates and politicians are putting pressure on EU regulators to demonstrate the value and efficacy of ESG policies.

In the US, the new Trump administration is widely expected to roll back ESG initiatives, posing challenges for the low-carbon transition and sustainable investments. For example, Trump is likely to exit the Paris Agreement again, Congress may reduce or eliminate some of the clean energy subsidies in the Inflation Reduction Act, while the SEC may reverse the rules requiring public companies to disclose greenhouse gas emissions and climate-related risks.

Meanwhile, the US Department of Labor’s guidance on ESG factors for Erisa-covered plans is likely to shift back toward stricter rules requiring fiduciaries to prioritize financial returns and avoid ESG-related costs unless they are clearly linked to long-term value creation.

In the rest of the world, the focus will likely remain on rolling out climate and sustainability disclosures such as the International Sustainability Standards Board standards. In parallel, several jurisdictions are due to launch or expand voluntary taxonomies.

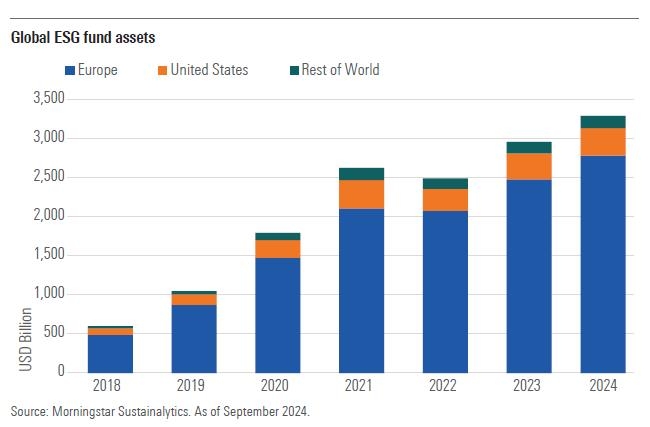

The Reshaping of the Global ESG Fund Landscape

By this time next year, the global ESG fund landscape will look significantly different.

The main transformative driver will be the ESG fund-naming guidelines issued by the European Securities and Markets Authority. The guidelines aim to protect investors from greenwashing risk by introducing minimum standards for EU funds that use ESG-related terms in their names.

We anticipate that between 30% and 50% of EU ESG funds will change names by mid-2025, while other funds will adjust investment objectives and/or portfolios to keep their ESG-related terms in their names. Some of these will become fossil-fuel-free, while others will rebrand into transition strategies.

In the UK, sustainability label adoption will increase next year but will likely remain limited to 150-200 funds.

Meanwhile, we expect an acceleration of fund closures globally. In the US, the USD 353 billion ESG fund market has already started to shrink in terms of number of offerings (although not in terms of assets, which continue to rise, supported by market appreciation). There were 595 ESG funds at the end of September, compared with 647 at the beginning of the year.

ESG fund assets in the rest of the world, which account for 5% of global ESG fund assets, should continue growing, but at a slower pace than in the past.

Transition Investing: From Targets to Tangible Action

Similar to 2024, one major theme for 2025 will be transition investing. We expect investors to take a more hands-on approach to the low-carbon transition, moving beyond simply encouraging companies to set targets to ensuring they take tangible actions.

Investors will also increasingly look at the significant opportunities arising from the energy transition. According to the International Energy Agency, more than USD 6 trillion will be needed per year until 2030 to achieve a successful energy transition.

Since 2021, the green solutions sector, including wind, solar, battery, and electrical vehicles, has struggled to generate good returns for investors investing in public markets, mainly due to high interest rates. However, next year, with central banks expected to cut interest rates and companies becoming more efficient—and despite the uncertainties introduced by the incoming Trump administration’s plans to cut tax credits for green projects—the outlook for low-carbon solutions is positive. Structural drivers—including technological advancements, cost declines, and the rising demand for power—position green solutions, in both public and private markets, favorably despite near-term uncertainty.

Meanwhile, we expect companies operating in the electrical equipment sector to continue to benefit from the rising demand for green infrastructure and building efficiency, supported by robust fundamentals.

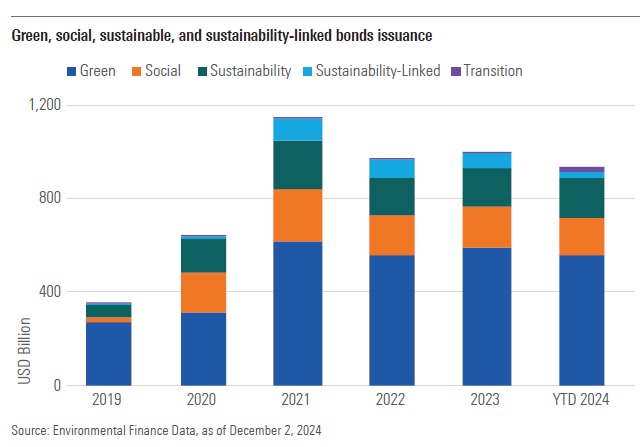

Sustainable Bonds: Lower Interest Rates Will Bolster Issuance to USD 1 Trillion

In 2025, we expect the issuance of green, social, sustainable, and sustainability-linked bonds, or GSS+, to exceed USD 1 trillion again, from just under that mark at the end of 2024, supported by a more favorable interest-rate environment and investor demand for sustainable investments. GSS+ bonds have become popular debt instruments to finance the transition.

We will also see the birth of the EU green-bond market. The EU aims to further strengthen investors’ trust in the green-bond market with a new voluntary standard that requires enhanced reporting and verification. Bonds issued under the EU GBS will be required to allocate at least 85% of their proceeds toward EU Taxonomy-aligned sustainable activities.

Furthermore, we anticipate more green-bond issuances to finance green-enabling activities, which play a critical role in facilitating the transition. Examples of green-enabling projects are investments in companies that extract materials (such as lithium), which are vital for green technologies, and companies that manufacture materials (such as insulation) that help reduce emissions in the building sector.

Biodiversity Finance: Time to Scale

As we move into 2025, it is widely acknowledged that nature, as an asset class, is mispriced. This misguided pricing signal has led to the ongoing degradation of biodiversity, which ranks among the most severe global risks of the coming decade.

Over the past two years, initiatives such as the Taskforce on Nature-related Financial Disclosures, the adoption of the Global Biodiversity Framework, and the UN Biodiversity Conference (COP16), have enabled investors to engage with the issue more effectively.

We expect to see continued interest in biodiversity in the year ahead, with a need to scale nature finance. The rise of innovative financial mechanisms signals growing investor appetite for nature-related investments, but key challenges, including regulatory uncertainty and undefined nature transition pathways, remain.

AI Rapid Adoption Increases Environmental and Social Risks

Finally, artificial intelligence was a prominent investment theme in 2024, and it is likely to continue to rise on the agenda of sustainability-focused investors in 2025.

AI holds great potential to help combat climate change and achieve sustainability goals across industries.

However, its rapid adoption in recent years has revealed significant ESG risks for investors, and these risks may increase in the likely scenario of fewer regulations in the US under the Trump administration.

On the environmental side, AI-fueled data centers run by tech firms such as Google and Microsoft require a huge amount of (not all green) energy, which not only jeopardizes these companies’ net zero commitments, but also could divert green electricity from other critical sectors that need it more urgently to achieve their decarbonization goals.

On the social side, AI poses a host of new risks, which, if they materialize, can cost companies a lot of money. These risks include privacy breaches, biases, fake news, and copyright infringement, among others. For example, in May 2023, Meta was fined USD 1.3 billion by the EU for mismanagement of its data.

You can read the full report “Six Sustainable Investing Trends to Watch in 2025” here.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar's editorial policies.