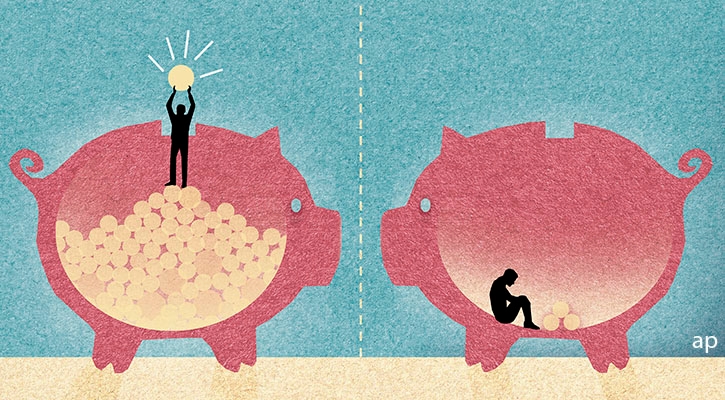

After many years on the job, most of us look forward to retirement. But uncertainty over one’s financial security is less palatable. Just how much money is enough? Depending on how active you expect to be, particularly in terms of recreation and travel, the figure many experts come up with is between 60% and 70% of your pre-retirement income. Perhaps you can get by on less.

An adequate nest egg will thus depend on your projected lifestyle, the age at which you begin drawing on your savings, and whether you wish to leave an inheritance to your family and perhaps a bequest to charity.

Determine Your Sources of Income

Regardless of the savings you eventually achieve, it’s important to know what sources you can draw retirement income from, and how this money will be taxed. For most retirees, this includes:

- Savings accumulated in government pensions

- Employer pensions

- Life income retirement accounts

- Registered retirement savings plans (RRSPs),

- Tax-free savings accounts (TFSAs)

- Other investments and savings outside the various tax-advantaged vehicles

Here’s a breakdown of your likely income sources.

Government Pensions

These include old age security (OAS) and the Canada Pension Plan (CPP)—or if you live in Quebec, the nearly identical Quebec Pension Plan (QPP). Your OAS entitlement depends on how long you have lived in Canada and your overall income level once you begin receiving this pension. C/QPP is available solely based on your contributions to these plan(s) during your working years. (CPP and QPP are largely synchronized, so if you worked both inside and outside Quebec over the years, your contribution records are consolidated.)

The normal age for applying for C/QPP benefits is 65. You can start to receive benefits as early as age 60, but the monthly amount will be smaller. Payments will decrease by 0.6% each month (or by 7.2% per year) up to a maximum reduction of 36.0% if you start at age 60.

By the same token, if you postpone receiving your pension (as old as 70), you’ll receive bigger monthly payments. These will increase by 0.7% each month (or by 8.4% per year) up to a maximum increase of 42% if you start at age 70.

For assistance with deciding when to start taking your pension, consult the CPP website’s calculator.

You can apply for CPP here.

You can apply for QPP here.

OAS and GIS

As of 2025, OAS will pay a maximum of C$728 for those ages 65-74 and C$800 if 75 and over. These amounts will be greater if you delay beginning to receive payments, which you are permitted to do until age 70. However, if your annual net income from all sources exceeded C$90,997 in 2024, you will be subject to the OAS pension recovery tax, more popularly referred to as the “clawback.” OAS income received from July 2024 through June 2025 must be partially repaid (depending on your income level) and fully repaid if your 2023 income exceeded C$142,609 (or if 75 and over, C$148,179). For the following period (July 2025-June 2026), the clawback threshold (based on 2024 income) will be C$90,997, with benefits completely paid back if your income exceeds C$148,605 (C$153,771 for 75-plus recipients).

To determine your OAS payments, consult the online Old Age Security Benefits Estimator.

There is an extra amount, known as the Guaranteed Income Supplement (GIS), available for seniors whose income is below C$21,624 (income thresholds are higher for those with a spouse, depending on whether they receive a full OAS pension.

Employer Pensions

Your employer’s pension department (or the financial institution that administers the plan) will provide you with information on the benefits (usually as periodic payments) you will receive, usually beginning at age 65. In the case of a defined benefit plan, the payments will be fixed and guaranteed (and in some fortunate cases, indexed to inflation). Defined contribution plans are similar to employers’ group RRSPs; your plan administrator will provide details on the payment amount and other details.

In some cases, you may have employer-pension-related savings in a locked-in retirement account (LIRA). This is akin to a locked-in RRSP, where you have control of how the money is invested but cannot withdraw until retirement, when the LIRA is converted to a life income fund (LIF) or, in some situations, a locked-in retirement income fund (LRIF) or a restricted life income fund (RLIF). The latter operates similarly to a RRIF, discussed below.

As with other types of pension income, proceeds from employer pensions are fully taxable.

TFSAs

Although not specifically designed to provide retirement income, a TFSA is often part of the mix. However, it can last for as long as you live, including ongoing annual contributions. As such, it provides a continual tax shelter, as withdrawals are completely tax-free. Draw down your TFSA only if you need money beyond what you are receiving from other sources.

RRSP Savings

Most Canadians’ retirement income hopefully comes from many years of making significant contributions to their RRSPs. These contributions are tax-deductible, which means the entire amount in your plan (capital and income) grows on a tax-deferred basis over the years until money is withdrawn, in most cases through a registered retirement income fund (RRIF). Since this generally happens after retirement, in theory, tax will be payable at a lower tax rate than had you made the withdrawal in a higher income, working year.

An RRSP must be terminated by the end of the year in which you turn 71. The proceeds can be taken as cash (and fully taxed in that year, which is a very expensive choice). The viable options are to transfer the RRSP balance to an RRIF or purchase a registered annuity. In both cases, the savings continue to be enhanced by a tax deferral until the money is paid out to you, at which point the proceeds (both capital and income) are fully taxable.

With a registered annuity, you surrender control of your retirement assets in exchange for a guaranteed payment, either a fixed amount or an indexed amount, depending on the level of interest rates at the time the annuity is purchased and on the type of annuity. Some annuities pay for life while others terminate at a specified age, such as 90.

RRIFs

Most people take the RRIF route, as it allows you to retain control over how your savings are invested and the amount of income you can draw down. The only difference from an RRSP is you must withdraw a minimum percentage amount each year, and that amount increases each year.

- If you begin taking RRIF payments in the year in which you are age 71 as of Jan. 1, the minimum withdrawal for that year is 5.28% of the fund’s total assets. The minimum withdrawal payouts increase incrementally, to 5.40% the following year (based on age 72 on Jan 1), 5.53% the next year, and so on.

While many retirees opt to receive periodic payments (usually monthly or quarterly) for the sake of managing their cash flow, the most tax-effective timing is to withdraw the minimum amount just before the end of the year, thus maximizing the tax deferral.

Remember that RRIF payments are fully taxable at your marginal tax rate, and tax may be withheld by the financial institution that holds your fund. If you withdraw only the minimum amount, no tax will be withheld at the source. On amounts over that, the following withholding taxes apply:

- Up to C$5,000: 10% withheld (for Quebec residents, a combined total of 19% to the CRA and Revenu Québec)

- C$5,000-C$15,000, 20% (Quebec 24%)

- Over C$15,000, 30% (Quebec 29%)

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar's editorial policies.