I was recently cleaning out old files and came across an Ameritrade brokerage statement from 1999. It made for embarrassing viewing. Not Pets.com-level embarrassment, but the fact that I can’t remember why I bought shares in Lucent Technologies or Centura Software is proof I was swept up in the internet bubble, also known as dot-com mania or the TMT—the technology, media, and telecom—era. You know how the story ends. The bubble burst in early 2000, and my Ameritrade account fell victim to a “Tech Wreck.” To be clear, I wasn’t working at Morningstar at the time.

Though I had little to lose and no dependents, the experience scarred me as an investor. It made me leery of growth stocks, the technology sector, and stories like: “The internet is gonna be huge; buy internet stocks!” I don’t say this as a point of pride. Like many value-oriented investors, I haven’t fully participated in US stock gains of the past 15 years. Uneasy with the “FANG Stocks”—Facebook, Amazon.com, Netflix, and Google—and the “Magnificent Seven,”—Alphabet, Amazon.com, Apple, Meta Platforms, Microsoft, Nvidia, and Tesla—I have been skeptical of a market that has rewarded optimism.

Whether the DeepSeek AI disruption will burst another bubble remains to be seen. Technology stocks have taken hits before—like in 2022—and bounced right back into leadership. Still, now seems like a good time to take a look at the composition of the Morningstar US Market Index—a broad gauge of equities. What do shifts in its sector weightings over time suggest about the future?

The Rise, Fall, and Rise of Technology

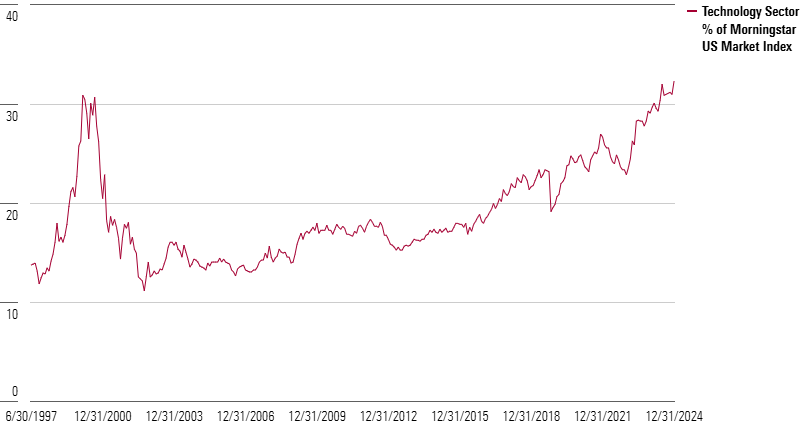

Stocks belonging to the technology sector represented 32% of US equity market value as of the end of 2024. That dwarfs the next largest sector—financial services—at just 13%. It also surpasses the 31% share tech stocks reached at the internet bubble’s early 2000 peak, as displayed below.

Coming into this year, the three largest stocks in the Morningstar US Market Index—Apple AAPL, Nvidia NVDA, and Microsoft MSFT—all belonged to the technology sector. Broadcom AVGO, like Nvidia, benefiting from artificial intelligence-related semiconductor demand, was also a top-10 constituent. Amazingly, the first three companies each exceeded USD $3 trillion in market value as of 2024’s end.

Back in early 2000, the big tech giants were worth more than USD $300 billion apiece—as astounding a number then as USD $3 trillion is today. Cisco Systems CSCO, Microsoft, Intel INTC, Lucent Technologies, and IBM IBM were all part of the Morningstar US Market’s top 10 at the turn of the millennium. Some readers will remember that the 2000 Super Bowl featured a parade of commercials for internet companies—including Pets.com and its infamous sock puppet.

By the 2001 Super Bowl, it was a very different picture. Interest-rate hikes and profitability concerns turned investor sentiment against tech stocks. The bubble burst. Pets.com went bankrupt and was mocked in an ad. My small investment in Lucent Technologies shriveled, with its shares falling from more than USD $75 at the start of 2000 to less than $15 by year’s end. Long after I had cut my losses, Lucent merged with the French telecom Alcatel, and Nokia eventually acquired the business. Centura Software filed for bankruptcy in 2001.

The tech meltdown continued for years. After the Sept. 11, 2001, terrorist attacks, the technology sector fell to 15% share of the US market. In 2002, a series of accounting scandals, most famously Enron and WorldCom, eroded confidence further. Technology even dipped below 12% of the Morningstar US Market Index’s value in the fourth quarter of 2002.

By the time I started at Morningstar in 2004, value investing was the thing. The stubborn contrarians who had sidestepped the Tech Wreck were heroes, while the internet bubble’s cheerleaders became laughingstocks. Lack of enthusiasm for Google’s GOOGL 2004 IPO reflected the market’s disinterest in technology.

In vogue were sectors once dismissed as old economy. Financials, basic materials, and energy all filled the void left by technology. Low interest rates were fueling a boom in dealmaking, and, fatefully, the US housing market. Demand from China and other emerging markets saw commodities prices soar. As displayed below, the energy sector comprised nearly 15% of the index in mid-2008—a level it hasn’t come close to since.

The technology sector’s rise in the years following the 2007-09 financial crisis is well documented. The dreams of the 1990s were finally realized as the internet transformed life and work (including pet-food shopping). Trends like mobile computing, e-commerce, and the cloud took off. Apple, nearly left for dead in the 1990s, rode the success of the iPod into the iPhone and never looked back. Microsoft reinvented itself into a cloud-computing giant.

If you’re wondering why Amazon.com AMZN, Meta Platforms META, and Alphabet haven’t been mentioned as part of the technology sector, it’s an interesting story. Several years back, Amazon, which was one of the stars of the late 1990s as an online bookseller, was reclassified to the consumer cyclicals sector. Meta Platforms, which came to market as Facebook in 2012, now resides in communication services. Alphabet, Google’s parent company, is in the same sector. What were once seen as internet businesses, are now classified by what they do.

Even without some of its erstwhile biggest names, the technology sector grew its share of the market pie in 2020 and 2021. The pandemic accelerated tech trends, as life and work went digital. At one point, Zoom’s ZM market value exceeded that of Exxon Mobil XOM by a factor of three, and the tech cohort first known as FANG expanded into FAANG, FANGM, and MAMAA.

Then, in 2022, inflation moved from “transitory” to “stubborn”; interest rates went parabolic, and the technology sector lead the market down. Energy was the top performer that year, thanks to soaring oil prices. Some heralded the bursting of yet another tech bubble and the dawn of a new market regime. Higher rates devalued tech companies’ long-dated cash flows—or at least according to the conventional wisdom.

That narrative faded fast. The launch of ChatGPT in November 2022 focused investors on the transformative potential of artificial intelligence, which is commonly referred to as “bigger than the internet.” Jeremy Grantham, a legendary contrarian who called the internet bubble, believes AI inflated a new bubble less than a year after a previous one had popped. Now DeepSeek AI has investors questioning business models.

Where Do Investors Go From Here?

The tech sector’s recent rise to dominance presents challenges, just as it did in the late 1990s. Investors holding a market portfolio are less diversified than they might prefer. Exposure to sector-specific risk has spiked. Technology, especially, is a fast-moving, hard-to-predict sector. How many had heard of DeepSeek AI before last week?

Of course, just because the US stock market crashed the last time the technology sector crossed the 30%-share threshold doesn’t mean it will happen again. It’s often pointed out that today’s tech giants are extremely profitable; they aren’t just selling investors on how many “eyeballs” they attract (a popular metric in the 1990s).

Valuations matter, however. Coming into 2025, Morningstar’s research and investment group saw the technology sector in aggregate as trading at a premium, reflecting “irrational exuberance,” to invoke a 1990s term. Brian Colello, Morningstar’s equity strategist for the technology sector, wrote in 2024: “Spending on AI graphic processor units and hardware is less likely to provide anywhere near the massive positive surprises we saw in 2024 as this fast-moving megatrend is better understood.” Meanwhile, Morningstar’s equity research team saw the energy, healthcare, and basic materials sectors as trading at discounts to their intrinsic values. The upside in today’s market, in their view, lies with recent underperformers.

History shows that market composition is highly changeable. Some of today’s largest companies weren’t even public 15 years ago, let alone in 2000. Meanwhile, most of 2000’s leaders are shadows of their former selves. Microsoft stands out as one of the biggest stocks in both 2000 and 2025, but it had many lean years and is a different business today.

Sector leadership, too, is extremely dynamic. Will technology fade like it did after 2000? Will energy ever again reach 15% market share? Could healthcare grow from its current 10% level? The answers are unknowable. But I’d be very surprised if the tech sector leads the market over the next five to 10 years.

Value investors like me have been wrong for a while now, but my bet is on new sector leadership for the Morningstar US Market Index. As ever, diversification—not just across sector, but asset class, geography, and size—assures a portfolio is prepared for different regimes. In markets as in life, change is the only constant.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar's editorial policies.