Few words in the investment world are as seductive—or as overused—as “innovation.” But asset managers hope it can help stanch the relentless outflows from their stock-picking mutual funds and have launched dozens of innovation-themed active exchange-traded funds in recent years. These funds promise exposure to businesses that could reshape industries, out-innovate incumbents, and profit from seismic technological shifts.

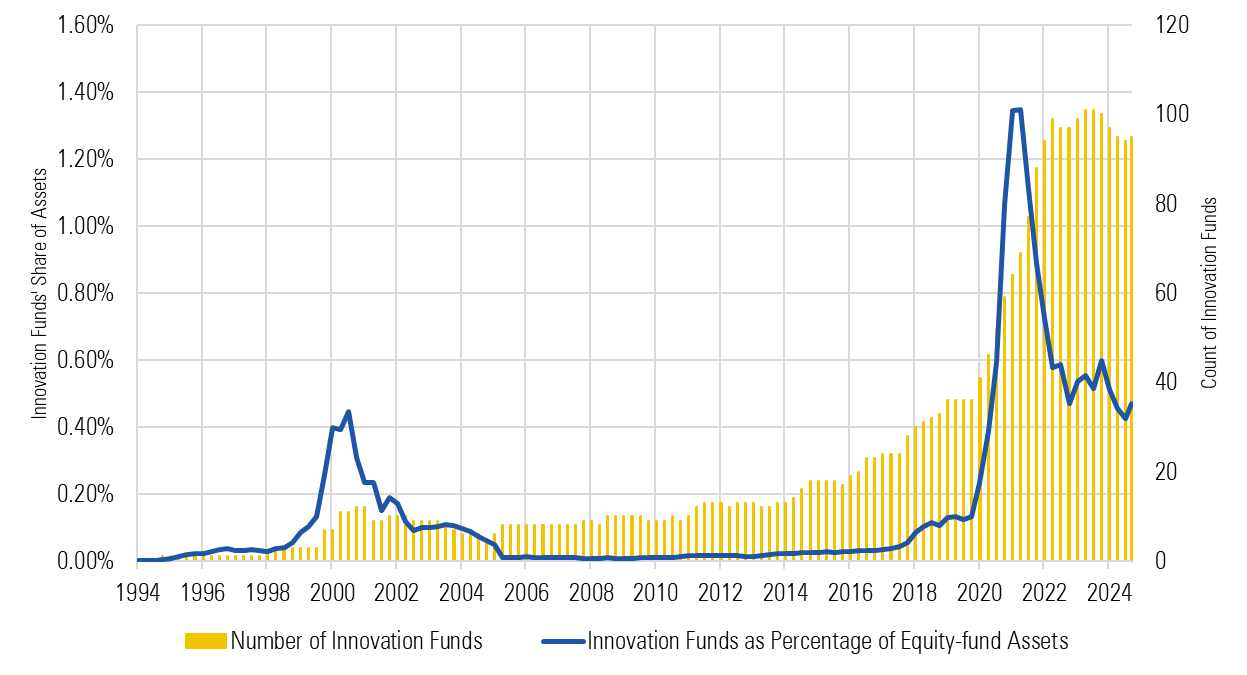

Innovation-focused strategies, which include the many ETFs labeling themselves with buzzwords such as “disruptive,” “next gen,” or “revolution,” collected a sizable sum at the turn of the century. It soon dissipated. But after a steady climb from 2011-19 to around 40 innovation funds sold in the US, the number leaped to roughly 100 by 2022 as asset managers launched new products or rebranded old ones to capitalize on the theme. While that figure pales in comparison to the trillion-dollar universe of mutual funds and ETFs, it signals a steady interest in the strategy.

However, these funds, with their lofty promises and diffuse approaches, demand close scrutiny. Products have proliferated in the active ETF arena, and the landscape is littered with funds whose objectives, risks, and merits can be hard to discern. Innovation ETFs are no exception.

The Promise: Invest in Tomorrow’s Leaders

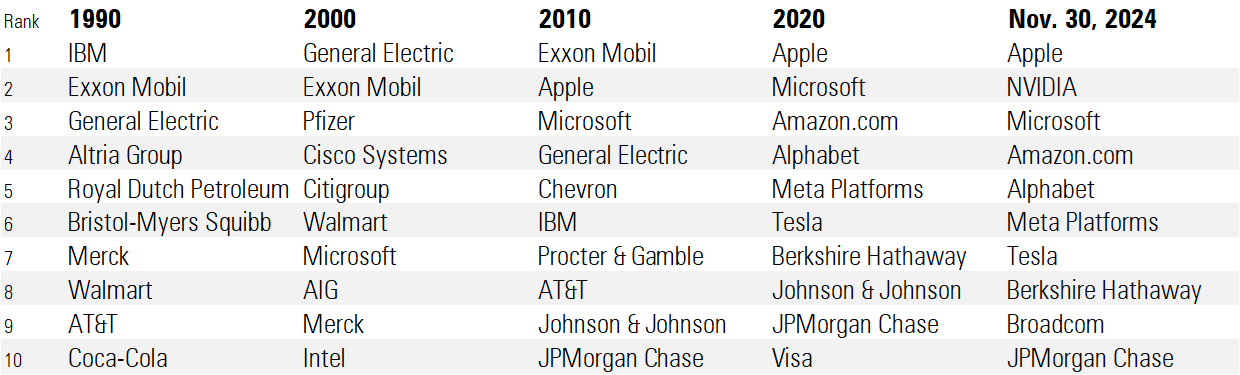

Innovation funds tap into a compelling narrative: Technology-enabled businesses models have the potential to sweep aside incumbents and elevate new leaders. Within a handful of years, the Apple AAPL iPhone and app-store ecosystem helped the firm leapfrog behemoths like ExxonMobil XOM and GE to become the world’s most valuable public company. Chip vendor Nvidia NVDA, a prime beneficiary of recent breakthroughs in artificial intelligence, briefly overtook Apple this year. Netflix’s NFLX streaming business crushed Blockbuster, revolutionized entertainment distribution, and fueled its phenomenal stock performance over the past decade. These examples illustrate the power of innovation to redefine market hierarchies—and the investment opportunity that comes with it.

Unlike traditional tech funds that focus on the purveyors of technology, innovation funds often invest across sectors in companies that its portfolio managers think superbly leverage it. Instagram-owner Meta META and Netflix (both classified as communication-services stocks) are popular examples. The funds also invest in companies that may indirectly benefit from tech demand. Think of industrials or utilities companies that build infrastructure for data centers or produce the energy they need. Stocks held by innovation-themed funds also often lack clear sector designations. (Is Uber UBER a transportation stock, software stock, or something else?) For investors who fear overexposure to a single sector, the diversification offered by these funds looks appealing.

But beware of facades. Those stocks share many underlying drivers and correlated price movements. For investors seeking the cushioning effect of true sector diversification, the reality might disappoint.

The Peril: The Fog of Uncertainty

The same forces that create opportunity for innovation-themed stocks also breed uncertainty. How big is the potential market for a disruptive company’s product? How quickly will that market grow? Which companies are best positioned to capture value? Overestimating a technology’s potential—or betting on the wrong beneficiary—can result in steep losses.

The stakes are highest at the frontier of a new technology or business model. Consider the excitement around generative AI. Most portfolio managers agree the technology is transformative, but their views diverge on how best to invest in it. Some believe the biggest long-term beneficiaries will be software firms that can use AI to boost revenues and cut costs. Others have put their chips on Nvidia and other semiconductor stocks, whose products are essential to making the technology work. Investors in innovation funds must rely on managers to make the right bets in a landscape defined by ambiguity.

Compounding the challenge is the fact that technological change and business-model disruptions rarely happen in clean, predictable ways. Even when a technology is transformative, its impacts unfold unevenly, with winners and losers emerging over years, not months. What seems like a surefire disruption today may fizzle tomorrow. The high hopes that accompany innovation often give way to sharp volatility and steep losses.

Innovation or Illusion?

There is another, more fundamental question investors should ask: How much of the innovation story is real, and how much is marketing hype? In recent years, fund companies have raced to launch new products, sometimes rebranding older funds to capitalize on the innovation trend. The result is a cluttered landscape of funds with lofty names and vague mandates. Some are well-researched vehicles run by seasoned stock-pickers; others are little more than a collection of speculative bets on whatever technology is in vogue. Telling the difference is not always easy, even for sophisticated investors.

A Cautious Optimism

Innovation funds offer a tantalizing promise: the chance to invest in the technologies and companies that will shape the future. For those who get it right, the rewards can be extraordinary. But the risks—high volatility, the difficulty of predicting winners, and the possibility of overpaying for an uncertain future—are just as real. Amid a crowded landscape of funds claiming to pinpoint the next big thing, careful scrutiny—and a healthy dose of skepticism—remain the investor’s best tools.

The author or authors do own shares in any securities mentioned in this article. Find out about Morningstar's editorial policies.