Quality investing is an enigma. Few, if any, investment strategies increase return without increasing (or even cutting) risk. But the quality factor has done just that over the past decade.

Higher return without higher risk is counterintuitive and undermines economic theory in finance textbooks. What’s more puzzling is that there’s no universally accepted definition of quality or consensus on which metrics best identify it.

Three questions might help solve these mysteries:

- What is quality?

- Why does it work?

- How is it captured?

Defining Quality Investing

Quality is in the eye of the beholder. Just as any of us could rattle off our own criteria for what makes a product high-quality, so too could investors regarding high-quality companies.

How academics and investors mix and match quality characteristics is another story. Eugene Fama and Kenneth French incorporated quality by expanding their three-factor model (market risk, value, and size) to five factors (tacking on profitability and conservative investment). Buying profitable companies that don’t require heavy investment to grow that profit is intuitive. Robert Novy-Marx put it best in his seminal work on profitability by saying, “While traditional value strategies finance the acquisition of inexpensive assets by selling expensive assets, profitability strategies exploit a different dimension of value, financing the acquisition of productive assets by selling unproductive assets.”

In 2018, research by Jason Hsu, et al, looked at the many definitions of quality and ultimately found evidence that the following indicators deliver superior performance:

- Profitability

- Accounting quality

- Payout/dilution

- Investment—with the caveat that its edge can be explained by other factors in a multifactor model.

To expand on Novy-Marx’s explanation above, quality companies carry productive assets that can be reliably accounted for in financial statements and won’t be diluted away by the company issuing new shares.

Why Does Quality Investing Work?

Quality wouldn’t work if markets were highly efficient. The quality factor’s risk premium signifies that those companies are consistently underpriced. How can that happen across geographies and over long periods of time?

Antti Ilmanen, global co-head of portfolio solutions at systematic investing titan AQR, called out a few behavioral biases and explanations for why quality works in his book, Investing Amid Low Expected Returns. They include investors’ preference for stocks that perform like lottery tickets, constraints against leverage, and “story-oriented” analysts/investors.

- Preference for lotteries, or stocks with high potential return, has taken center stage in a market fueled by crypto, meme stocks, and leveraged single-stock exchange-traded funds. Buying into bitcoin a decade ago was like winning the lottery. A gambling mentality pushes some investors to take big risks in the hopes of hitting home runs when they could more easily (and more safely) compound doubles with the quality factor.

- Some investors may not be able to use leverage. That constraint shifts their focus from risk-adjusted returns to total returns, which pushes them into riskier assets and leaves high-quality companies behind.

- Story-oriented analysts and investors buy narratives not fundamentally sound businesses. That typically excludes high-quality stocks from their portfolios.

Adding my own thought to the mix: Quality works because investors seek out core/satellite portfolios. Broad market funds form their core holdings. They’re unlikely to add a fund with similar holdings and returns. Quality factor ETFs fit that mold. They often hold many of the large stocks that dominate the market, so it’s reasonable for investors to seek more differentiated strategies for their satellite position(s).

Finding Quality ETFs

Definitions of quality aren’t the only inconsistencies that investors need to figure out. Academics and fund providers tap into different quality metrics, even when seeking the same characteristic, like profitability.

Novy-Marx found that one measure of profitability—a company’s gross profits/assets [(revenue – cost of goods sold)/assets]—has as much predictive power as price/book historically. Even better, gross profitability tends to be negatively correlated with value, meaning that the combination should add diversification and cut volatility while harnessing two powerful factors.

Cliff Asness and his colleagues at AQR published research that showed the “Quality Minus Junk” factor improved performance in a traditional factor regression. Quality Minus Junk combines several metrics that fall into three buckets: profitability, growth, and safety. AQR’s interpretation of quality averaged in Novy-Marx’s gross profitability with return on equity, return on assets, cash flow over assets, and gross margin while subtracting accruals. Growth metrics tallied the rate of change of those same profitability metrics. And safety tapped into low beta, low leverage, low bankruptcy risk, and low ROE volatility.

Hsu and a team of researchers tested even more quality metrics, adding return on invested capital to the aforementioned profitability measures, and over a dozen more under the themes of earnings stability, capital structure, growth in profitability, accounting quality, payout/dilution, and investment. Broadly, their research found that profitability, accounting quality, and investment metrics proved robust in regression testing, but growth in profitability, capital structure, and earnings stability metrics did not.

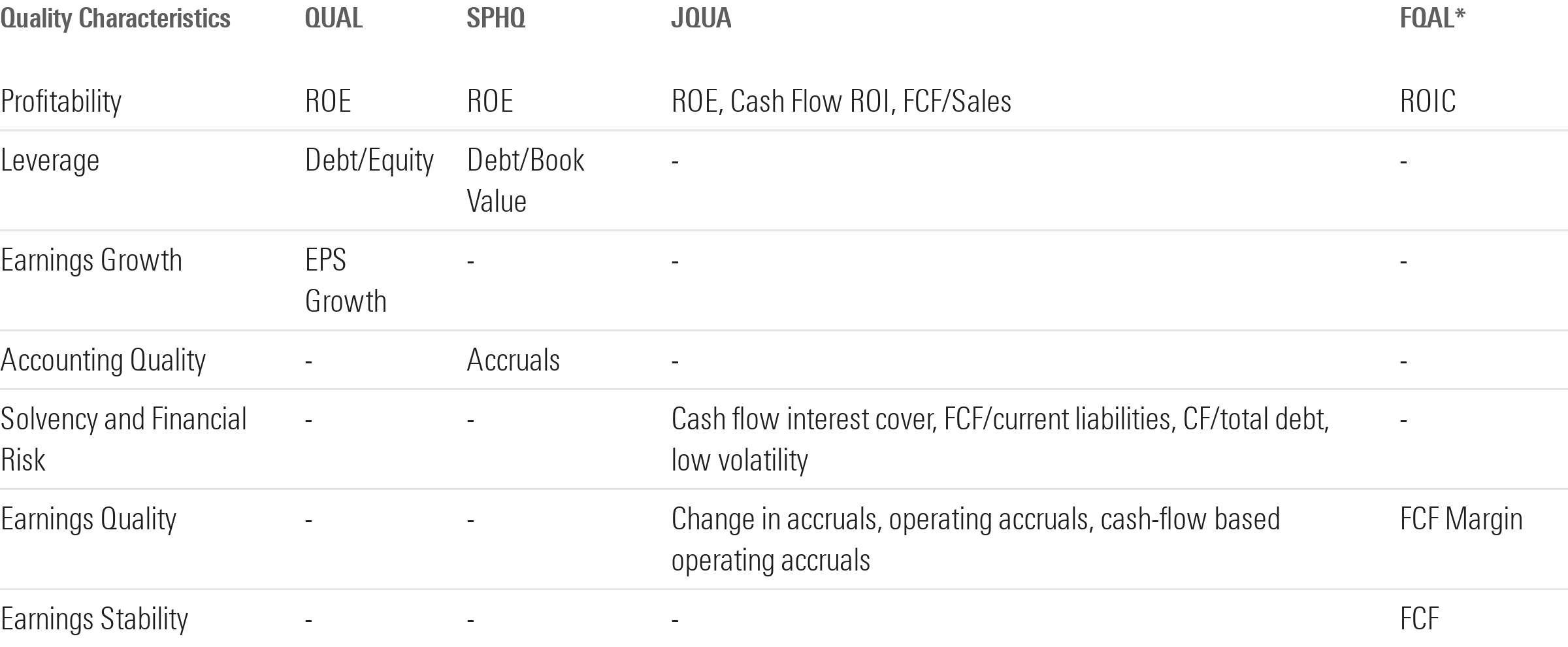

So how have practitioners put this research to work? Inconsistently, of course! The two exhibits below show the approaches taken by four ETFs focused on quality. Interestingly, at least one of financial leverage, earnings growth, or earnings stability made it into each of these ETFs despite poor results in research by Hsu. These ETFs went to the bottom of companies’ income statements by pulling net income for ROE metrics rather than Novy-Marx’s approach of reducing accounting noise by using figures from higher in the income statement.

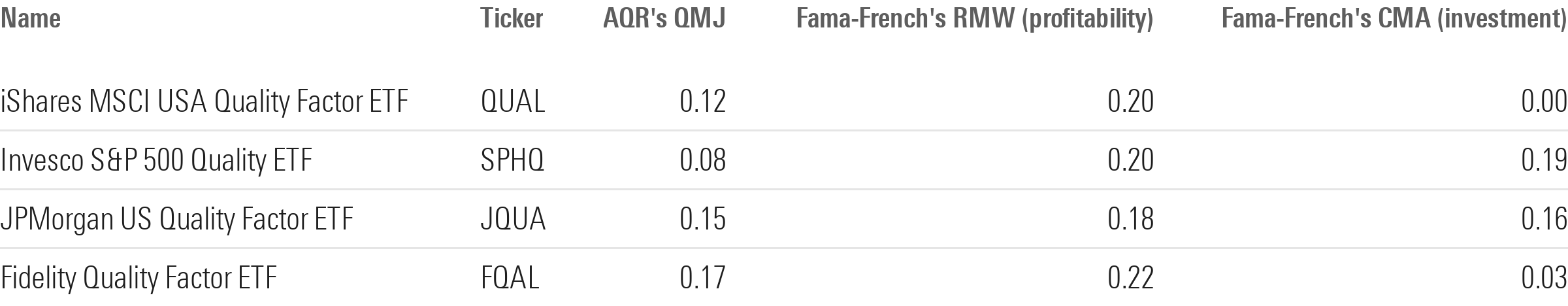

Which ETF best aligns with quality factor research? To test this, I ran regressions using AQR’s Quality Minus Junk model and the Fama-French five-factor model (which incorporates gross profitability and investment).

By Fama and French’s model, Invesco S&P 500 Quality ETF SPHQ best tapped into quality through its combination of profitability and investment. Invesco S&P 500 Quality ETF was the only ETF with a statistically insignificant quality coefficient, according to AQR’s model. This is somewhat of a surprise given that Invesco S&P 500 Quality ETF’s quality metrics (ROE, accruals, and debt/book value) conceptually match a portion of AQR’s Quality Minus Junk definition (profitability and safety, less so for growth).

The ETFs’ divergent approaches to portfolio construction failed to make much of a mark on the regression results. IShares MSCI USA Quality Factor ETF QUAL uses sector-neutral weightings. Invesco S&P 500 Quality ETF focuses on the top 100 S&P 500 companies by their quality definition and weights them using a combination of quality and market cap. JPMorgan US Quality Factor ETF JQUA has the best-diversified portfolio of the bunch, with 280 holdings and just 18% of assets in its top 10 holdings, and a smaller average market cap than the other quality ETFs. Fidelity Quality Factor ETF FQAL also takes a sector-neutral approach and holds about the same number of stocks as iShares MSCI USA Quality Factor ETF, but only 50 of their 125 holdings overlap owing to their different definitions of quality.

Despite their differences, strong performance brought these four ETFs together. From December 2017 (the earliest month that all four ETFs were live) through September 2024, the four ETFs matched or beat the Morningstar US Market Index in risk-adjusted returns.

JPMorgan US Quality Factor ETF and Invesco S&P 500 Quality ETF topped the list by total return and turned in the lowest volatility (the quality enigma incarnate). Only Fidelity Quality Factor ETF lagged the market’s return over that period, and IShares MSCI USA Quality Factor ETF was the only ETF with higher volatility than the market.

How ETF Investors Can Use Quality

Quality remains a bit of a puzzle. Divergent approaches by academics and practitioners alike leave some questions unanswered. But quality’s ability to beat the market with lower volatility keeps its pursuit worthwhile.

Each quality ETF offers a version of quality for investors, but incorporating quality can benefit any strategy. Our highest-rated dividend ETFs control for quality to avoid the pitfalls of chasing yield. Many ETFs offered by Dimensional and Avantis explicitly tap into profitability in combination with value and small size. Many options exist for investors, and it’s wise to incorporate quality in some way. How, exactly, remains in the eye of the beholder.

This article first appeared in the October 2024 issue of Morningstar ETFInvestor. Download a complimentary copy of FundInvestor by visiting this website.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar's editorial policies.