Overall, we think revenue and margin expansion are looking favorable for software firms in the coming years: We see total software revenue growing in excess of 11% annually through 2029.

Our outlook for the industry centers on three key themes:

• Switching costs drive high customer retention.

• High upfront investments secure very sticky revenue.

• Growth should remain attractive.

We share the key tailwinds and headwinds that will steer the industry and an overview of the moatiest companies.

The Software Market Should Remain a Robust Area for Growth

Software industry revenue growth is derived from existing clients in the form of additional seats and new modules and from new vendors and new business formation. Pricing tends to be lumpy, as software vendors may raise prices by 10% once every three years rather than annually by 2% to 3%.

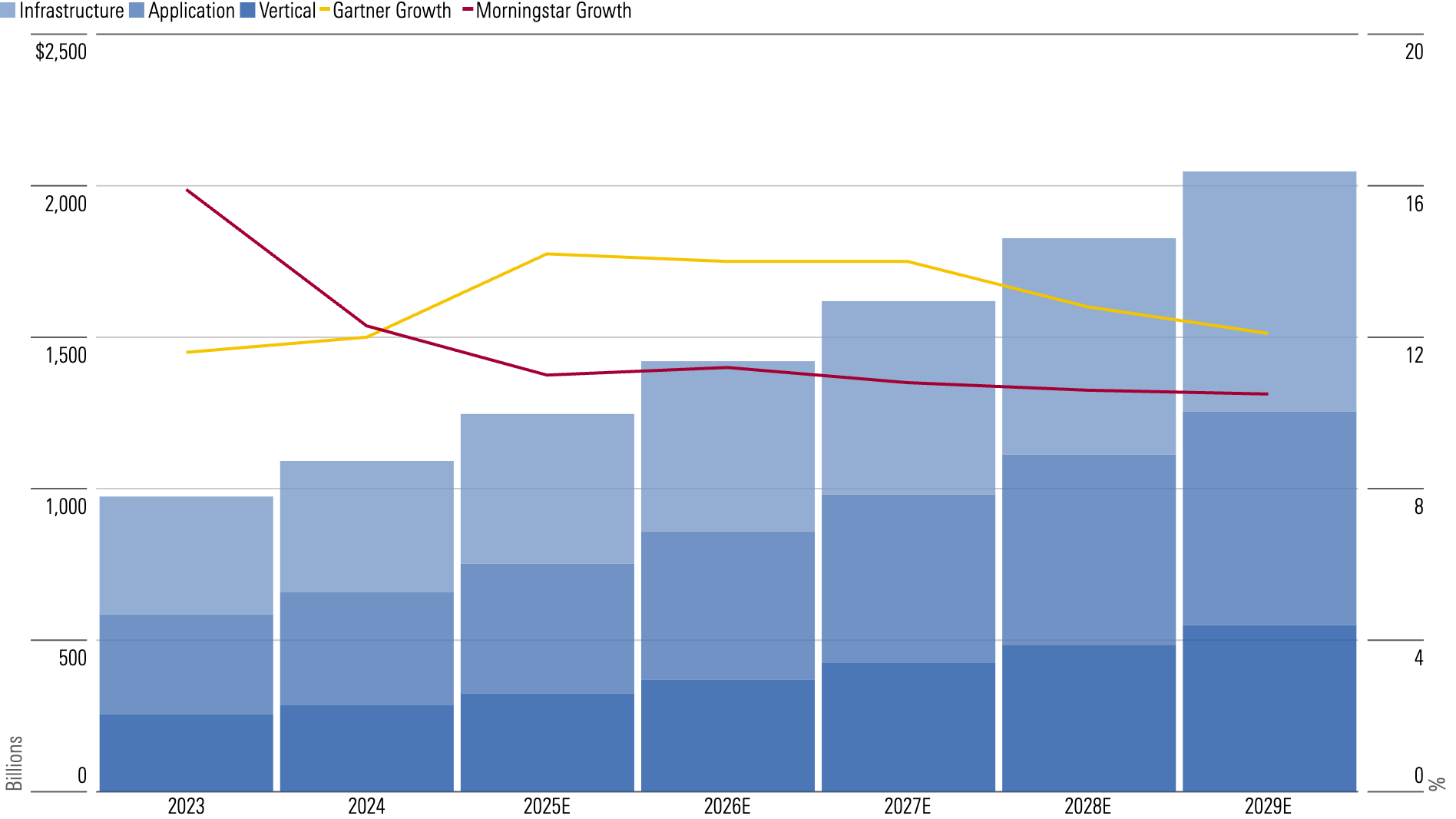

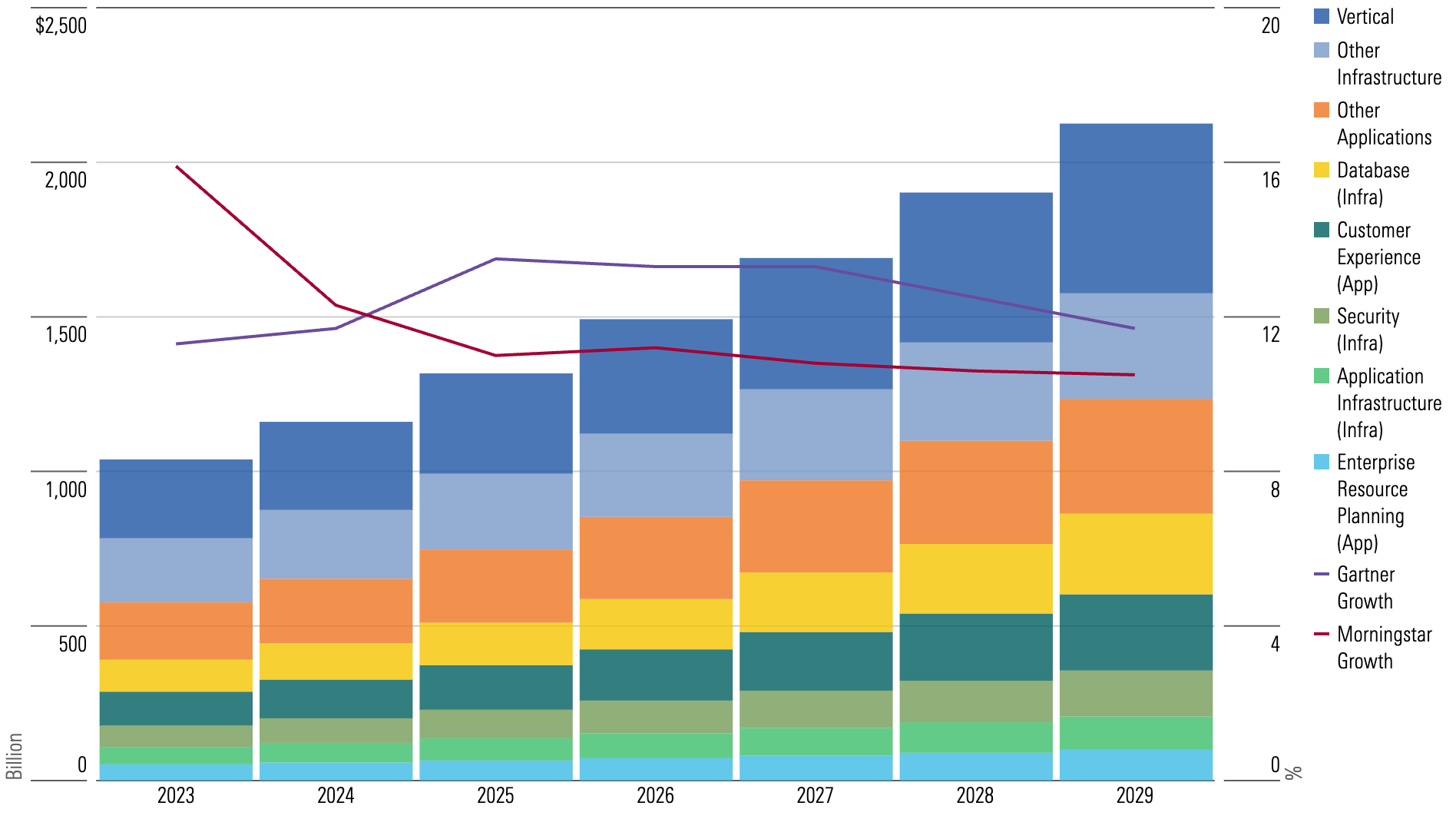

Our bottom-up approach suggests software revenue should grow by more than 10% annually through 2029. Total software revenue is expected to grow more than 10% annually through 2029, including approximately 12% in 2025.

While Gartner provides widely followed software industry data, our bottom-up forecast is slightly less aggressive over the next several years, as they clearly forecast an acceleration that, although not possible, has not manifested itself in management outlooks for 2025.

Overall, we are expecting solid revenue growth from our software coverage this year.

Key tailwinds include:

Artificial intelligence. We see the demand for generative AI use cases fueling software growth in the coming years.

Data. The exponential growth in data and the need for storage will only multiply. Software firms have the expertise to organize, protect, and use this data.

Public cloud. The rise of the public cloud has driven heavy software investment across industries. Firms take on the expertise of hybrid or cloud-native software firms to support the transition from on-premises to cloud.

Digital transformation. Accelerated by the pandemic, there is a push for firms to implement digital workflows.

Key headwinds include:

Higher interest rates. Higher interest rates make it more expensive to fund growth as a software firm (via debt and private equity funding) and can also lead to leaner budgets for customers.

Economic downturn. Customers are tightening their IT budgets in tough macroeconomic times, or macro factors like foreign-exchange pressures.

Privacy concerns. Reluctance to onboard software or digitize workflows because of data privacy concerns, which hampered software as a service and public cloud growth early on.

Regulation. One of the most significant risks to slow innovation is regulatory intrusion.

Switching Costs Drive Software Firms’ Moats

Software firms within our coverage overwhelmingly have moats, with a majority garnering narrow moats and many earning wide moats. Moats in the software industry are largely driven by switching costs, with occasional support from network effects or even intangible assets.

There isn’t a single example of a software company within our coverage that is awarded a moat without benefiting from switching costs. Once an application is installed, employees become proficient in it, and the client builds business processes around it and even integrates it with other applications within the organization. Changing software applications, then, is more complicated than swapping vendors.

Network effects are also relatively common within the software industry, although we see them typically as a secondary moat source. They occur when the value of the platform increases with the number of platform participants.

The table below maps out the 25 software companies within our coverage that earn a wide moat.

Stock | Ticker | Fair Value Estimate (as of March 4, 2025) | Price/Fair Value Ratio (as of March 4, 2025) | Uncertainty Rating |

|---|---|---|---|---|

Microsoft | $490 | 0.79 | Medium | |

Oracle | $172 | 0.94 | High | |

Adobe | $590 | 0.75 | High | |

Salesforce | $315 | 0.93 | High | |

Intuit | $580 | 1.04 | Medium | |

ServiceNow | $990 | 0.92 | Medium | |

Shopify | $120 | 0.89 | Very High | |

Automatic Data Processing | $290 | 1.10 | Medium | |

Workday | $300 | 0.85 | High | |

Dassault Systemes | 37 EUR | 1.06 | Medium | |

Autodesk | $290 | 0.94 | Medium | |

Snowflake | $165 | 1.05 | Very High | |

Roper Technologies | $540 | 1.08 | Medium | |

Paychex | $130 | 1.18 | Medium | |

Veeva | $275 | 0.80 | High | |

Ansys | $350 | 0.93 | Medium | |

Fair Isaac | $1,500 | 1.24 | High | |

VeriSign | $210 | 1.14 | Low | |

Manhattan Associates | $230 | 0.75 | Medium | |

Tyler Technologies | $650 | 0.93 | Medium | |

Aspen Technologies | $265 | 1.00 | Medium | |

Guidewire Software | $140 | 1.40 | Medium | |

Descartes Systems Group | $90 | 1.22 | Medium | |

Technology One | A$15.75 | 1.90 | Medium | |

Fineos Corporation | A$3.10 | 0.54 | Very High |

High Upfront Investments Secure Very Sticky Revenue

Software firms invest heavily in research and development to create differentiated applications and in a salesforce to secure customers. On average, software companies spend 21% of their revenue on R&D efforts.

This means there’s a lot of spending upfront, and software companies can be unprofitable from an accounting viewpoint during early, high-growth periods.

However, strong customer retention for moaty firms creates an annuity-like revenue stream that pays for these costs over time. Customer acquisition costs may be high in year one, but when a customer sticks around for 10 or more years, the lifetime value of this customer can be very high—often greater than 3 times the acquisition cost.

Growth in the Software Industry Should Remain Attractive

We see total software revenue growing at 11% annually through 2029.

The covid lockdowns brought a surge in software investment, while the period after lockdown has been characterized by a more subdued demand environment as customers wrestled with their IT needs in a hybrid world. Though this has created additional worries about software growth, we see a steady demand for the foreseeable future.

Overall, we believe increased automation, a focus on customer-centric software, and generative AI will drive growth. The software industry should continue to offer attractive revenue growth for investors.

What About AI?

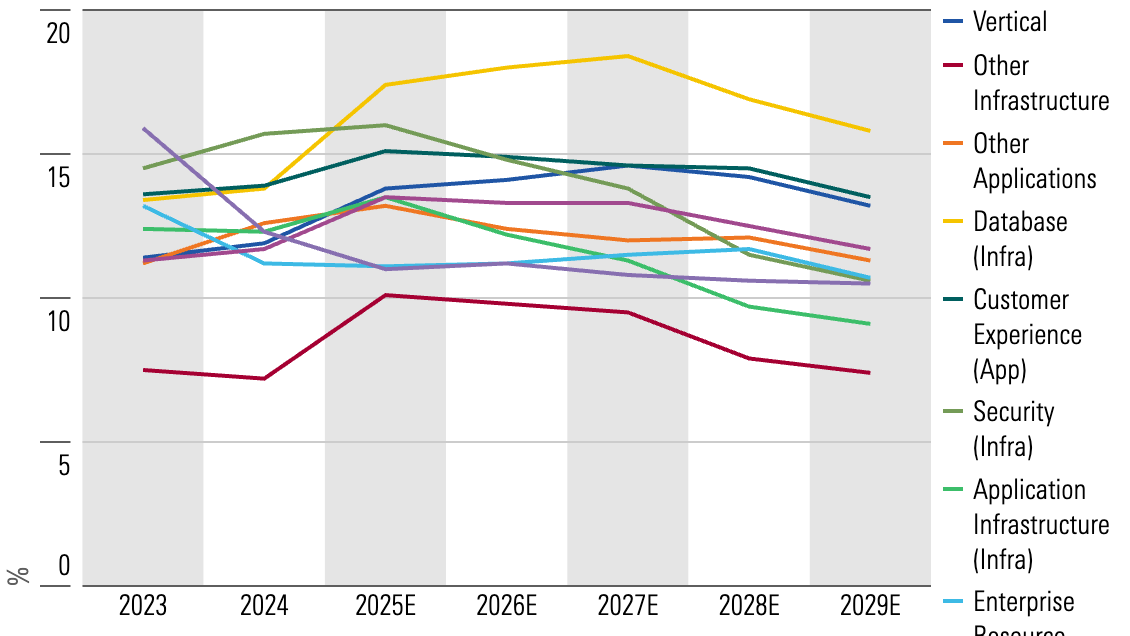

Database software is the largest category within infrastructure software, while customer experience is the largest category within application software, which is a dynamic we do not expect to change over the next five years.

Further, while they are the largest categories, we still expect they will also be the fastest-growing areas over the next five years.

We believe database-related solutions are growing because of the need to organize and prepare data to apply generative AI. Customer experience grows because it helps users generate new sales.

This article was compiled by Emelia Fredlick.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar's editorial policies.