Vanguard announced its broadest round of fee cuts in its history on Monday, Feb. 3. The reductions applied to 168 share classes of 87 US mutual funds, ETFs, and money market funds. Collectively, Vanguard estimated the total cost will amount to about USD 350 million in lost revenue this year. Two of the cuts have implications for three of its Canadian ETFs.

The impact is directly tied to how Vanguard manages its Canadian index-tracking ETFs. Some track the same index as a US ETF. For example, Vanguard FTSE Developed All Cap ex US Index ETF VDU tracks the FTSE Developed All Cap ex US Index, the same benchmark as its US sibling, Vanguard FTSE Developed Markets ETF.

That similarity gives Vanguard two options for managing some of its Canadian ETFs. It can attempt to replicate an index by owning the constituent stocks, or it can buy shares in one of its US ETFs. Both approaches are reasonable, and Vanguard looks at each ETF’s circumstances to determine which is best. Vanguard representatives said it aims to provide the most cost-effective replication after accounting for transaction fees, withholding taxes, and the costs of managing an additional stock portfolio.

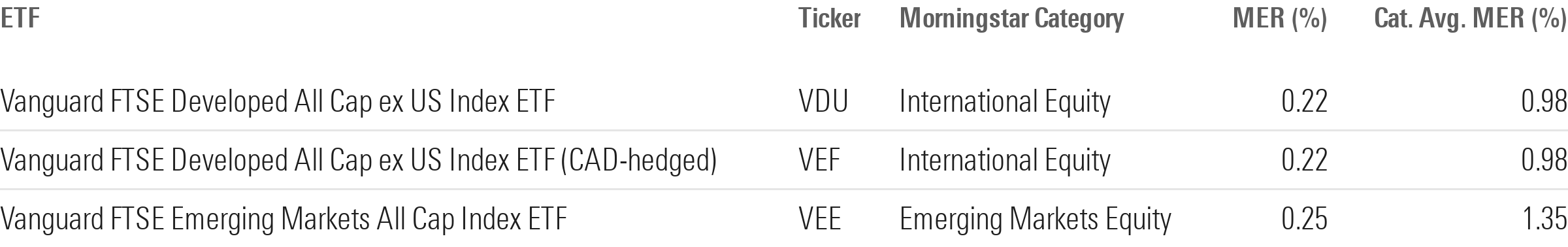

Three of its Canadian ETFs use the second approach. They hold a US ETF, one of which had its fee cut. Vanguard opted not to pass along the fee reductions to the Canadian ETFs. Vanguard representatives said it would use the incremental revenue to reinvest in its Canadian business.

That said, all three ETFs have management expense ratios much cheaper than their category averages, and the cuts were small. Passing along lower fees would have been an improvement for investors, but it won’t dramatically change their long-term total return.

Vanguard has grown enormously over the past two decades, and it hasn’t pleased everyone. It’s less disruptive than it has been in past decades. However, Vanguard’s decision to reduce fees and the revenue hit it’s taking send a positive signal that it hasn’t strayed too far from the course Jack Bogle charted 50 years ago.

The author or authors do own shares in any securities mentioned in this article. Find out about Morningstar's editorial policies.